Rent-to-earn is a different approach to blockchain-based gaming within the P2E ecosystem, and crypto firms are developing inventive ways to use it. Further, these rent-to-earn services popping up in the Web3 gaming space have already made an impact.

For one thing, rent-to-earn has made player entry more accessible and created new revenue streams. But who is the target audience for rent-to-earn? Additionally, what value does this model create for participants? How is this new space shaping up, and who are these NFT renters?

This article will answer these questions and more as we explore this revenue model. The recent crypto crash has set everything back on its heels for the moment, but the concept of rent-to-earn is likely to survive and possibly even thrive in the future.

No one knows how long this recent market crash will last. But crypto is here to stay. So, learning how to invest during a crypto bear market is more critical than ever. Check out our recent blog article at Moralis Academy to find out.

What is Rent-to-Earn?

The concept of rent-to-earn is quite simple. It works similar to the way renting works in the real world. Participants buy things like in-game assets and then rent them to others. Furthermore, renting helps those who can’t afford to purchase gaming items to onboard to games more easily.

For example, before playing a game, let’s say a user must buy a minimum of one character and a weapon. Or let’s say a gamer can start with free in-game assets. However, the problem is they’re less powerful and won’t get the player beyond the first level. In either case, the player must invest in some game items. Moreover, just like in the real world, scarcity plays a role in pricing.

In-game items on the blockchain are in the form of non-fungible tokens (NFTs). And the rarer an NFT is, the more it will cost. Such costs can impose a stiff barrier preventing new players. But thanks to the rent-to-earn system, the barriers get lowered.

GameFi is the combination of blockchain gaming and decentralized finance (DeFi). So if you want to understand GameFi concepts better, get to the root of it by learning DeFi. The best DeFi course with the most up-to-date information is the Master DeFi in 2022 course at Moralis Academy.

Why Buy When You Can Rent?

The good news for prospective renters is that they no longer have to onboard to a new game with an initial outlay of purchasing NFTs. For players from countries with lower incomes, renting makes a lot of sense. But it also makes financial sense for the lenders. They can generate passive income by renting their game assets.

Since players can rent NFT gaming items rather than buy them, they pay lenders a percentage of their earnings in the P2E ecosystem. Further, because both sides of the equation benefit from the transaction, rent-to-earn could be the next big thing in the blockchain gaming sector.

Check our recent blog article at Moralis.io if you’re ready to try your hand at Web3 game development. It shows you step-by-step how to build a Web3 action role-playing game.

Renting In-Game Items

Games like Axie Infinity already demonstrated demand for rent-to-earn from the Web3 gaming community. We already mentioned renting in-game assets like characters, weapons, skins, and other items. In blockchain games, players need these NFTs to start playing or to gain an advantage. In addition, since many Web3 games have multiple levels of NFTs, the rarer ones are more valuable to the gaming experience. Since some players can’t afford the upgrade, renting becomes a viable option.

Axie Infinity

One of the best-known P2E games is Axie Infinity. At the height of its popularity, gamers from lower-income countries claimed to be making a living playing Axie. Most popular blockchain games require NFTs to play, and Axie is one of them. Axie Infinity demands players to have at least three Axies, and an entire set can be costly. Anyone who meets the minimum can form a team to battle other teams and earn crypto in their P2E model. The popularity of P2E is getting traction, which in turn is propelling NFT rental services like Axie University.

Axie University

Maxim de Clippelaar and Mick de Bock are two entrepreneurs from Holland who bootstrapped their rental service in August 2021 called Axie University. In their model, there are managers and scholars. Managers provide the Axie game characters, and scholars play the game with managers taking a cut of the scholar’s earnings.

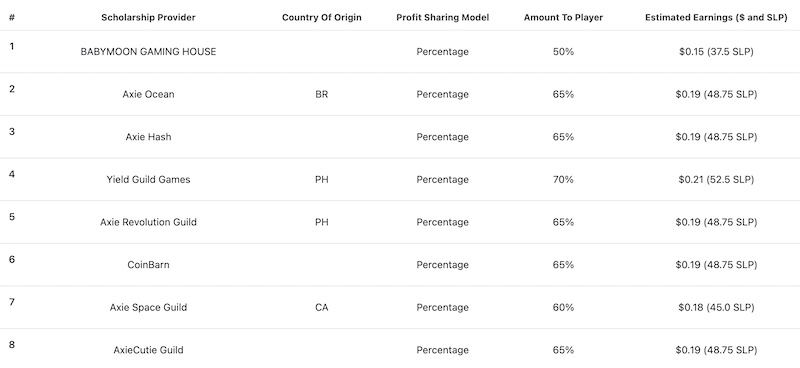

So, with this scholarship system, gamers who can’t afford to invest in NFTs can instead rent them. Scholarships are a cost-effective way for newer players to get started. It allows them to test the waters by renting in-game items before buying their Axies. Scholarship programs help new players try the game and earn money before purchasing required NFTs. Furthermore, different Axie Scholarship providers offer various profit-sharing models where renters pay the lenders a cut of the crypto they earn while engaging in P2E.

JavaScript is the most popular language of Web2, but you can still put it to work in Web3. Learn JavaScript from scratch by building a decentralized exchange at Moralis Academy. The good news is you don’t need any programming experience!

More on Axie Scholarships

Players who can’t pay up-front costs can become scholars. To do so, they must play daily to meet a steadily rising minimum daily earnings threshold. Market factors can change, but typically scholars need to play at least two hours a day to meet their quota. As they improve, however, they can devote less time. However, players who miss their quota too many times can get dropped. Luckily for these players, there are no costs for quitting or getting dropped other than losing future income.

The financial agreement is for players to keep 40% of their gaming profits. Axie University and its investors take the remaining 60%. During the peak times, the founders calculated their gross earnings at approximately $5,000 a month before paying investors and scholars. The remainder went back into growing the company’s operations.

After earning enough money, scholars can graduate and invest in their own team. Or they can stick with Axie University and become a manager. That way, they can get the 60/40 split or a higher percentage if they decide to rent their team to someone else.

So the goal for some players is to save enough money by playing to get a team and then earn income by renting it out. Thus, Axie’s rent-to-earn model works for renters and lenders. Some lenders (individuals and groups) have figured out a way to make the rental business a profitable one.

One Scholar’s Story

One Axie University scholar from the Philippines claims to earn up to $250 every couple of weeks after the University takes its percentage. The playing time takes from three-to-four hours daily. Since the minimum wage in his town in the Philippines is about $110 every two weeks, he earned more money playing Axie.

This player had been with a scholar program before using a different lender, but he quit when he saw a better opportunity to earn more money with Axie University. He was early, becoming only the fifth person to enlist as an Axie University scholar. Later he moved up to becoming a manager, making him more money.

He also helped recruit new people to become Axie scholars, which was no small feat since people initially believed it was a scam. Recruiting became easier when friends saw his money earned from playing Axie.

Developers are building other blockchains to compete with Ethereum, and Solana is one of them. Check out our article about Solana vs Ethereum. Furthermore, the programming language developers use to work with Solana is called Rust. You can learn more about Rust & Solana here. Or, if you have some programming experience, you can learn to build dapps on Solana by taking the Rust & Solana Programming 101 course at Moralis Academy.

Axie Infinity and the Crypto Crash

The above examples happened last summer and during peak periods. Since then, Axie’s AXS token took a beating like other cryptos dropping from an all-time high of $164.90 to about $15 at the time of writing. It’s no surprise the trading price of AXS has had a ripple effect throughout its gaming ecosystem. So, the game’s fate still hangs in the balance, and grand stories of renter and lender profitability may only reside in the past for now.

However, the rent-to-earn model requires a second look regardless of present-day market conditions. The P2E model with players earning crypto for playing and the rent-to-earn model offering passive income opportunities to lenders is just beginning to take off. It just needs more time and developer effort before mass adoption occurs.

Cryptocurrency is far more volatile than traditional asset markets. Whipsaws and crashes can happen quickly, so understanding crypto crashes is essential to protect your portfolio. The Moralis Academy blog has the articles you need.

Critics of NFT Rentals

The rent-to-earn concept has its share of critics who call it gambling or something worse. They liken it to a feudal system of lords and serfs where exploitation reigns supreme. However, since Axie scholars primarily reside in Southeast Asia, where low wages are the norm, proponents argue scholarships give people a chance to supplement their income.

Rent-to-earn models may incentivize people to take a particular action, but they still get to choose whether to participate or not. As such, the model provides income opportunities of choice, not exploitation. Many believe the scholar program benefits people by playing a game they already enjoy.

Other issues aren’t limited to renting NFTs specifically but exist in the NFT space as a whole. As is often the case with a new niche, projects can get overhyped and never live up to exaggerated expectations. Others can pop up as get-rich-quick scams. Therefore investors must always be careful to conduct their due diligence and not FOMO into unsafe waters.

Other Use Cases

Besides in-game assets like weapons and skins, the other type of rental is digital land plots. Virtual landlords can also invest in digital property within P2E games and lend them out to players. Such income-generating opportunities can help entice new participants to join the blockchain gaming ecosystem without too much outlay.

But there are other use cases for rent-to-earn besides gaming scenarios. Digital art installations and exhibitions can use the rent-to-earn model to help kick start their openings by displaying imaginative new art. NFT galleries could also hold events with rental pieces showcased for a limited time. As this model evolves, more users won’t get confined to buying and selling NFTs. They can profit by becoming a digital landlord or a lender of digital art.

Rent-to-Earn – Summary

To sum up, rent-to-earn solutions can help lower barriers to entry in sectors like Web3 gaming. They can create more trust by reacting to user demand and educating new market participants. Such rentals can potentially boost the NFT and GameFi space specifically and contribute to the development of the blockchain industry by bringing in more investors and new opportunities for gamers and NFT holders.

Investors are already showing interest. One scholarship provider, Yield Guild Games, received a $4.6 million investment led by the VC firm Andreesen Horowitz (a16z) last summer. GuildFi, another scholarship provider, raised $6 million in funding led by VC firms Hashed and DeFiance Capital. While this niche is still finding its feet, participants looking for new ways to profit will undoubtedly find other use cases for the rent-to-earn model.

So, now it’s your turn to profit. At the same time, crypto prices are struggling to find the bottom. You can prepare for the next rally by learning how to become a blockchain developer. The best place to do that is Moralis Academy. So, enroll and get started today!