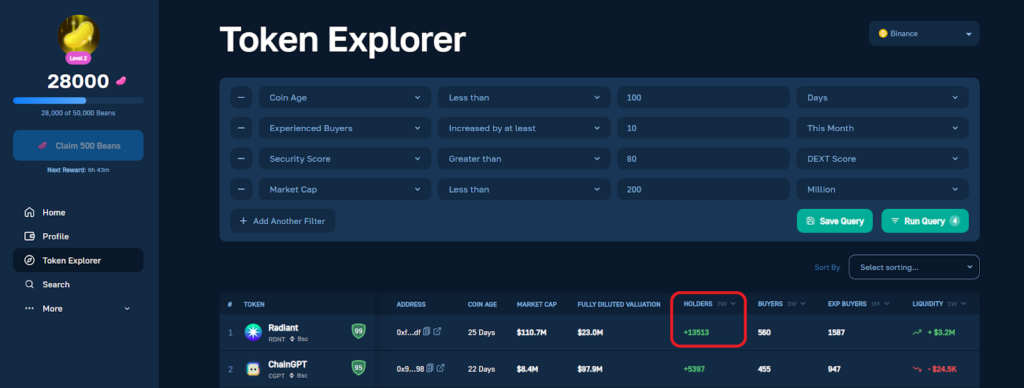

Judging by the on-chain performance of the Radiant coin, its popularity continues to grow. For example, just in the last three weeks, there have been more than 13k new holders of the RDNT token on BNB Chain:

Using Moralis Money, anyone can see how tokens perform based on their on-chain activities. However, the true edge is the Moralis Money Pro plan. Users with Moralis Money Pro have access to on-chain insights in real time. Consequently, they can detect any increasing or decreasing momentum, enabling Pro users to predict the direction of the price. After all, on-chain activity precedes price action!

If you want to experience the power and simplicity of Moralis Money firsthand, use the interactive iframe below to run your first on-chain query. Simply click on one of the preset filters or apply your unique search parameters:

If you want to see whether or not the Radiant coin is still on top, make sure to select “Binance” or “Arbitrum” from the drop-down menu:

If your main goal is to catch the next rally or find the next “RDNT token” for those massive gains, then focus on playing around with Moralis Money. After all, it is the best tool to identify upcoming crypto opportunities!

Now, if you wish to learn more about Radiant Capital and its RDNT token, make sure to dive into the following sections.

What is Radiant Capital and the Radiant Coin?

Radiant Capital is a DeFi project that aims to be a “one-stop shop” money market. Furthermore, it is a cross-chain borrowing and lending protocol built on LayerZero. The goal is to create a multi-chain platform that allows users to seamlessly deposit and borrow assets across multiple chains.

An important part of this project is the Radiant DAO. This decentralized autonomous organization includes the core team and the entire Radiant community. Essentially, everyone holding the Radiant coin (RDNT) has the governing power. So, one of RDNT’s use cases is that it serves as the native utility token for the Radiant DAO. Plus, RDNT holders who interact with this DAO can capture the added value from the communities’ engagement and from borrowers and platform fees.

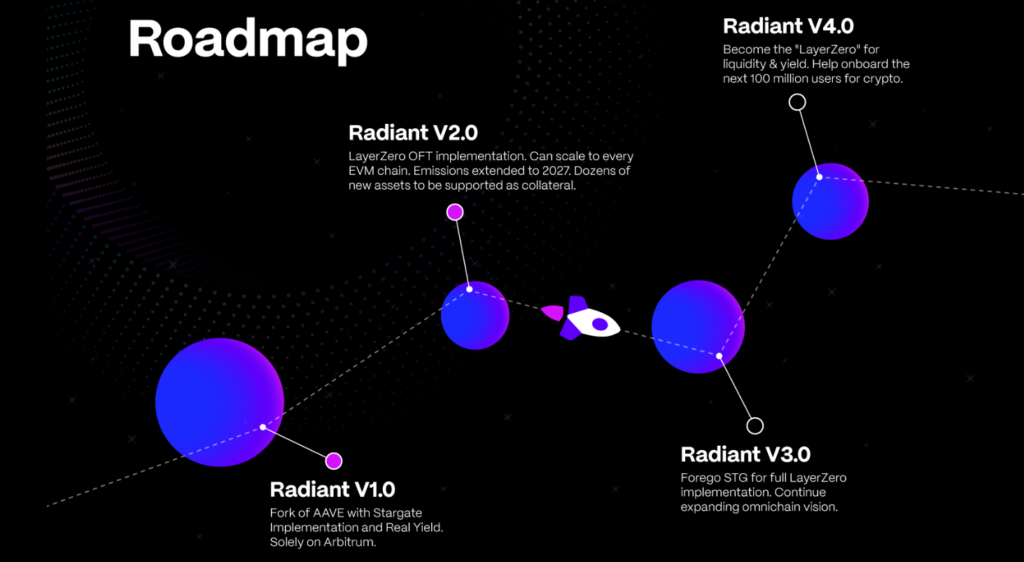

Radiant v1, which is essentially a fork of Aave with Stargate implementation and real yield, went live on July 24th, 2022, on the Arbitrum network. That was also the birth of the Radiant coin. However, on March 19th, 2023, the project upgraded to Radiant v2 as per their roadmap. With this upgrade, RDNT migrated to a new contract address.

Radiant v2 essentially converted RDNT into an “omnichain fungible token (OFT) by LayerZero. This upgrade also allowed Radiant to scale to every EVM-compatible chain and extended “RDNT emissions” (incentivized RDNT for lending and borrowing activity) to 2027.

Not long after the v2 upgrade, Radiant launched a smart contract that governs RDNT tokens on BNB Chain. So, since March 28th, 2023, you can own and utilize RDNT on Arbitrum and BNB Chain.

It’s also worth pointing out that the current roadmap on the “radiant.capital” website already indicates a future Radiant v3 and v4. However, they haven’t provided any clear timeframes.

Why Radiant?

The project behind the Radiant coin sees the current dispersion of crypto assets across multiple chains as a large obstacle. This demands lenders to decide on a chain. Moreover, if they want to transfer assets across chains, they need to execute a series of cumbersome transactions.

So, Radiant aims to solve the current liquidity dispersion for the borrowing and lending experience. The project’s core goal is to be the first omnichain money market.

By achieving this goal, the Radiant platform would allow users to deposit any major asset on any leading chain and borrow a wide selection of supported assets across all leading blockchains.

How Does Radiant V2 Work?

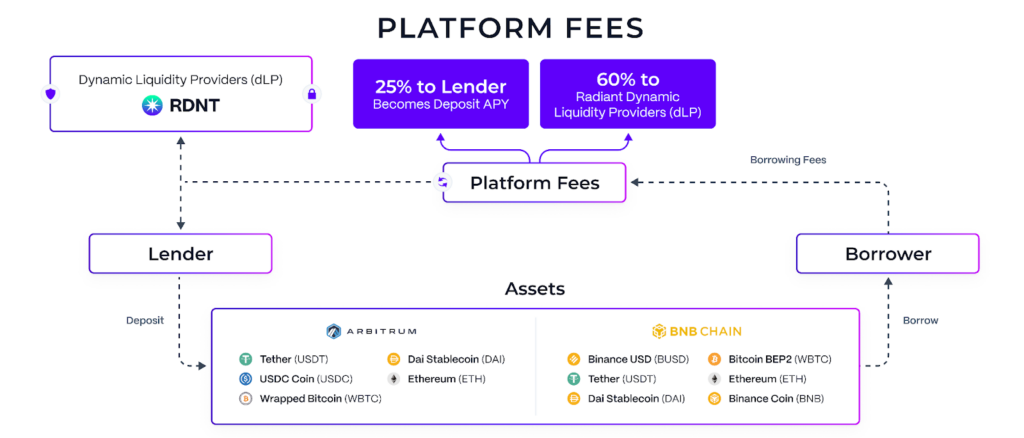

If you are new to DeFi and unfamiliar with Aave and other leading lending protocols, you may find the Radiant platform a bit complicated. However, the above image should provide some clarity.

It indicates that lenders who provide liquidity to Radiant are the users that interact with the platform and provide utility. As a reward for their contribution, lenders are able to capture extra value from the communities’ engagement via the Radiant coin.

The Radiant platform allows borrowers to withdraw against collateralized assets. Thus, borrowers obtain liquidity (working capital) without selling their assets and closing their positions, and borrowing fees serve as rewards for lenders.

Of course, all these processes are automated thanks to smart contracts.

If you want to dive further into Radiant, we recommend you explore the project’s documentation. You may also want to check out LayerZero’s and Aave’s docs for additional clarity.

RDNT Token Properties

After the v2 upgrade, RDNT is now an OFT-20 token and serves as Radiant’s native utility token. Thanks to LayerZero Labs’s OFT standard, RDNT is now cross-chain transferable.

Also, as touched on briefly, the core use case of RDNT is that it serves as Radiant DAO’s utility token. Those who hold RDNT coins can lock them and become dynamic liquidity providers (dLP) for Radiant. Their rewards also come in the form of RDNT, which are called “RDNT emissions.”

Radiant Coin Tokenomics

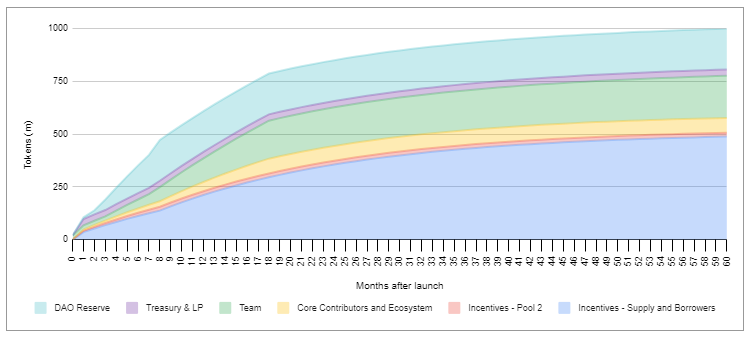

Here’s an overview of RDNT tokenomics:

- Total supply: 1,000,000,000 (to be fully released over five years since launch)

- Current circulating supply (at the time of writing): 261,942,535 RDNT

- Token allocation:

- 54% – Incentives for suppliers and borrowers

- 20% – Io the team

- 14% – To the Radiant DAO reserve

- 7% – To core contributors and advisors (released over one and a half years)

- 3% – For the treasury and liquidity pools

- 2% – Reserved for “Pool 2“ incentives (August 3rd, 2022 – March 17th, 2023)

Here’s a chart indicating the RDNT unlocking schedule during the months following the token’s launch:

Radiant Coin Price Prediction – Analyze the RDNT Token Using Moralis Money

When it comes to cryptocurrencies, most users focus too much on price predictions. Sure, we would like to know the exact price a specific token will reach. However, there’s just no way of knowing these kinds of things. It’s all speculation!

But, by focusing on timing, you can spot coins at their lows/highs. The best way to get your timing right is to utilize reliable, real-time, on-chain data.

The problem is that on-chain tools are typically created by data scientists with zero trading experience. As a result, they provide you with tons of detailed charts that cause nothing but information overload.

Fortunately, the launch of Moralis Money changed all that!

Now, casual traders can access easy-to-understand, actionable on-chain data. This tool allows you to spot top opportunities before price rallies. Moreover, Moralis Money helps you analyze key metrics of crypto tokens across all leading chains.

So, let’s look at the data that Moralis Money is currently showing for the Radiant coin:

The above results are for the RDNT token on the BNB Chain (BSC) network. You can see that the coin is 25 days old and that it has a market cap of $110.7 million. You can also see that the fully diluted valuation sits at $23 million.

When it comes to the number of holders of the token, it has increased by nearly 3,000 in the last week. The token also had 567 new buyers in the last week and 1,593 experienced buyers in the last month. As for the liquidity, it has increased by $3.2 million in the last week.

Is Now a Good Time to Buy RDNT?

The above-covered data shows noticeable on-chain activity around the Radiant coin. However, before deciding whether or not now’s a good time to buy RDNT, you must look at the token metrics on shorter timeframes, such as an hourly timeframe, which you can do with Moralis Money Pro.

So, make sure to inspect various timeframes (e.g., one-hour, four-hour, and daily) to determine if the increase in momentum is consistent. Also, do the same for other metrics; if traction is still increasing on all timeframes, now may still be a good time to enter. However, if you detect a decreasing momentum, this typically indicates at least a temporary pullback.

Of course, before determining whether the coin (RDNT or any other coin for that matter) is currently a good buy, you should look at its price history. You can use the DEXTools link in Moralis Money:

So, it’s always smart to combine on-chain data with your technical analysis (TA) skills. However, for new coins, you have limited price data, so proper TA is hard to perform. Thus, learning to read on-chain data is the way to go.

Remember, nothing stated in this article is financial advice. Always do your own research (DYOR) before investing in any asset.

Remember: RDNT V2 Upgrade Resulted in Migration to a New Smart Contract

In the case of RDNT, you need to remember that the v2 upgrade included migration to a new smart contract. This obviously affects the token’s on-chain data as well as price charts.

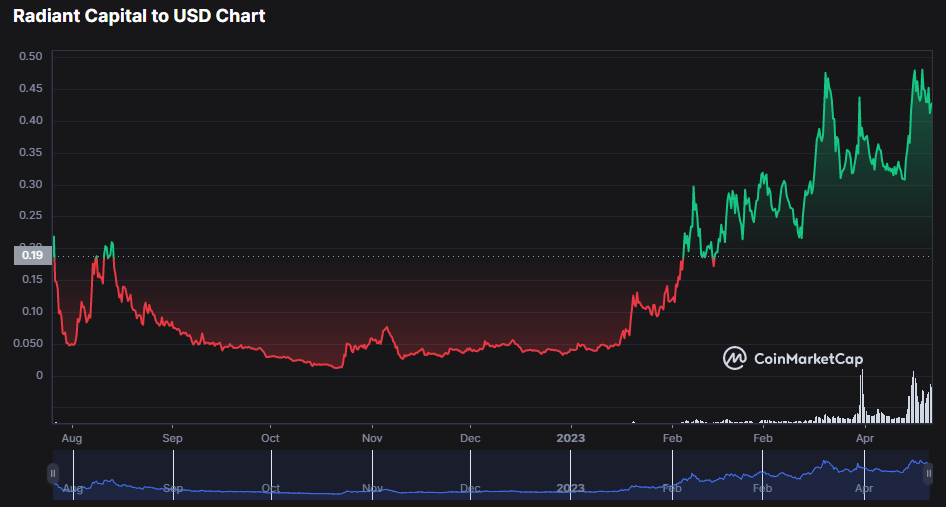

So, also look at a chart showing the full history of RDNT price action. For instance, below is a simple line chart available on Radiant’s page on CoinMarketCap:

The above chart clearly indicates that RDNT increased from its lowest point ($0.01115) in October 2022 to its current all-time high at $0.4952 in April 2023. That is more than a 40x increase in the last six months.

With that in mind – plus what could turn out to be a double top – be mindful if this is a good time to enter RDNT, as a retrace might be in order.

As such, it could be smarter to look for new opportunities that can return such or even greater gains.

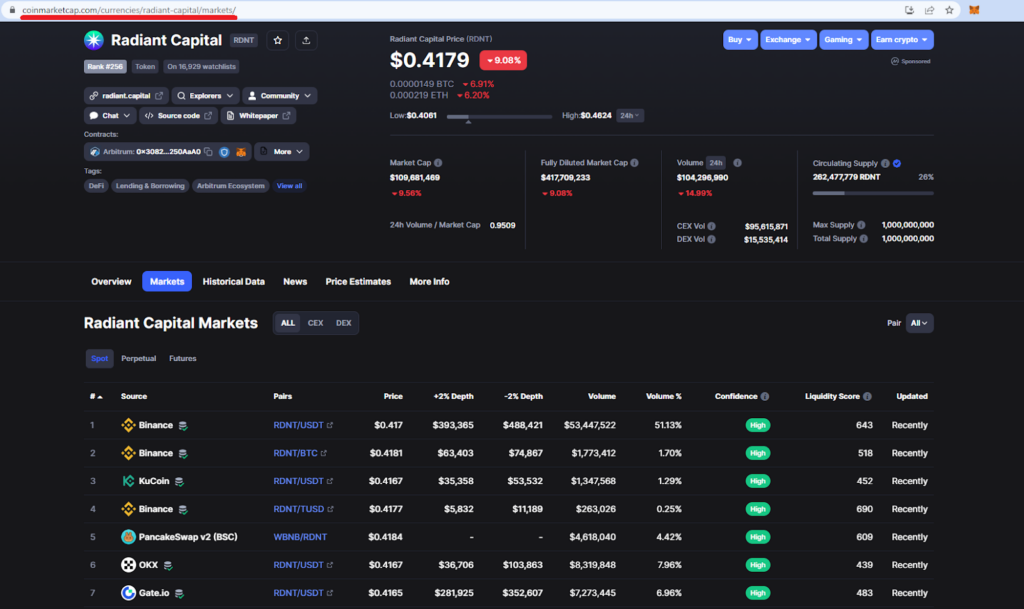

How to Buy RDNT Coins

There are many DEXs and CEXs where you can buy the RDNT coin. For the full list of your options, visit CoinMarketCap’s “Radiant Capital” page and select the “Markets” tab:

This list will also show you the asset pairs to help you determine which cryptocurrency you need to buy/swap for RDNT. If you decide to use a DEX to buy RDNT, remember that you can do it on BNB Chain (e.g., PancakeSwap) or Arbitrum (e.g., Uniswap v3).

How to Discover Alts Like the Radiant Coin

By this point, you know that Moralis Money is the tool that can help you discover the best opportunities in the crypto space. Thanks to this powerful yet simple tool, many Moralis Money Pro users have been able to spot recent rallies of various coins. Here are some examples:

- The HDRN token from Hedron

- The VERSE token

- Merit Circle’s MC token

- The PEPE token

- XEN crypto

- The WOJAK coin

Did you know that Moralis Money also helps you overcome the three main obstacles when trading alts?

The majority of inexperienced traders fail to profit with altcoins because of FOMO, scams, and lack of time. Moralis Money’s core features tackle these challenges head-on:

- Token Explorer helps you spot altcoin opportunities before it’s too late, which means you do not FOMO into coins at the top.

- Token Shield helps you detect shady projects and avoid rug pulls and other scams.

- Token Alerts enables you to set up email notifications that alert you whenever there’s a new opportunity in the crypto market. This means you get to keep an eye on on-chain data on autopilot, which saves you a ton of time.

Moralis Money Quickstart

The fastest and simplest way to find the best altcoins to invest in lies in Moralis Money’s preset filters.

Once on the Moralis Money homepage, just click on one of the preset filters:

With preset filters, you’ll get acquainted with Token Explorer and all the metrics it supports. However, to find unique opportunities, you want to get comfortable with applying your own search criteria.

As such, make sure to use this “crypto for dummies” four-step formula:

- Access Token Explorer.

- Apply the Coin Age filter to spot new coins. If you prefer to focus on more seasoned coins, use the Market Cap metric.

- Further refine your results by adding the Holders, Buyers, or Experienced Buyers filters. This will help you view tokens that are gaining some momentum.

- Finally, polish your list to show true winners by adding more filters or tweaking previously applied parameters. Do the following until you find your winning combo:

- Select a metric

- Select a filter

- Enter a value

- Select a timeframe

- Run your query

Exploring Radiant Capital and the Radiant (RDNT) Coin – Summary

If you are a DeFi enthusiast, you must be excited about the Radiant project regardless of the Radiant coin’s price. In that case, you should explore Radiant Capital and this team’s work deeper and perhaps even consider becoming a Radiant dLP.

If the RDNT token caught your eye primarily based on its 40x rally over the last six months, then you are a true crypto gem hunter by heart. Fortunately, the next bull market is slowly warming up, which means there will be a ton of opportunities in the 40x-plus range.

So, if you want to be able to determine which crypto to buy today for long-term gains or for short-term flips, learn to work with on-chain pulses. You now know that the best and simplest tool for that purpose is Moralis Money. With a free account, you can explore the monthly timeframe; however, for real-time insights, you want a Pro plan!

Start using Moralis Money today and get ready for the upcoming bull run!