J.P. Morgan opened Onyx Lounge in Decentraland’s Metajuku mall earlier this year. Decentraland is a virtual world on the blockchain. Furthermore, the Metajuku district is a virtual shopping section inspired by the Harajuku district in Tokyo, which in the real world is best known for its street fashion.

J.P. Morgan Metaverse on Decentraland

If you’re not familiar with Decentraland, it’s a platform where users can purchase virtual plots of land with cryptocurrency. The plots are available in the form of non-fungible tokens (NFTs). More importantly, J.P. Morgan decided to start its Onyx Lounge on Decentraland due to increased client interest in the metaverse.

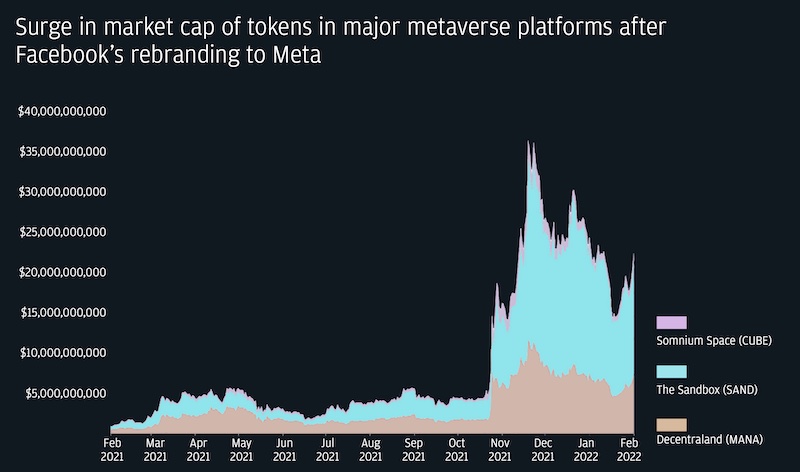

Ethereum-based platforms like Decentraland already sell virtual plots of land that users can develop, and land sales are a growing market. After all, the virtual world will need people to create and build products for consumption, leading to massive opportunities in the creator economy.

Furthermore, decentralized autonomous organizations (DAOs) could handle collateral management in decentralized finance (DeFi). That would be different from how traditional finance companies usually undertake such endeavors.

Decentraland is on the Ethereum blockchain. Therefore, if you want to get a solid foundation on the subject, check out the Ethereum Fundamentals course at Moralis Academy!

Onyx Lounge Introduction

Opening the Onyx Lounge in Decentraland will provide a foundation for J.P. Morgan to launch into the metaverse. Moreover, Onyx Lounge will allow it to run banking services virtually just as it does in the physical world. The metaverse will have worlds with currencies for its native population. So J.P. Morgan can position itself like a real-world bank facilitating foreign exchange with cross-border payments and financial asset creation.

One day people cruising the J.P. Morgan metaverse can open an account, deposit their checks or fill out a mortgage app on a new home inside this virtual world. Notably, the move represents a complete reversal in strategy because CEO Jamie Dimon used to be the ultimate crypto skeptic. He once allegedly described Bitcoin as “worthless.” It seems he’s changed his tune now, admitting that the blockchain does have some use cases for finance. Now when new visitors arrive at the Onyx Lounge, a digital portrait of Jamie Dimon is waiting to greet them.

To visit the Onyx Lounge, you can go to Decentraland. Then locate the Metajuku district with coordinates 94, 21. The Onyx Lounge is the first thing you’ll see.

The Ukraine invasion has been on everyone’s mind lately. Nightly news reports show people fleeing their homeland with little more than the shirts on their backs. With their fiat currency crashing and Russians seizing their banks, please find out how the prepared Ukrainians have avoided losing everything in our Ukraine & cryptocurrency article.

J.P. Morgan’s Metaverse White Paper

If you read their white paper “Opportunities in the Metaverse,” the J.P. Morgan metaverse becomes more apparent. The report describes a new world where people will interact as avatars, work, make money, and tap into crypto’s potential. But the financial giant also admits that developing a business strategy for the J.P. Morgan metaverse is challenging because virtual worlds are still a work in progress with continuous innovation unfolding.

However, the project’s white paper does help clients understand the future of the metaverse, the opportunities that businesses can explore, and the necessary steps to maximize such opportunities. It’s a snapshot of where the J.P. Morgan metaverse (and the metaverse at large) stands.

The report also covers identity, privacy, and infrastructure subjects because “the metaverse will likely infiltrate every sector in the coming years, with the market opportunity estimated at over $1 trillion in yearly revenues.”

The white paper predicts that the virtual real estate market could have real-world services such as mortgages and rental agreements. While it never suggests the metaverse will overtake every aspect of human interactions, it does highlight some of the many exciting opportunities it presents for consumers and brands alike.

The First Bank to Ever Enter the Metaverse

The quote from the movie Moneyball says it best, “the first one through the wall gets bloody.” So, J.P. Morgan will be wary of taking premature risks being the first bank to enter the metaverse. It’s challenging this early on to develop hypotheses about business models and to form partnerships and collaborators for the future.

But, there’s also the risk of being left in the dust that banks must consider. With such a rapidly moving technology, banks will need to make minimal investments at the very least to explore the metaverse’s potential. Otherwise, they could get left behind by the first goers.

Nonetheless, even with the launch on Decentraland, that does not necessarily mean the bank is going all-in to build the J.P. Morgan metaverse. The move is more like carving out a piece of turf to prepare for the possibility that the metaverse does grow to play a prominent role in our lives.

So, despite all the excitement about the possibilities for a J.P. Morgan metaverse, certain areas must develop further to enable the potential for community building, engagement, and commerce. But, along with these challenges come many new opportunities for business projects, DAOs, technology providers, and financial institutions to flourish in a vibrant, virtual ecosystem.

As mentioned, DAOs are decentralized autonomous organizations. Crypto developers and founders primarily set them up to provide community governance for their projects. If you’re interested in learning how to create a DAO? Please read our article on the Moralis blog.

The First Bank to Ever Enter the Metaverse – Metanomics

Metanomics describes the economics of the metaverse, and there are abundant opportunities in almost every area. One of the possibilities of the metaverse is it will expand marketplace access to consumers from emerging economies.

Web 2.0’s version of the internet has already enabled access to goods and services that were previously not attainable. So, as Web 3.0 and the metaverse evolve, other markets will evolve. Firstly, for corporate retail outlets, there are opportunities to scale massively. Instead of opening stores in every major city, a retailer could build a global hub somewhere in the metaverse and serve millions of clients.

Blockchain gaming is another skyrocketing sector that will be the precursor to the metaverse. Please find out about the top gaming tokens in our recent article.

Critical Technological Components for Metaverse Success

From the technological angle, the following are some of the critical components that will enable the metaverse to grow:

1. Reduction of hardware requirements for 3D rendering and other complex interactions.

2. Expanded accessibility across all devices.

3. Better definitions for digital assets standards (wearables, brands, and cryptocurrencies) so users can transfer them across various blockchains and virtual worlds

4. Web 3.0 integrations with legacy finance payment systems like credit cards.

5. Web 2.0 integrations with crypto payments.

6. Evolution of cryptocurrency financing and mortgages via lending models, DeFi leverage, or collateral-backed NFT virtual world mortgages.

7. Develop cross-metaverse liquidity and foreign exchange solutions.

The metaverse is still in its infancy. Therefore, you’ll want to get a solid foundation in blockchain technology to understand better how it will evolve. Take the Crypto for Beginners course at Moralis Academy for starters!

The J.P. Morgan Solution

Building and scaling successfully in the metaverse will depend on its robust and flexible financial ecosystem. In addition, users should be able to connect from the physical world to the virtual seamlessly. The J.P. Morgan metaverse approach to economic infrastructure will ensure that interoperability between the two realms can grow.

Each virtual world will have its population, in-game currency, and digital assets. J.P. Morgan’s core competencies shine in this regard. With its expertise in cross-border payments, trading, asset creation, foreign exchange, and safekeeping of funds, it’s in a position to be a significant player in this new virtual economy.

In short, the banking firm is beginning to appreciate the blockchain’s potential. J.P. Morgan is building emerging technologies that can scale to help modernize business models and infrastructure to handle new challenges such as digital identity and tokenization. The goal is to prepare for perpetual innovation and new ways to organize financial transactions on the decentralized web that will ultimately evolve into the metaverse.

The Evolution of Banks to Crypto

The relationship between banks and crypto has always been tenuous at best. Many crypto pioneers hoped the new currency could replace the need for banks entirely. On the other hand, institutional banks first ignored or dismissed cryptocurrencies. But later vehemently denounced the industry when crypto became more of a competitive threat.

It wasn’t until July 2020 that things began to change. That was the year the U.S. Comptroller permitted banks to hold cryptocurrencies. Consequently, the amendment gave banks the green light to start exploration. After experiencing increased demand from their clients, banks are more likely to figure out ways to get in on the action.

Notably, Onyx Lounge is not J.P. Morgan’s first foray into crypto:

1. It started the blockchain unit of its corporation in 2020.

2. Further, in July 2021, it became the first major U.S. bank to offer its wealth-management clients cryptocurrency funds.

3. A month after that, J.P. Morgan began offering its private bank wealth management clients access to a Bitcoin fund in partnership with New York Digital Investment Group.

4. Lastly, it started a digital currency called the JPM Coin.

Cryptocurrencies are currently in a slump like other markets due to investor concerns over the Ukraine war and the potential for interest rate hikes. But not to worry! All you need to do is check out our blog article about how to survive a bear market to help you get through it.

The First Bank to Ever Enter the Metaverse – More to Follow?

The recent launch of Onyx Lounge on Decentraland signals that a virtual land grab is underway. This situation offers opportunities for all sorts of investors, and there’s a rapid proliferation of decentralized applications (dApps) hitting the expanding metaverse.

So, even though big banks haven’t supported the blockchain industry in the past, behemoths like J.P. Morgan are looking to stake a claim where they can offer their services.

Not wanting to be left behind, Citigroup C announced in November 2021 that it was expanding its blockchain and digital assets division with 100 new employees dedicated to the space. Also, in 2021, Citigroup launched its Digital Assets Group to offer digital asset services to its wealthy clients. It’s part of the wealth management division that focuses on cryptocurrencies, stablecoins, CBDCs, and NFTs.

Goldman Sachs also launched trading with derivatives tied to Bitcoin, shielding itself from volatile price swings in crypto by trading Bitcoin futures.

Onyx Lounge – Conclusion

Wall Street historically is slow to change. But once it embraces new technology, it likes to take credit for being the leader in innovation. Now that big banks are no longer mocking cryptocurrencies. The attitude seems that the crypto industry should be grateful to have them on board.

For those of us who grasped the potential for blockchain technology years ago, it seems odd that the “smartest guys in the room” took so long to figure it out. Nonetheless, it’s better late than never. Even if they were slow to “get it,” big financial institutions bring loads of capital and a large client base. All of which should fuel even more innovation in crypto.

Hopefully, the big banks with centralized systems will play nicely in the sandbox and not let their penchant for centralized control drive their activities. It’s still anybody’s guess whether they will ever be able to grasp such concepts as decentralization and transparency. Or if they’ll ever be able to operate in a permissionless, trustless fashion. But at least they are no longer ignoring or ridiculing the crypto space en masse.

The quote by Gandhi keeps resonating in the ears of crypto fans: “First they ignore you, then they laugh at you, then they fight you, then you win.”

Now it’s time for you to win in crypto. Join Moralis Academy and start learning how to become a blockchain developer today!