Decentralized Finance, more commonly known as DeFi, is one of the hottest areas in the blockchain sector. In fact, some argue the growing interest in DeFi solutions highlights the crypto industry’s increasing maturity.

Cryptocurrencies, which are arguably the most well-known example of blockchain programming technology in use, are already revolutionizing global payments. Through offering reliable, scalable, and – perhaps most importantly – open alternatives to fiat currencies and banks, crypto is gaining traction.

The easiest way to describe the DeFi field is that this aims to do what cryptocurrencies have already done for payments, but for the entire finance industry. As such, DeFi solutions aim to wholly replace the existing financial legacy infrastructure of banks, lenders, insurers, and more.

Instead, DeFi solutions (or “Open Finance”, as some refer to the movement) intends to open up the finance field. Instead of requiring approval from financial legacy actors, DeFi solutions could one day provide ready access to financial services straight from your smartphone.

What’s more, this is not just a pipe dream. So-called “dApps”, or decentralized applications mainly built on the Ethereum network, are already proving that this vision is attainable. This is due to the advent of smart contracts, which can execute automatically without requiring a middleman or bank organization.

Although this example is a sweeping simplification, dApps are often understood as analogous to the mobile applications we all know. True, dApps generally rely on blockchain-driven underpinnings, which are more intricate than the code for mobile apps.

However, the overall vision for a world of DeFi solutions is that people will be able to download and access financial services directly to their devices without contacting a bank, lender, or financial organization.

DeFi Definition

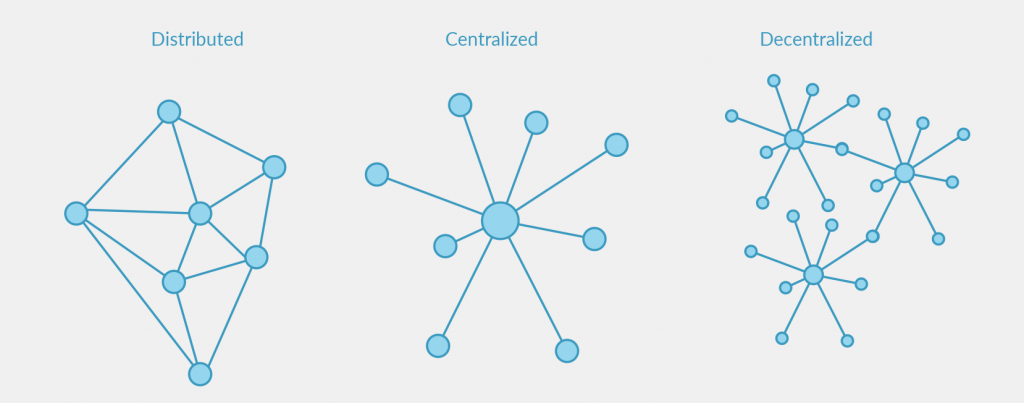

The term DeFi is an abbreviation of Decentralized Finance. This might sound vague on its own but comes as a counter-reaction to the traditional centralization of finance services. This is evident in everything from banks, who have an immense amount of power over individuals’ finances, to borrowers, lenders, insurers, and much more.

Does this sound hard to wrap your head around? Don’t worry – we are going to dissect the subject and come to a concrete DeFi definition. The centralized nature of the finance sector not only surrenders a great deal of influence to financial service providers, but it is also prone to error.

Whenever a service is centralized, this central node presents an innate weakness – unlike decentralized services. So, in order to get to the bottom of DeFi, we need to look at not only the DeFi definition, but also the definition of decentralization itself.

Although the word is thrown around a lot, it generally refers to a network that cannot be controlled by a single entity. This often takes the expression of blockchain-driven networks, in which no single entity can control all the nodes.

This provides an inherent resilience to attacks as well, as no single node is responsible for the entire network. Consequently, we understand that the decentralized part of the DeFi definition means the network is spread out as a peer-to-peer (P2P) network.

Assuming a financial DeFi dApp truly runs on this same type of network, it will be extremely difficult – if not impossible – for a single actor to control it, as no single node controls all of it.

Moreover, this presents one key advantage of DeFi networks; their independence. Essentially, DeFi refers to various types of digital assets, financial protocols, and smart contracts built on these types of open, resilient networks.

What are DeFi solutions?

Although DeFi proponents point out countless advantages of decentralizing the finance system, the principal benefit is clear. Decentralized finance could help pave the way for truly open financial systems all around the globe.

Furthermore, it eliminates the sometimes troublesome idea of having to trust a central authority or organization. Corrupt banks, companies, and governments worldwide have shown the risks of putting trust in central authorities.

Just like central banks can decide to devalue a currency, a regular bank can withhold your money, or an insurer can try to get out of responsibilities due to self-serving purposes, so can any central authority abuse the trust you put in them.

So, what is DeFi? DeFi is a radical reimagining of what financial service providers should look like, and how the entire financial ecosystem should function. Building on revolutionary technologies ranging from the internet to cryptography and blockchain technology, DeFi is emerging as a truly intersectional industry.

Although this is naturally beneficial to anyone looking for more robust, efficient, and resilient financial services, it is a real game-changer to those without existing access to financial services. If DeFi dApps truly become as easily accessible as mobile smartphone applications, they could open the floodgates to rising global prosperity.

Just imagine the impact microfinance loans had in Bangladesh and India during the first decade of the 2000s. This innovation, from Grameen Bank, was key in reaching previously unbanked individuals without access to traditional financial services. It also landed the founder of Grameen Bank, Muhammad Yunus, the Nobel Peace Prize.

Now imagine what a veritable “App Store” of similar DeFi dApps could do for those without access to traditional financial services. Forget about India and Bangladesh; the entire world could suddenly have access to bias-free financial services. How? Through smart contracts.

Smart Contracts

So, now that we’ve gone through what DeFi is and how it is upending the finance industry let us take a look at the technology that makes this possible. Specifically, at smart contracts.

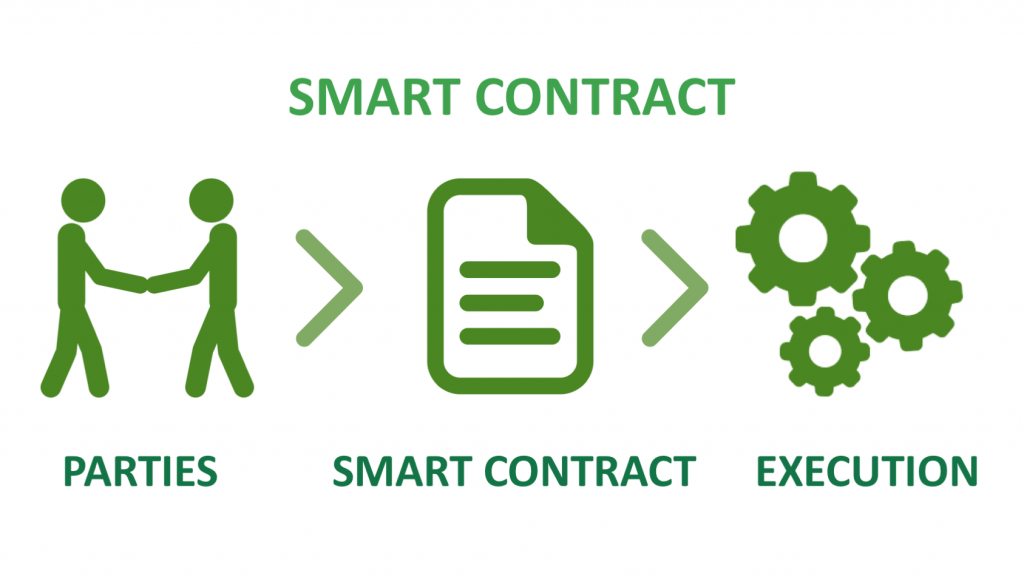

Another key aspect of the emerging DeFi ecosystem is that of smart contracts. Specifically, smart contracts can be thought of as certain contracts or “agreements,” written on a blockchain network – usually the Ethereum network.

What makes these smart contracts special is that it is possible to program them to one’s liking. As such, anyone with a rudimentary knowledge of blockchain to program a smart contract that can facilitate, verify, and enforce a particular agreement between two parties.

As such, there is virtually no need for third party actors, intermediaries, or other types of middlemen. Moreover, the verifications on blockchain-driven smart contracts are usually faster than traditional systems by order of magnitude.

In fact, traditional banks are already turning towards blockchain technology and DeFi solutions themselves. This is not necessarily because they like the new technology and the shifting power dynamics – oftentimes they don’t – but they recognize that it is vital for them to adapt to the new financial environment.

This all sounds rosy in theory, but you might be wondering what smart contracts can actually do for you. After all, merely the promise of being able to “facilitate, verify and enforce agreements” can sound a bit vague.

Put simply, then, smart contracts can help you exchange any number of things (such as money, cryptocurrencies, ownership of properties, stock shares, or other assets) with another party. All that needs to happen in order to execute the transaction is that the agreements between the parties are fulfilled.

Consequently, smart contracts can actually increase trust by eliminating the middleman – ensuring that the agreement is held.

Types of DeFi

The existence of smart contracts is naturally vital to the emergence of the DeFi field, as it replaces all middlemen. Consequently, there are many different types of DeFi projects under development. These are also looking to fulfill all the roles that traditional financial service providers typically provide.

For example, a DeFi project could be about creating a loan software that will connect lending partners with willing borrowers. Such a decentralized loan software could, e.g., allow a holder of cryptocurrency to lend some funds to someone looking to borrow cryptocurrency.

The software itself could make sure to connect lending actors, and the smart contracts could ensure that the deal happens according to plan. As such, this loan software project could – in essence – replace the loan operations of a traditional bank, seeing that it can connect lending parties to borrowers.

Moreover, if such a project would succeed, it would also be able to execute its services more or less for free. This means that it would not have the high costs of a traditional bank, and would, therefore, be cheaper to use.

Nevertheless, this is not the only type of DeFi project. Although lending is one of the prime use cases proponents of DeFi often bring up, it is important to remember that the DeFi field is envisioned as a full-fledged replacement to the existing finance sector.

As such, there are also many different types of projects relating to decentralized exchanges (mainly cryptocurrency exchanges), decentralized derivatives markets, decentralized systems for payments or assets, or even decentralized insurance.

The arguably most well-known DeFi lending project is that of Compound. Compound is also, incidentally, the largest DeFi project right now.

DeFi and Stablecoin Tokens

Although smart contracts are one of the cornerstones of the emerging DeFi industry, one should be sure to remember the other tenets of DeFi. For example, stablecoin tokens are also relatively common in the DeFi industry.

In order to understand why, one first needs to appreciate the nature of cryptocurrencies. Although they offer definite advantages in terms of speed and cross-national money transactions, they have some relative drawbacks. One of these is that they are volatile.

True, many cryptocurrency traders would say that the volatility of crypto is – in fact – an advantage, as it allows them to make quick money on certain crypto asset classes. However, it does present some distinct drawbacks.

Perhaps most notably, it adds uncertainty. The possibility that the underlying cryptocurrency could quickly and violently suffer from price swings means that investors became somewhat careful. After all, what was the point of cryptocurrency payments if one was not certain what the payment would be worth in a few days.

DeFi solutions can sometimes especially benefit from a sense of continuity and that users can plan ahead. This is where stablecoin tokens come into play. These are generally of the nature that they come with a pegging to another currency, cryptocurrency, or basket of goods.

If a stablecoin has a pegging to the US dollar, users can be sure that one stablecoin will always be worth approximately one US dollar. Consequently, those looking to get into DeFi and various DeFi solutions should also be familiar with stablecoins and how they function.

What’s The Point of DeFi Solutions?

So, in summary, why is DeFi breaking onto the big scene – and why now? First and foremost, this is all about enabling financial freedom. DeFi promises to bank the unbanked, introduce an unbiased finance system, and uproot essentially everything that is wrong about traditional finance.

At the same time, some might be interested in the advent of DeFi solutions merely due to the technology underpinning them. Blockchain technology is one of the hottest subjects to work with right now, and even tops LinkedIn’s list over most in-demand hard skills of 2020.

In fact, becoming a blockchain engineer is even said to be one of the best ways to increase your software engineer salary. However, working with developing DeFi solutions is far more than just getting a higher salary.

You can also participate in developing the future of the finance sector. It is not every day you get to rethink a sector that has been around for thousands of years. Could you be the one to invest a breakthrough DeFi solution, which creates an entirely new way to offer financial services to people all over the world?

Moreover, creating a DeFi solution like this is not as hard as it sounds. Rudimentary blockchain education is all that is necessary in order to be able to program smart contracts and join in the DeFi revolution.

As always, Ivan on Tech Academy is the best place to learn blockchain. The site offers an abundance of various blockchain courses, and naturally both a DeFi 101 course and a DeFi 201 course. As such, there is something both for DeFi beginners and DeFi experts.