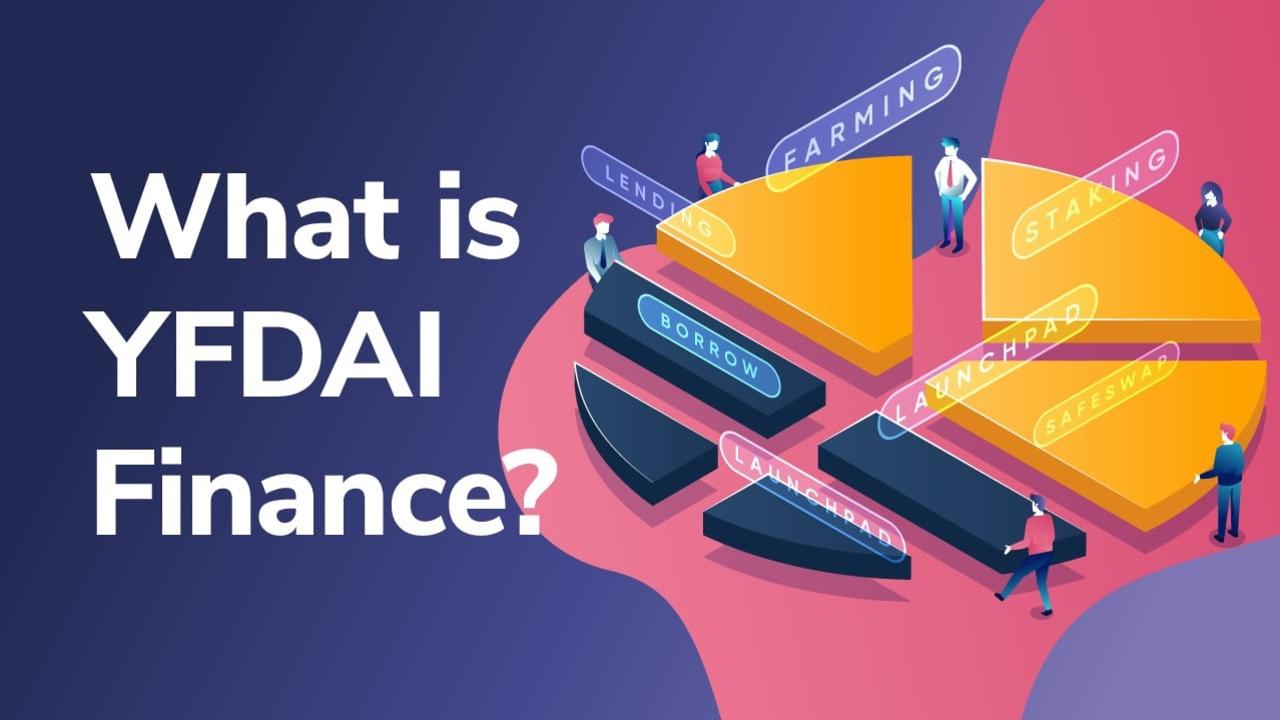

YFDAI.Finance seeks to provide a full-on DeFi ecosystem that combines lending and borrowing, staking and farming services, a decentralized exchange (DEX), automated predictions trading, insurance, and a secure platform for new product launches.

So, unlike your average protocol, YFDAI offers an entire suite of DeFi services. The team has ambitious plans as we’ll see in this article. So, with that in mind, let’s look at some of their basic features before digging deeper into the ecosystem itself.

- Accessibility

YFDAI wants to offer an intuitive user experience (UX)—part of that being a detailed list of instructions to make the platform easier for their users to navigate.

- Trustlessness

YFDAI is committed to the philosophy of distributed trustlessness.

- Intuitive Governance

The YFDAI.Finance team believes in nourishing a healthy community, that’s why they offer the first of its kind, a free on-chain voting mechanism.

- Security

Security is king in the YFDAI Finance ecosystem and YFDAI wants a secure protocol. They have already been audited and certified by the Blockchain Consilium.

However, you should do your own research and due diligence when taking a look at any DeFi project. The decentralized finance ecosystem is vibrant and more sprawling than ever. However, in order to determine what projects suit you the best, you need to have a basic understanding of cryptocurrencies and blockchain technology. Enroll in one of Ivan on Tech Academy’s blockchain courses to supercharge your blockchain education to be able to evaluate YFDAI Finance!

The YF-DAI token

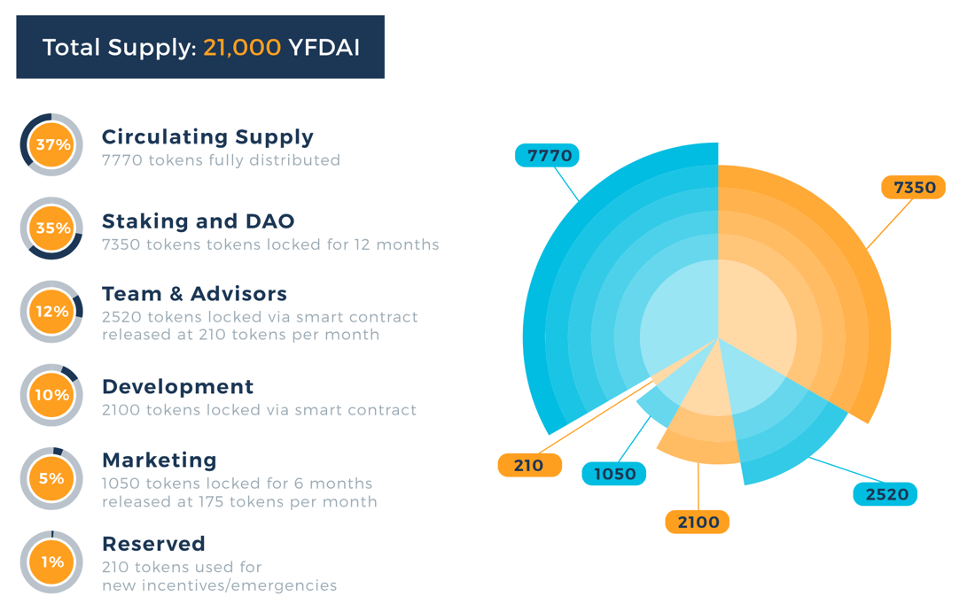

YFDAI Finance’s native YF-DAI token aims to facilitate governance and be used for paying fees. There will only ever be 21,000 YF-DAI tokens. They are stored in a staking contract that does not allow for more to be minted.

The platform also rewards liquidity providers with YF-DAI tokens. And the deflationary burn mechanism will continue until the total supply has been reduced to just 13,950 tokens.

The Pillars of the YFDAI Ecosystem

A lot is going on with YFDAI Finance, so let’s start by examining the main cornerstones of this project.

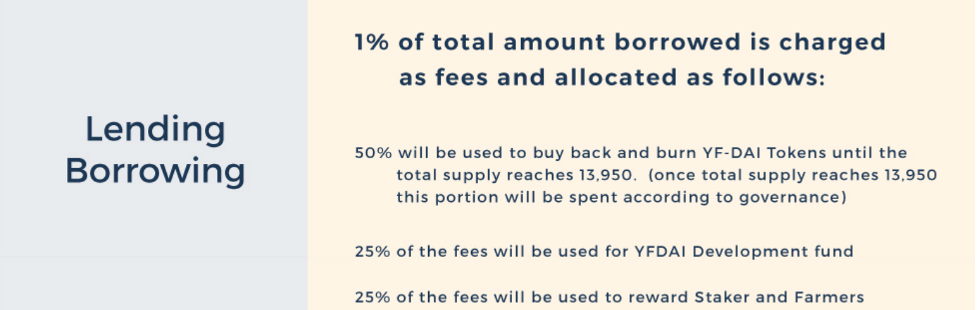

Lending and Borrowing

A community of lenders and borrowers grease the wheels of the DeFi machine at YFDAI.Finance. Depositors provide liquidity and earn a passive income whilst borrowers get access to over or under collateralized loans.

The YFDAI Finance platform seeks to simplify this process as much as possible by giving its borrowers convenient access to loans. Liquidity providers, on the other hand, just need to deposit funds and they can start earning income. The amount they can earn will be based on the borrower’s demand.

Staking

YFDAI.Finance also designed their staking feature to be as simple as possible. They only require a 72-hour lock-up. After that, stakers can withdraw their tokens plus any interest earned at any time. The goal is to encourage users to stake tokens whilst also reducing the available circulating supply of YF-DAI. The basic supply and demand metrics should also increase the token’s price.

Users can stake YF-DAI tokens to earn an ROI of 72% annually—which works out to approximately 0.2% daily or 6% monthly. The team believes their offer is superior since they consider other farming pools to be little more than introductory APR’s that gradually diminish over time. Whilst YFDAI offers fixed return rates guaranteed by their self proclaimed, superior tokenomics system.

Staking Fees

Stake Entry Fee: 1.5%

Stake Exit Fee: 0.5%

The good news for the average retail investor is that rewards are not based on the size of a user’s stake. For example, let’s say a staker locks 1000 tokens into the protocol. The protocol will deduct a 1.5% entry fee from the initial 1000 tokens. So 15 tokens will come right off the top. If a user staked 100 tokens, the percentage would be the same, resulting in a 1.5 token fee.

All YF-DAI tokens collected from staking will be burned at 3-month intervals until the magical number of 13,950 is reached. Here is the burn transaction if you’re interested:

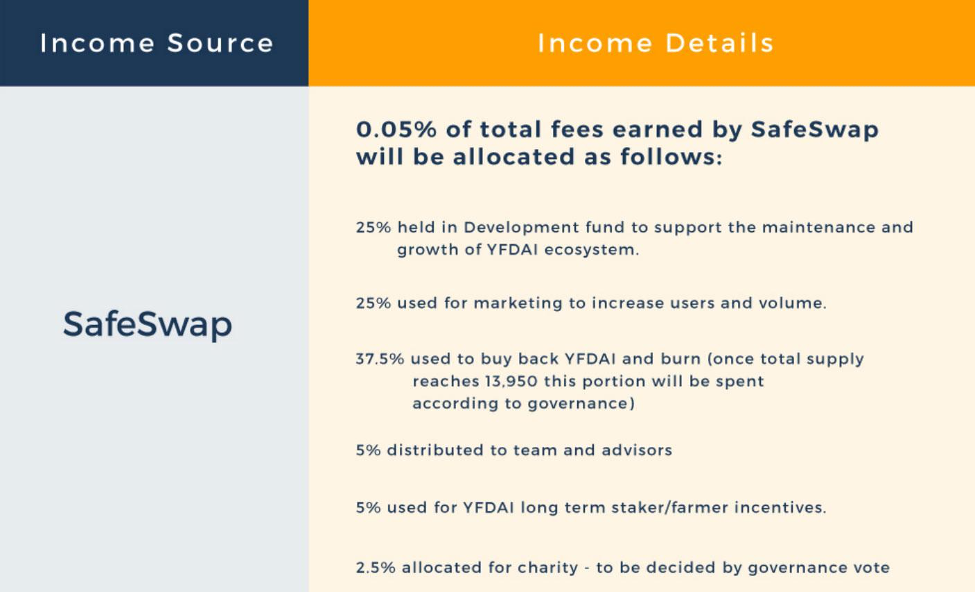

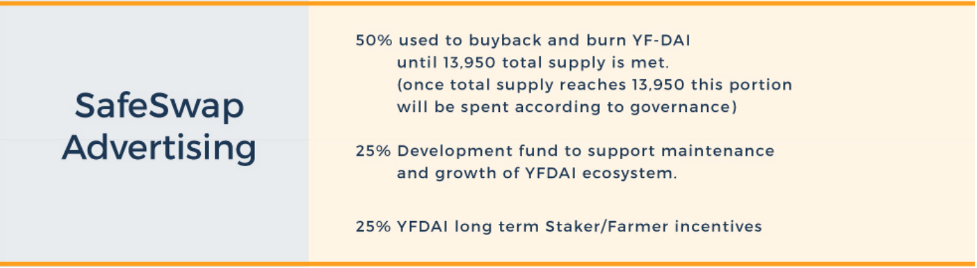

Besides the burn mechanism, YFDAI wants to reduce the circulating supply of their token by incentivizing users to stake their tokens long term. Those engaged in long-term staking will benefit from the SafeSwap profit share, the SafePredict profit share, and the Borrowing/Lending profit share. Learn more about the YF-DAI Staking dApp.

Farming

The platform has dedicated 1,455 YF-DAI tokens to their yield farming services to be distributed amongst four pools. It will burn farmed tokens over time and more pools will be opening via LaunchPad (see below) dependent upon governance vote.

The team doesn’t want to fall into the trap of offering large introductory annual percentage yields (APYs). That’s because these rates have to fall at some point and usually do so rather quickly.

When that happens, it just incentivizes farmers to hop over to newer pools with higher introductory rates. YFDAI wants their farming to be sustainable and not based on token inflation. So, they will use income provided from fees generated in their ecosystem to counter inflation.

At present, YFDAI Finance’s pools require users to provide liquidity to the Uniswap YFDAI-ETH pool. Liquidity providers will receive a token (with no resale value) called YF-DAI/ETH UniV2.

With this token, liquidity providers can then access the related pool on YFDAI’s platform to receive YF-DAI tokens. Once the team has launched SafeSwap (see below), however, farming will move away from Uniswap.

Farming has been one of the prime movers in DeFi and has been a great way for users to generate income with their cryptocurrency holdings. Otherwise, they’d just be collecting dust in a cold-storage wallet somewhere. With YFDAI, farmers will have a variety of pools to choose from. Looking for more related techniques to yield farming? Check out our recent guide for how to earn a passive income with Ethereum! What’s more, if you enroll in Ivan on Tech Academy using the code BLOG20, you’ll get a 20% discount!

The SafeSwap DEX

With recent hacks hitting some popular centralized exchanges (CEXs), as well as government crackdowns on exchanges like BitMex and OKEx, the idea of trading on a DEX is becoming more acceptable. SafeSwap is the DEX of YFDAI.Finance. It’s just a fork of Uniswap.

However, with Uniswap having a huge advantage over other DEXs at this point, the YFDAI team hopes to gain a modest 10% market share off Uniswap’s volume by making SafeSwap a safer place to trade.

They cite 34 as the number of “rug pulls” recorded in one day on Uniswap amongst other fraudulent activities. The team believes this offers them an opening to win some of the Uniswap faithful over by offering them a more secure trading environment.

To do this, the SafeSwap exchange will only take on projects that meet their strict criteria. The goal of SafeSwap is to offer users peace of mind by trading in a safe environment while eliminating as many of the pitfalls as possible.

Transactions on SafeSwap will use the YF-DAI token, which will also trigger the burn mechanism mentioned earlier.

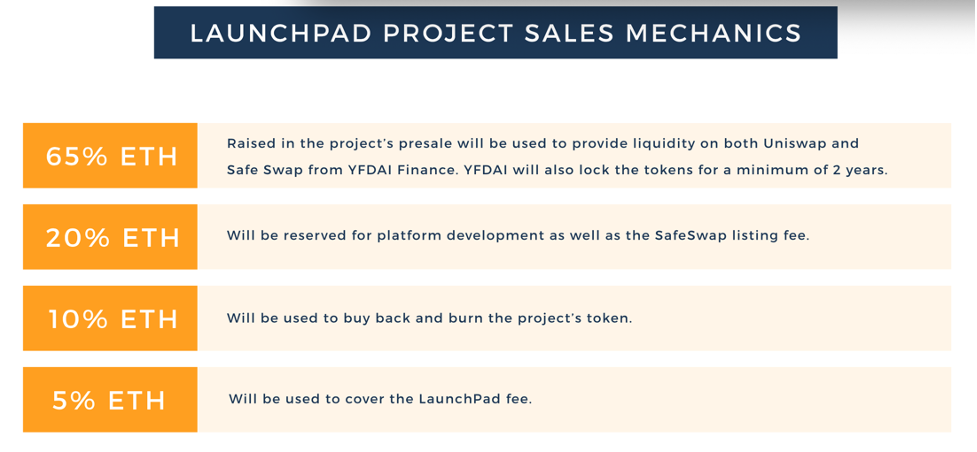

Launchpad

YFDAI Finance seeks to promote new projects on its platform they call LaunchPad. The team believes they can offer abundant advisory and development services to help legit start-ups reach their potential. They plan on doing this by fully auditing all smart contracts and by matching the right tokenomics to the right projects. Projects that can meet their high standards will get access to their SafeSwap exchange and other services.

Each new startup will have to pass the same security audits. Also, YFDAI Finance is committed to an ongoing bug bounty program to prevent everything from code inconsistencies to protocol exploits.

To be eligible for LaunchPad, projects must:

- Not engage in any private sales until the YFDAI.Finance team has reviewed and approved the project’s tokenomics.

- Use fully audited and secured smart contracts.

- Allow YFDAI.Finance to conduct the pre-sale.

- Know that the YFDAI team will be available for any advisory services throughout the process.

So, new projects will have to undergo code audits, token locking, as well as fully comply with the LaunchPad protocol if they want to be accepted. In essence, they have to adhere to the same standards that the YFDAI Finance platform demands of itself.

Insurance

Transacting with smart contracts can be risky especially when it comes to moving large amounts of money around. That’s why YFDAI will be mitigating some of that risk by offering an optional DeFi insurance program.

SafePredict

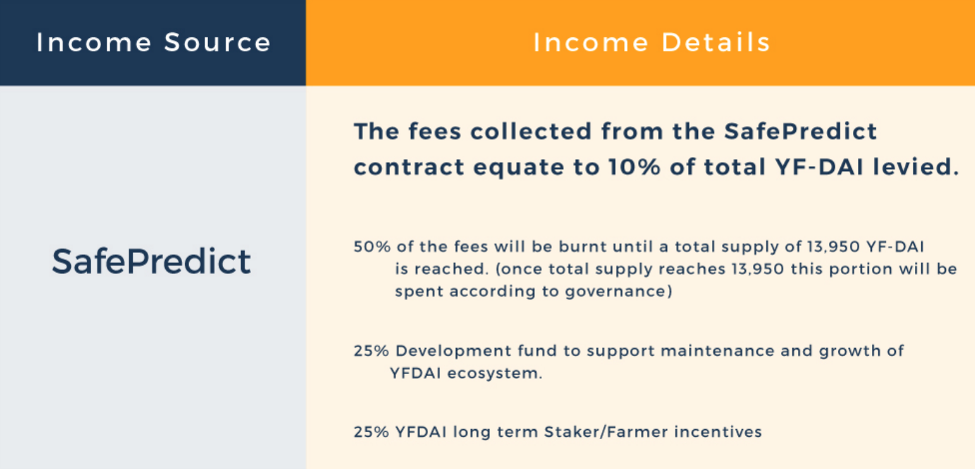

SafePredict is YFDAI Finance’s automated predictions trading platform. With SafePredict, YF-DAI holders can make price predictions regarding the token’s future price. Users must predict what the price will be on a specific date in the future and submit their tokens to the SafePredict smart contract to participate. The fee to use SafePredict is 10% with terms ranging from 1, 3, 7, or 14 days.

When the contract date expires, a third-party price oracle will determine the winner. The winner takes all, while the others who predicted incorrectly will lose their funds. And should there be any disputes, they will be resolved through the governance system.

Also, the platform will distribute 25% of SafePredict’s profits to farmers and stakers who have participated for a minimum of 30 days. In the spirit of fairness, rewards are based on the time users participated rather than the size of their investment.

YFDAI.Finance’s Vision

The team’s vision is in line with the philosophy of DeFi at large: They seek to provide trustless financial services to the world.

From the beginning, they decided to make transparency and security a priority in stark contrast to all the “exit scammers” and “rug pullers” that have entered the space. Bogus projects seem to be growing in tandem with DeFi’s popularity. And this is one of the reasons why they created YFDAI.Finance—to combat the fraudsters.

And it’s also why they’re adamant about upholding a “best practices approach” when it comes to maintaining a high level of security in their entire ecosystem.

How is YFDAI.Finance Different?

The team at YFDAI believes that many of the DeFi solutions out there are lacking in the way of a sustainable tokenomics system. Many systems are deflationary instead of inflationary and are not running on sound economic principles. Also, while other DeFi platforms offer some of the same services like lending and borrowing, they come with a limited set of tokens. YFDAI hopes to launch a full suite of products by the end of this year.

The Future of YFDAI.Finance – More than DeFi

DeFi is ever-growing and evolving to the point where one day, it will legitimately challenge the legacy financial system. Once it reaches critical mass, DeFi will prove unstoppable. And YFDAI wants to be poised to ride this wave of upcoming, worldwide financial services. So, YFDAI seeks to bridge the gap between DeFi and traditional finance in multiple ways.

Looking ahead, DeFi will remain the primary target, but the team has set its sights even higher. They look forward to one day creating a platform that offers a plethora of merchant services for a seamless shopping experience with the following:

DEX – Crypto to Crypto

SafeSwap will function as the DEX for crypto to crypto swaps.

CEX – Fiat to Crypto

Accordingg to YFDAI, their DEX will not require users to fill out Know Your Customer / Anti-Money Laundering (KYC/AML) registration forms. However, with fiat that will change. Those who wish to use the YFDAI CEX will need to satisfy KYC/AML requirements before trading fiat. The CEX will be fully licensed and compliant with regulators. The goal is to onboard loads of new users wishing to exchange their fiat currency for crypto.

The Unbanked

We’ve previously talked about the issue of the unbanked, and gone into depth on banking the unbanked with decentralized finance. The 1.7 billion adults still unbanked are a target market of lots of protocols and YFDAI is no exception. They see this market as an untapped pool of future customers.

Free Debit Card

The goal of implementing the YFDAI Debit Card is so that users can convert and spend crypto worldwide for free with cashback offers on purchases.

eCommerce

YFDAI seeks to integrate an e-Commerce app into its existing framework. They hope to build a digital mall in essence, where they can offer lots of online goods and services like tokenized art (see NFTs).

Conclusion

As mentioned, YFDAI.Finance has some ambitious goals. Frankly, it can all seem a bit much, but it’s nice to have big dreams. What’s more, their initial plans for setting up a secure DEX with high standards for its users can only be a good thing for DeFi.

If you have big dreams in DeFi, why not get started on your blockchain education today? The longer you wait the longer it’s going to take. So, check out the courses at Ivan on Tech Academy today! Ivan on Tech Academy offers DeFi courses and numerous free in-depth blog posts relating to all things blockchain and cryptocurrency!

Author: MindFrac