Users of centralized trading platforms may take the many tools, visualizations, and data made available to make trading simple for granted. Decentralized exchanges (DEXs) have become a popular alternative to centralized exchanges (CEXs) due to the appeal of self custody, and the absence of intermediaries. However, what is somewhat absent in the DeFi space is a professional decentralized trading platform. UniLayer claims to be a “next-generation decentralized trading” platform built on top of popular DEX, Uniswap. With the use of the native ERC-20 LAYER token, UniLayer lets users take advantage of professional-level trading features and apply them in the world of DeFi, without the need for a third-party.

In this article, we’re going to explore the UniLayer platform and its various components. Also, we’ll look at the utility of the LAYER token and the roles it serves within the UniLayer ecosystem. Furthermore, we’ll discuss some of the unique features of the platform and what we can expect to see in the future!

UniLayer is one of many platforms taking decentralized finance (DeFi) to the next level. DeFi is reshaping the global financial system in a way far beyond cryptocurrency trading alone. The DeFi 101 course at Ivan on Tech Academy is designed to guide you through the fundamental aspects of DeFi to help you safely explore some of the most popular decentralized applications (dApps) and protocols available. From here, if you want to create your own dApps and learn about yield farming, be sure to check out the DeFi 201 course at Ivan on Tech Academy!

What is UniLayer?

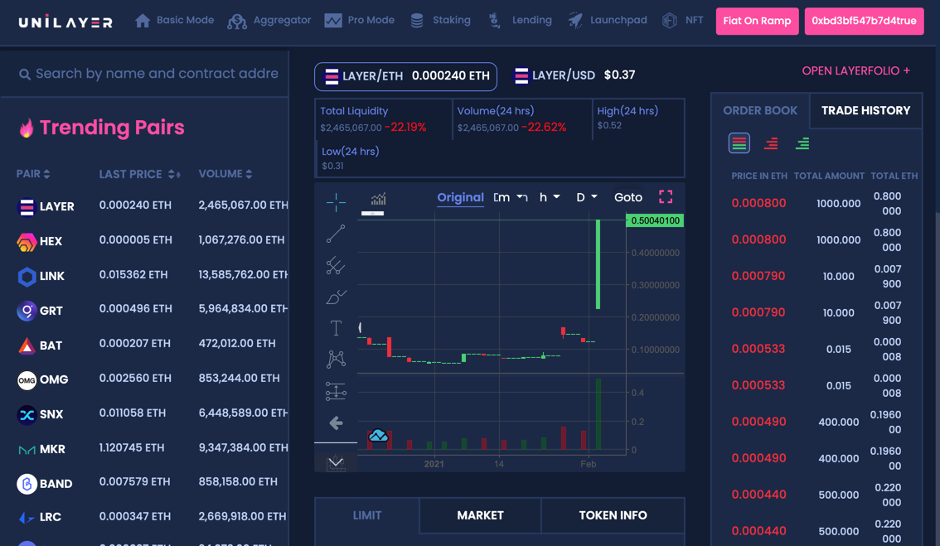

UniLayer is a decentralized trading platform built on popular decentralized exchange (DEX) Uniswap. The platform boasts a range of features to bring professional-level trading to DeFi. Such features include live charts, live order books, analytics, and other tools seen on popular centralized exchanges and trading platforms. Furthermore, the UniLayer ecosystem offers automated swaps, liquidity management, staking, a DEX aggregator, as well as a crypto launchpad for up and coming projects. Soon we will also see the introduction of non-fungible tokens (NFTs) to the platform.

Also, UniLayer features a fiat on-ramp. This makes it extremely simple for users to access decentralized finance (DeFi), without the use of a centralized exchange as an intermediary. Though it has been done before with projects such as Kyber Network, this is quite rare in DeFi! These features combined present an appealing platform for both experienced DeFi users and newcomers looking to broaden their horizons in the crypto space. UniLayer merges many of the hottest trends in crypto into a single, user-friendly, professional trading experience.

The LAYER Token

The LAYER token is the native ERC-20 utility token that powers the UniLayer ecosystem. Most of the functions within the UniLayer platform reward LAYER holders for staking their tokens within the platform. This is a common theme that will continue along with the expansion of the platform, bringing further utility to the LAYER token as new features are introduced.

Currently, LAYER has a circulating supply of 19,999,998, out of a max supply of 40,000,000 tokens. Following an extended bull rally at the beginning of February 2021, the price of LAYER shot up to approximately $0.56, coming close to its previous all-time high of $0.68 in August 2020. At the time of writing, the LAYER token has a market cap of $8,376,774 and is trading at around $0.41.

Users who stake LAYER receive 1% of all ETH raised from each successful project launched on the UniLayer launchpad. Also, LAYER token holders get priority access to UniLayer token launches. Those that hold the most LAYER tokens receive the earliest access to project investment rounds.

Why Use UniLayer?

UniLayer boasts several features that provide a professional decentralized trading experience. Furthermore, the platform expands across many other areas of the crypto space. Below are some of the key features of the UniLayer platform.

Trade Automation

High gas fees mean that automated trades are often too expensive and impractical to perform on-chain. UniLayer takes these functions and incorporates them into an intuitive dashboard that harnesses the liquidity of blockchain-based liquidity platforms.

When trading with UniLayer, buy and sell orders can be scheduled and executed at specified times and token prices. As with popular trading platforms such as Binance, this makes it possible to efficiently time entries and implement trading strategies. Moreover, UniLayer enables users to automate trades based on specific price movements.

UniLayer uses real-time on-chain feeds for data regarding token prices, liquidity, and exchange rates. This is compiled into a sleek user interface (UI) to allow trade automation based on reliable data.

Many people are wondering how to take their trading game to the next level. If this sounds like you, check out the Ivan on Tech Bitcoin Strength Index (BSI) Indicator. This essential tool combines on-chain analysis with technical analysis to let you make decisions based on the highest quality data available. This allows you to make trading decisions based on probability, rather than emotion or gut feeling. Furthermore, The Ivan on Tech BSI Indicator lets you see what is likely to happen before it plays out on the charts!

Live Order Books

Another tool many traders take for granted is order books. Using UniLayer’s live order books, users can automate trades and schedule buy and sell orders for token pairs. Scheduling is made possible because UniLayer is a browser app that uses the JavaScript Date to execute scheduled orders accurately.

UniLayer order books give users the chance to preview all buy and sell orders as they are placed and filled. The ability to see trading activity as it happens in real-time provides an advanced tool for decentralized trading.

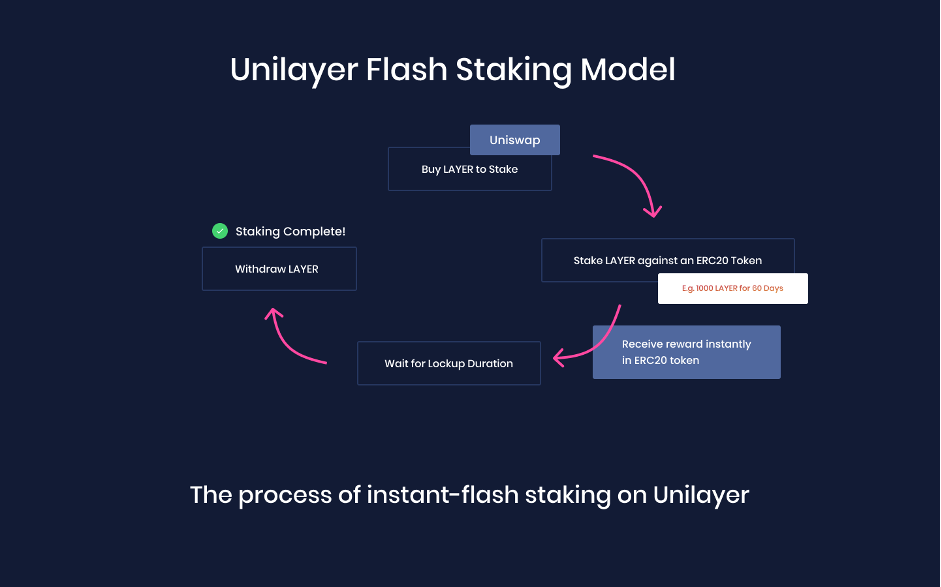

Staking

Another feature of the UniLayer ecosystem is Flash Staking. This allows users to quickly earn rewards for locking up funds, without the risk of being penalized for going offline or unstaking, as is common with many staking mechanisms.

UniLayer rewards stakers with a commission of 0.3% of trading fees, which is managed by Uniswap. Rewards are distributed proportionally to a user’s pool share. Each product created by UniLayer is designed to pay ETH to users that stake the LAYER token. As such, 92% of the ETH collected from limit orders is distributed to LAYER stakers.

Automated Lending Management

Also, UniLayer facilitates the automation of liquidity management by reallocating funds in lending pools for automatic portfolio rebalancing. Users can opt to automate the movement of liquidity from one pool to another when particular events occur.

The UniLayer Dashboard offers lending management features that make it easy to automate the movement of assets between Uniswap liquidity pools. This could be particularly handy when providing liquidity to pools containing volatile assets, as it means users can exit when a specific trading indicator is presented, or when a specific period has passed. Also, the UniLayer Swap facility includes a DEX aggregator, Uniswap liquidity pool portal, and token swap function.

UniLayer Launchpad

The UniLayer Launchpad is a decentralized and transparent way of raising funds for a new crypto project or startup. This works much like popular crypto launchpad projects TrustSwap and Polkastarter.

The UniLayer Launchpad presents a trustless method for fundraising that reduces the risk for investors by incentivizing users to hodl the token required for the launchpad allocations. This feature also facilitates team token locks, adding a further layer of stability to token launches.

Furthermore, all projects launched on the UniLayer Launchpad platform will undergo a security audit by German blockchain experts Chainsulting. Chainsulting has participated in over 300 audits for smart contracts on blockchains including Ethereum, EOS, and Tezos. This will give higher levels of security to the UniLayer Launchpad and greater confidence to its users.

The UniLayer Launchpad uses smart contracts to protect investors. Investors don’t have to trust the teams behind a project, they can trust the UniLayer technology. UniLayer Launchpad tokens will be minted using smart contracts that automatically lock liquidity into Uniswap pools for at least 6 months. Furthermore, team tokens will also be vested using smart contracts. The UniLayer Launchpad is designed to provide stability to the initial DEX offering (IDO) model in a way that protects both early investors and the teams behind the new projects.

LAYER token stakers will receive 1% of the ETH raised for each project launched on the UniLayer Launchpad. A minimum of 7,500 LAYER tokens will be required for access to the ‘priority queue’ which will soon go live. Furthermore, projects launching on the UniLayer Launchpad will have the opportunity to airdrop a percentage of the new token supply to stakers of the UniLayer token.

Charts & Analytics

The UniLayer Dashboard displays price charts just like most popular professional trading platforms. This provides a wealth of information including order data, liquidity volume, and much more! UniLayer makes it easy to apply technical analysis to your decentralized trading without the need for a third party charting tool.

Many professional traders have become accustomed to advanced chart analytics and trading tools. This has been mostly absent in the DeFi user experience (UX) until recently. The Dashboard provides multiple interactive price charts and data feeds that create a familiar and reliable trading environment with the most pertinent information to hand at all times.

Technical analysis is an essential tool for crypto trading. Understanding how to read market sentiment, trading patterns, and indicators can be pivotal to the success of a crypto trader. To learn how to read price charts, candlestick patterns, and various trading indicators, check out the Technical Analysis 101 course at Ivan on Tech Academy!

Why Build on Uniswap?

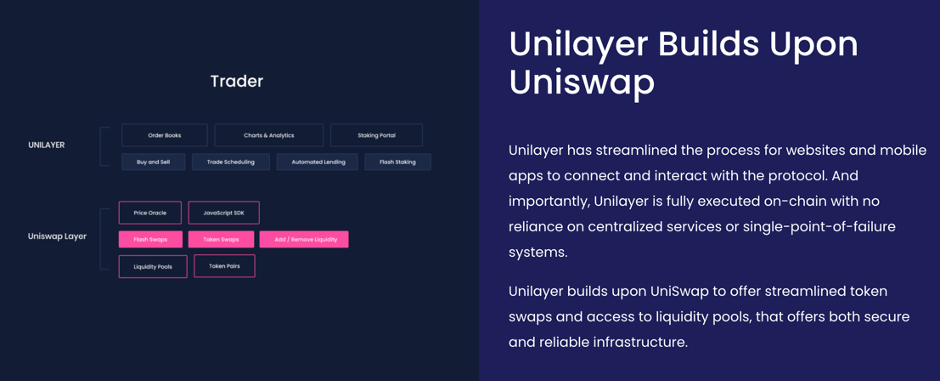

Decentralized exchange (DEX) Uniswap has created a streamlined process for mobile and web app integration using a fully-transparent and open-source JavaScript software development kit (SDK). This allows apps to equip Application Programming Interfaces (APIs) that facilitate many of the core features of trading and liquidity management needed to integrate Uniswap into third party applications with ease. Furthermore, this enables developers to publicly audit their code to check for bugs and vulnerabilities, while allowing legitimate concerns and improvement proposals to be addressed.

At the time of writing, Uniswap is the largest decentralized exchange (DEX) with $3.20 billion total value locked (TVL). Uniswap brings huge liquidity to crypto with a vast array of ERC-20 tokens. Some of this liquidity could easily migrate to UniLayer. As Uniswap continues to gain huge adoption, the liquidity made available to UniLayer will also increase. In time, this could make UniLayer the go-to platform for professional-level decentralized trading.

Furthermore, Uniswap has been publicly audited by ConsenSys. This essentially verifies the security of the smart contracts used in the Uniswap protocol. As a result, the security derived from the Uniswap risk assessments apply to the liquidity used by the UniLayer platform. This adds an extra layer of reliability to UniLayer. Moreover, Uniswap is a trustless, decentralized application, with no single-point-of-failure or central authority, which also benefits UniLayer by proxy.

UniLayer V2

UniLayer V2 is just around the corner! After several weeks of beta testing, an announcement from UniLayer outlined several updates and new features that will be added to the UniLayer ecosystem. These include a new and improved landing page, DEX aggregator, and a new staking platform and smart contract. As is frequent with many new projects, the first version of UniLayer had some issues.

However, after careful consideration of community feedback, extensive testing, and auditing, this upgrade aims to address those issues, and more. UniLayer plans to continue innovating and expanding the ecosystem and improving the user experience. Other new features and updates include new ‘Basic’ mode interface, a new fiat on-ramp integration, plus the ‘frontend gas selector’ that ensures limit orders are filled.

Another new feature lined up for UniLayer V2 is LAYERscan. LAYERscan will include Tradingview charts for Uniswap token pairs, liquidity and token data, price alerts, transaction history, and daily volume information. Also, LAYERscan will feature sponsored marketing campaigns for projects which can distribute 10% of fees to LAYER token holders. UniLayer also intends to integrate yield farming and governance, with the introduction of the LAYERx liquidity pool token.

All projects launched on the UniLayer Launchpad platform will undergo a security audit by German blockchain experts Chainsulting.

Furthermore, UniLayer V2 will introduce Polkadot ecosystem support. This will allow greater interoperability by bringing cross-chain compatibility to the platform while expanding its user base. In the future, we can also expect integrations with Binance Smart Chain and TRON, along with the introduction of non-fungible tokens (NFTs).

UniLayer Summary

UniLayer has experienced its share of ups and downs in the project’s short history. From a problematic first launch with BetFi, to issues with staking and gas fees. However, the project appears to be acting on feedback from the community to fix these issues quickly with the launch of V2. This should bring enhanced functionality to the platform to improve the user experience.

UniLayer could be considered an ambitious project. Combining so many elements into a single platform is a large task for a new crypto platform. After some unexpected occurrences and unfortunate setbacks, the UniLayer team could be about to reap the fruits of their labor. After months of hard work, UniLayer is about to become a step closer to achieving its goal of becoming the ultimate decentralized trading platform. Many of the features mentioned are yet to be implemented. However, UniLayer could soon be the go-to choice for professional traders looking to automate strategies on decentralized exchanges (DEXs).

Automated trading is a game-changer for crypto. If you want to learn how to create and backtest your trading strategies, the Algorithmic Trading course at Ivan on Tech Academy is the ideal place to learn how to maximize the effectiveness of your trade automations and keep you ahead of the curve in the crypto markets! Also, if you’re using UniLayer already, find us on Twitter at @Academy_IOT to let us know what you think about the project!