ParaSwap is an innovative and competitive decentralized exchange (DEX) aggregator. Using a combination of features, ParaSwap aims to streamline the user experience with decentralized finance (DeFi) protocols, branding itself as a solution for DeFi liquidity. ParaSwap aggregates price and data feeds for many major decentralized exchanges to discover and offer the best price for users. This is in addition to routing through the ParaSwapPool, offering even better exchange rates. Moreover, ParaSwap acts as a middle layer between DeFi liquidity protocols and users. ParaSwap aims to facilitate the fastest and fairest trades of Ethereum-based tokens (ERC-20).

In this article, we are going to dive deep into the fundamentals of ParaSwap and explore how this decentralized exchange (DEX) aggregator operates under the hood. Moreover, we’ll explore the differences between ParaSwap and Uniswap, the largest DEX on Ethereum. Also, we’ll look at the advantages of ParaSwap and why the project has seen so much success.

To interact with ParaSwap, you must first be familiar with the number one Web3 wallet, MetaMask. Be sure to check out the DeFi 101 course at Ivan on Tech Academy for a video-guided tutorial of installing and using MetaMask with some of the most popular decentralized finance (DeFi) protocols. If you have yet to invest in cryptocurrency, our Crypto Basics course is perfect for newcomers to the industry. We offer expert-led tutorials, including how to create an exchange account and ensuring your crypto coins are stored safely using hard wallets. No matter your experience or background, Ivan on Tech Academy has the right course for you to get started in crypto today!

What is ParaSwap?

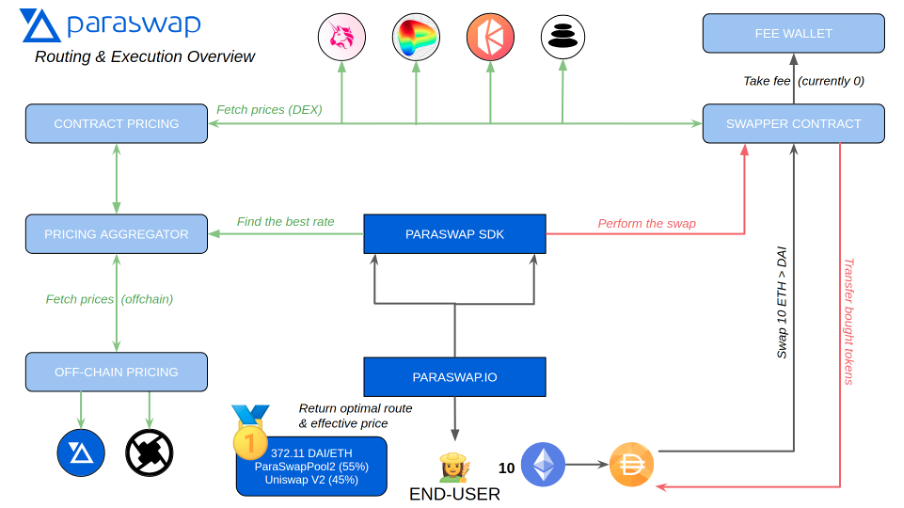

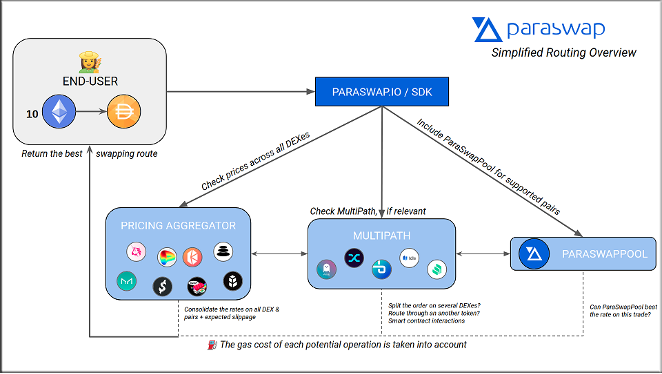

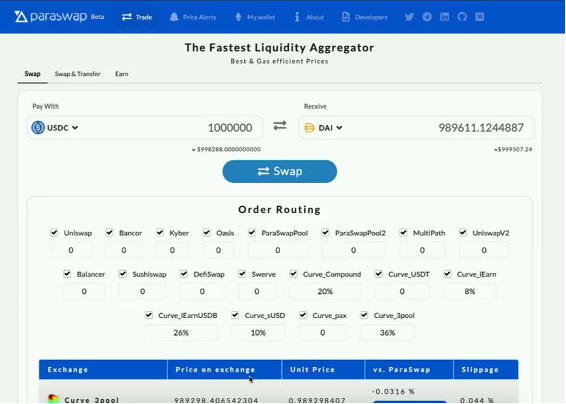

ParaSwap is a decentralized exchange (DEX) aggregator created on Ethereum. This means, when a user wants to make a trade, the project scours through many of the largest exchanges and automated market makers on Ethereum to find the best price. Moreover, ParaSwap has designed a pathing protocol, MultiPath, to take into account gas fees and other variables, when searching for the best trade on a transaction.

The protocol is backed by several large name investors. During the recent successful seed funding round, ParaSwap gained the backing of Blockchain Capital, Coinfund, Arrington XRP Capital, among several more. ParaSwap aims to become the chosen DEX aggregator on Ethereum offering the fastest trades with the best rates.

Users can access ParaSwap through their direct website ParaSwap.io. Alternatively, developers can integrate the open-source DeFi liquidity solution into their own decentralized applications (dApps). To discover how to create your own decentralized application (dApp) with an end-to-end video tutorial from industry experts, see the Ethereum dApp Programming course at Ivan on Tech Academy!

ParaSwap DEX Aggregator Features

One of the advantages of using ParaSwap is that it benefits both large and small value trades. This is achieved using a combination of various innovative protocols including the ParaSwapPool, MultiPath, and GST2 Gas tokens.

ParaSwapPool

Traditionally, decentralized exchange (DEX) aggregators don’t hold or store any liquidity of their own. The liquidity is available through the chosen DeFi protocol, the DEX aggregator merely provides another gateway.

Conversely, ParaSwapPool gives users access to ParaSwap’s private Market Maker pool, as its own decentralized finance DeFi liquidity source. This creates further opportunities for pathing and optimization of transactions. The ParaSwapPool liquidity is an aggregate pool from professional liquidity investors. Using an RFQ (request for quote) system, the ParaSwapPool uses liquidity from private investors. However, ParaSwap has plans to create a more decentralized and accessible alternative in the future.

ParaSwap ensures any relevant trade will be routed through the ParaSwapPool to achieve the best rates. The ParaSwapPool is treated just like any other decentralized exchange. Occasionally, optimization of trades can beat the going market rate!

If you like the idea of creating your own decentralized exchange (DEX), Ivan on Tech Academy can make this happen! For programmers new to blockchain, see our Ethereum Smart Contract Programming 101 course to become familiar with the Solidity programming language to start with. Then, you will have sufficient knowledge to move on to our Ethereum Smart Contract Programming 201 course, where you can design and deploy your own decentralized exchange (DEX)!

If this sounds appealing but you have no programming skills, Ivan on Tech Academy has your back! For readers with no previous coding experience, we recommend starting with our Javascript Programming for Blockchain Developers course, designed for beginners. From here, you will have sufficient knowledge to move on to our blockchain programming courses! Join over 30,000 students at Ivan on Tech Academy today!

MultiPath

The pathing protocol designed by ParaSwap is known as MultiPath. The name represents some of its functions, including discovering multiple ‘paths’ or routes of a token exchange during a trade. Moreover, MultiPath can interact with automated market makers (AMMs) and decentralized finance (DeFi) lending platforms. This means ParaSwap users’ transactions can be routed seamlessly through some of the largest DeFi protocols including Compound and Aave.

The MultiPath protocol can also split transactions across several exchanges. Also, MultiPath can facilitate intermediary tokens to achieve an even better rate when required. Sometimes, when users want to make a trade and swap tokens, there isn’t a direct trading pair. In this instance, MultiPath can process the transaction across multiple automated market makers (AMMs), decentralized exchanges (DEXs), and decentralized finance (DeFi) liquidity protocols to find the best conversion rates. Further, the consideration of Ethereum gas fees and fluctuating price variables are taken into account during the trade. MultiPath can facilitate indirect trading routes (two or more hops between protocols) for a frictionless user-end experience.

ParaSwap Fees

When a transaction occurs on the Ethereum blockchain, a certain amount of computational power is required to process the request. This is known as gas. Depending upon the size of the transaction (not the value!) and the amount of activity on the network, gas fees can fluctuate greatly. With the gradual rollout of Ethereum 2.0 and scaling solutions, the gas fees on Ethereum are set to reduce over time. ParaSwap, however, does not charge a fee for its service.

Instead, the services integrated with ParaSwap charge a commission for any swaps facilitated. ParaSwap will then take a cut of this commission (default 15%). For decentralized applications (dApps) that have integrated the ParaSwap API, ParaSwap will take a small commission through a Revenue Sharing contract.

ParaSwap optimizes gas fees under the hood when users make a trade. Although ParaSwap itself doesn’t charge any fees, users must still pay the Ethereum network fee as each trade on ParaSwap.io is settled on Ethereum. ParaSwap enables the tokenization of gas costs when they are low, as GST2 Gas tokens. These tokens are then used in conjunction with ParaSwap trades during periods of high network activity, to reduce and optimize gas fees on Ethereum.

The gas price suggested by ParaSwap will be calculated to be optimal at the time. Ultimately, however, the user has full control and choice over the gas fee when making a trade. This greatly influences the time a transaction takes to confirm. If a gas fee is too low, the transaction will never be picked by miners to verify and confirm the transaction.

Positive Slippage

Cryptocurrencies operate in a free market. As the market cap of some currencies is still relatively small, the prices of these assets can be volatile. Other transactions on the network can push a token price up or down, during the time one is waiting for their transaction to be confirmed. This is known as ‘slippage’. ParaSwap has implemented several features to hedge against this. These include a “minimum received” amount and securing token prices for a set amount of time using the ParaSwapPool.

In the ParaSwap v3 smart contracts, the fee model around slippage has adapted slightly. In the event of positive slippage, more tokens can be received for the price paid. Applications are not obliged to give their users the positive slippage amount, with some services keeping 100% of profits. As a more community-orientated project, ParaSwap’s contracts are set to take 50% of the positive slippage to put back into growing and evolving the platform. The remaining 50% is deposited straight back to users. This means that, when trading ETH to DAI, for example, you may receive slightly more DAI tokens than originally stated.

DeFi Liquidity Solutions: ParaSwap vs Uniswap

Uniswap is the number one decentralized exchange on the Ethereum blockchain, with over $6.25 billion TVL (total value locked) at the time of writing, according to DeFi Pulse. There are two main ways to interact with Uniswap (this is another protocol where users will need to know MetaMask). Firstly, users can trade ERC-20 tokens on the Ethereum blockchain, using ETH to pay for gas. Secondly, users can become liquidity providers (LP), by depositing ETH and a chosen paired token, to receive LP tokens and a percentage of transaction fees as rewards. This is a popular way of earning a passive income in the crypto community!

The Uniswap graphical user interface (GUI) is simple and sleek, featuring only a centered trading widget and two buttons to interact with. However, there are some limits to the Uniswap routing logic underneath the hood. Uniswap uses limited trading pairs with token transactions, even if there is a better alternative. These include wETH, DAI, USDT, USDC, MKR, and COMP. This means ERC-20 tokens without a trading pair to the aforementioned list will be subject to worse conversion rates and transaction fees, than tokens that do.

As a top DEX aggregator, ParaSwap compares the rates of all token pairs to the relevant token to ensure all transactions are cost-efficient and fair. ParaSwap considers Uniswap to be healthy competition, although the projects are quite different. Uniswap is the top decentralized exchange (DEX) and ParaSwap is a DEX aggregator that uses Uniswap in its routing.

Why use ParaSwap DEX Aggregator?

ParaSwap is a solution for decentralized finance (DeFi) liquidity by exhausting swapping routes thanks to MultiPath, a “redefined pathing analysis”. This includes splitting an order up across several major exchanges such as Kyber, Curve, and 0x network.

Also, the ParaSwapPool is used in the pathing analysis, often resulting in even better exchange rates. The ParaSwap routing algorithm compares the rates of tokens across all integrated exchanges. This is in addition to gas fees and slippage, frequently involving extra ‘hops’ between protocols.

Further, transactions on ParaSwap may be routed through several exchanges to execute the trade. However, the trade itself will be executed with a one-time gas fee to cover the minimum costs of computation on the Ethereum network. Also, ParaSwap uses its tokenized gas in the form of GST2 tokens for when the Ethereum network becomes congested, and the gas fees increase substantially. Any gas cost saved as a result of the use of the GST2 tokens is returned to the user. The platform displays the estimated minimum amount of tokens to be received as a worst-case possibility. Often, the case is better than expected. ParaSwap aims to under-promise and over-deliver on every trade.

ParaSwap Summary

The ParaSwap platform offers a simple and seamless user experience for exchanging tokens. However, there is a lot that goes on under the hood of this application. The innovative MultiPath routing algorithm searches extensively across all integrated exchanges and relevant token pairs to find the best rate. Moreover, MultiPath takes into account gas fees, slippage, and other price variables.

The ParaSwapPool is another feature of the decentralized finance (DeFi) liquidity solution. This creates an additional layer of pathing analysis, often bettering the exchange rates. Also, ParaSwap can be integrated into developers’ decentralized applications (dApps) with zero friction. Implementing efficient protocols for both traders and developers means ParaSwap appears set to have a strong position in the future of decentralized finance (DeFi).

As we grow ever closer to the mass adoption of cryptocurrency, it may be beneficial for one to understand the rules and regulations around the integration of finance and technology. As it happens, Ivan on Tech Academy has a course dedicated to discovering how the world’s two largest industries are becoming one, and what this means for businesses and compliance. See our FinTech 101 course for a detailed breakdown from our industry experts. Also, our US Taxation of Digital Assets course is perfect for US-based individuals looking to file their taxes and be crypto-compliant with their assets. Discover all things crypto and blockchain at Ivan on Tech Academy! Also, don’t forget to follow us on Twitter @Academy_IOT! Let us know your thoughts about ParaSwap!