You might be forgiven for thinking that food-themed cryptocurrencies were just a ‘flash in the pan’, so to speak. To an extent, you may have even been correct. The yield farming frenzy during Summer 2020 produced several food-based yield farming protocols and tokens. PancakeSwap is a decentralized cryptocurrency exchange (DEX) built on Binance Smart Chain (BSC), powered by the BEP-20 Pancake token (CAKE). The CAKE token is one of several tokens used within the PancakeSwap protocol and made available for token swaps. Similar to Uniswap, PancakeSwap is an automated market maker (AMM) and decentralized application (dApp) that features liquidity pools where users can earn fees from staking, lending, and yield farming.

In this article, we’re going to explore the PancakeSwap platform and the seamless yield farming experience it creates for users. Also, we’re going to look at the CAKE token and the other tokens used with the platform. Furthermore, we’re going to look at how Binance Smart Chain (BSC) has bootstrapped the PancakeSwap platform to create a secure and user-friendly environment for decentralized finance (DeFi) and yield farming.

Those new to crypto and unsure where to start, check out the Crypto Basics course at Ivan on Tech Academy! This is the perfect place to learn all about the industry from the ground up. Also, check out our Blockchain & Bitcoin 101 course to broaden your understanding of how blockchain works on a technical level!

What is DeFi?

Decentralized finance, or ‘DeFi’ is a term used to describe a decentralized network of blockchain-based financial applications. Sometimes described as ‘money legos’, DeFi protocols are often open-source. This means that anyone can build on top of them to create new variations and amalgamations. DeFi is disrupting the legacy financial system by removing unnecessary third parties and providing a compelling alternative as a solution.

Until recently, DeFi was considered by most to be a relatively risky endeavor, and there are undoubtedly still risks involved. However, DeFi has gained substantial adoption throughout 2020 and into 2021. Not only has the perceived technical barrier for entry been lowered for DeFi, but the industry itself has become an important part of the future of global finance. However, DeFi is still a relatively new industry. Therefore, DeFi should still be approached with caution. The technology is in its infancy, with many projects being tested during production, totally unaudited.

However, for the most part, DeFi is reshaping wealth distribution and how we think about money. It could also play a major role in ending global poverty and bringing financial parity to the unbanked. DeFi is borderless, permissionless, and allows people to gain financial freedom.

There are many sub-categories of DeFi, including, decentralized exchanges (DEXs), derivatives, asset management, lending protocols, and yield optimization. Decentralized exchanges (DEXs) such as Uniswap are peer-to-peer cryptocurrency exchanges that use smart contracts, rather than third-party intermediaries and order books. Furthermore, DeFi can be used for yield aggregation and automation with platforms such as Yearn Finance and Reef.

Popular DeFi lending protocols such as Aave, Compound Finance, and MakerDAO are great examples of how DeFi lending money-markets work. You can learn exactly how to get to grips with these protocols and much more with the DeFi 101 course at Ivan on Tech Academy!

What is Yield Farming?

Yield farming, or liquidity mining, is a term used in DeFi to describe the process of strategizing the movement of funds between multiple smart contract-based DeFi lending protocols to maximize returns. Returns come from annual percentage yield (APY) made from lending and trading fees. Also, DeFi implements an element of game theory by rewarding governance tokens to incentivize users of the protocol.

These governance token rewards combined with high levels of APY and effective yield maximization are the essence of yield farming. Users lock up crypto as collateral within a DeFi protocol, which then enables them to take out a crypto loan. This loan can then be used across multiple DeFi platforms to ‘harvest’ the best yields available.

Users must maintain collateralized debt positions (CDPs) to stay in the game. If token prices fluctuate, interest rates change, or a pool encounters an issue, users are at risk of liquidation. This essentially means that your funds are gone. To cover losses created by such volatility, CDPs are automatically liquidated if the collateral backing them falls below a certain threshold.

If you want to take your DeFi game to the next level, the DeFi 201 course at Ivan on Tech Academy is just for you! Here, you can learn all about yield farming, arbitrage, and much more!

With courses curated by our team of industry-leading professionals, Ivan on Tech Academy is the premier blockchain education suite available online. Also, it is the perfect place to start your journey in crypto. Regardless of experience, Ivan on Tech Academy has courses tailored to every area of the industry to help you find your perfect job in crypto!

What is PancakeSwap?

PancakeSwap is a decentralized cryptocurrency exchange for swapping BEP-20 tokens. If you’re familiar with Uniswap or SushiSwap, then you’ll know how PancakeSwap works. Each works in almost exactly the same manner.

The PancakeSwap exchange doesn’t use order books like traditional exchanges. Instead, it uses an automated market maker (AMM) model which matches buy and sell orders directly with others in a liquidity pool. User deposits maintain liquidity pools. By providing liquidity to such a pool, users can earn trading fees and liquidity provider (LP) tokens. LP tokes are redeemable for the initial capital deposited, plus any fees earned, minus any impermanent loss. Furthermore, LP tokens can then be staked, farmed, and traded!

Cloning or copying open source code from a popular decentralized application (dApp) is not uncommon. Particularly in DeFi, many new projects are based on existing protocols, with tweaks made to the original code. Simply make a few adjustments to a popular open-source code, create a new token, name it after your favorite snack, and presto - you’ve got yourself a freshly baked DeFi clone!

Regardless of whether you think cloning is a good thing or a bad thing, it happens a lot in crypto. For example, SushiSwap is a clone of Uniswap. Therefore, it should come as no surprise that PancakeSwap appears to work in a very similar way to SushiSwap, with a familiar layout and user interface.

However, PancakeSwap is flipping the yield farming model on its head, introducing a range of new features that provide an all-in-one yield optimization platform built around the Pancake token (CAKE). Furthermore, PancakeSwap benefits from the security of Binance Smart Chain (BSC), which could help convert some DeFi skeptics.

How to Use PancakeSwap and the CAKE Token

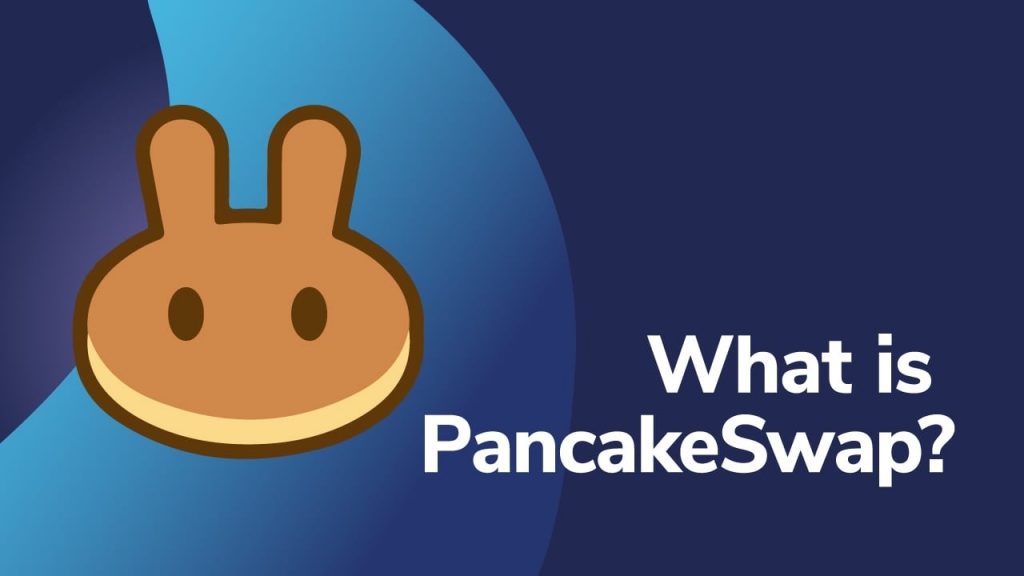

PancakeSwap makes yield farming simple and fun. To use PancakeSwap, you’ll first need to connect your MetaMask browser wallet or WalletConnect. Although MetaMask is an Ethereum wallet, the design of Binance Smart Chain (BSC) works in a way that makes decentralized applications (dApps) interoperable with Ethereum wallets such as MetaMask.

If you’re familiar with the Uniswap decentralized exchange (DEX) then PancakeSwap should be straightforward. The ‘exchange’ section is used for token swaps, while the ‘pools’ section is where fees are earned for liquidity provision. Finally, the ‘farming’ section is where the yield farming takes place.

To farm the Pancake token (CAKE), you’ll need to add liquidity to the PancakeSwap exchange pool. After selecting the token pair you wish to deposit, you can begin farming CAKE tokens. As with the movement of ERC-20 tokens in the Metamask wallet, withdrawals must be approved for BEP-20 tokens before PanckeSwap can withdraw them on your behalf. From here, you'll be prompted with a popup displaying the transaction amount and any fees. Then, to stake CAKE, you’ll need to transfer some Binance Coin (BNB) to your Binance Smart Chain (BSC) BEP-20 address for future transaction fees.

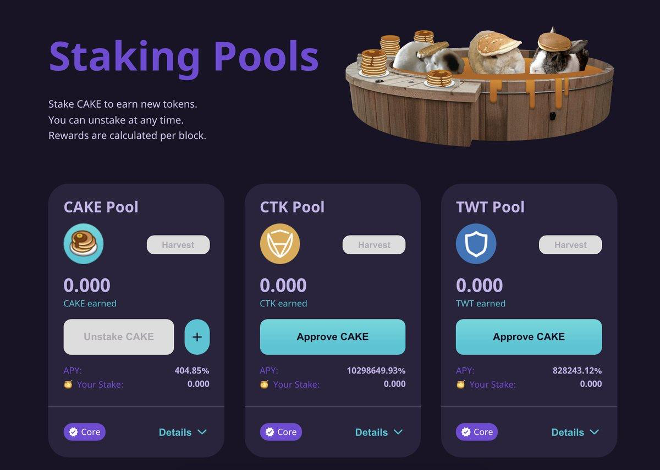

Upon the confirmation of your transaction, select how much you want to stake, and confirm the transaction. You can check at any point to see how much CAKE rewards you have earned and harvest any newly awarded tokens. This means CAKE tokens can then be staked to earn more CAKE!

Also, check out the ‘farm’ page to find which pool offers the greatest rewards based on your risk tolerance. Liquidity providers (LPs) earn 0.17% of all PancakeSwap transaction fees. Plus, PancakeSwap LPs also earn FLIP tokens, which can be staked too!

The Pancake Token

In September 2020, the Pancake token (CAKE) was launched on Binance Smart Chain (BSC). CAKE is a BSC-native BEP-20 token. The CAKE token has performed extremely well in 2021, showing an incredible price rally throughout February. The primary function of CAKE is to incentivize liquidity provision to the PancakeSwap platform.

At the time of writing, the Pancake token (CAKE) has a market cap of $335,680,356, selling at $3.03 per Pancake token, with a circulating supply of 111,566,950 according to CoinGecko. Also, CAKE has no max supply, which means it is a deflationary token, with tokens burned regularly to reduce the supply.

Yield Farming with PancakeSwap

As an early adopter of smart contracts, the network effect of the Ethereum blockchain gave rise to hundreds of decentralized applications (dApps) and yield farming protocols. However, many of these protocols are unaudited, and some outright scams.

Since then, advancements in the blockchain industry and DeFi have facilitated improved security measures by allowing the coming together of centralized finance (CeFi), and decentralized finance (DeFi). A great example of this is Binance Smart Chain. Binance Smart Chain is an ecosystem of decentralized applications that harness the power and security of Binance while offering many of the services that appeal to DeFi users, such as yield farming.

Yield farming allows users to stake funds in return for staking rewards. Rewards can be compounded and used across multiple protocols, allowing users to grow yield by chasing the highest interest rates across various parts of the DeFi ecosystem.

Services for yield optimization are now a common feature among many centralized crypto platforms. However, it was DeFi that truly popularized the idea of maximizing yield in crypto. Decentralized applications (dApps) have furthered the development and adoption of blockchain technology and cryptocurrency. DeFi Pulse is a website that displays the current rankings and analytics of DeFi protocols. According to DeFi Pulse, the total value locked (TVL) in DeFi has grown from around $1 billion to over $34 billion in less than a year.

The technology behind many yield farming protocols is unaudited and can be risky. Although these projects often offer high returns, the rates of these returns are extremely volatile. Yield farming protocols are ten-a-penny these days. However, the risk presented by many weird DeFi platforms should always be considered when participating in new technologies.

Providing Liquidity to PancakeSwap

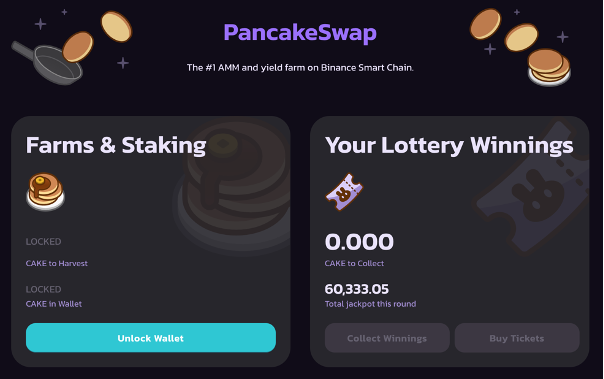

PancakeSwap liquidity provider (LP) tokens are suitably named ‘FLIP’ tokens. FLIP tokens come in different varieties depending upon the token pair provided to a pool. PancakeSwap farmers can lock up their LP tokens and earn further rewards in the process.

After depositing funds into a PancakeSwap liquidity pool, earning LP rewards, and using them to farm the Pancake token (CAKE), users could stake their CAKE tokens by locking them up to receive SYRUP tokes. However, SYRUP was discontinued and rendered useless after a smart contract issue. Instead, users can now stake CAKE, to earn more CAKE!

PancakeSwap Fees

PancakeSwap fees work just like other decentralized exchanges (DEXs) and automated market makers (AMMs) such as Uniswap, 1inch Exchange, and SushiSwap. Anyone that provides liquidity to PancakeSwap pools will receive ‘FLIP’ liquidity provider (LP) tokens along with any trading fees accrued. When using PancakeSwap, traders pay a 0.2% fee. Of this fee, 0.17% is allocated to liquidity providers (LPs) while the remaining 0.03% are burned by PancakeSwap Treasury.

Based on 30,000 blocks per day, the emission for fees on PancakeSwap amounts to approximately 750,000 daily Pancake token (CAKE) rewards. Of this, 60% goes to farmers. Holders of the CAKE token receive 40% of the rewards per block. With future governance proposals, however, these rates could change.

Why Build on Binance Smart Chain (BSC)?

Ethereum has been the go-to blockchain for smart contract-based decentralized applications (dApps) for several years. This is due to the early adoption of Ethereum which gave the second-largest blockchain a head-start against any competition. As this technology was only coming into development, the network effect of Ethereum-based decentralized finance (DeFi) protocols has resulted in phenomenal growth and continued development and adoption.

However, there are concerns for some developers building on Ethereum regarding high gas fees, speed, and network congestion. Many believe this could hinder the mass adoption of crypto. However, several measures are being taken to address this issue through scaling and interoperability in Ethereum 2.0.

Regardless, many crypto projects are opting to build on other blockchains due to lower transaction fees and less saturation. One such blockchain is Binance Smart Chain (BSC). BEP tokens are a token standard native to the Binance Smart Chain and the focus asset of the PancakeSwap protocol. BSC has considerably lower fees than Ethereum, lowering the barrier of entry for adoption while creating a cost-effective and secure platform for building dApps!

Additional Features

As if the team at PancakeSwap didn’t have enough on their plates, the project also boasts several other features that bring further utility to the platform. These include a platform for Initial Farm Offerings (IFOs) and a marketplace for non-fungible tokens (NFTs). Here, you can trade tokenized assets including Tesla, Google, and Netflix shares!

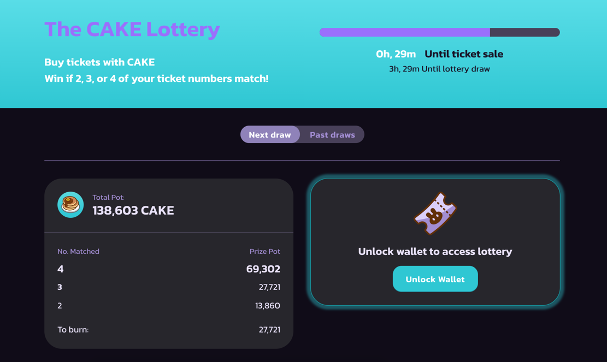

Also, PancakeSwap holds several community incentives to encourage participation, such as the lottery whereby holders of the Pancake token (CAKE) can buy tickets for a chance to win prizes. Furthermore, CAKE token holders oversee the proposal process for adding new token pools to the PancakeSwap protocol.

If you’re already partial to a bit of CAKE, follow us on Twitter @Academy_IOT and let us know what you think about PancakeSwap!

PancakeSwap Summary

As with any other DeFi protocol, PancakeSwap comes with inherent risks. However, the security afforded by Binance Smart Chain (BSC) is winning the hearts and minds of both CeFi and DeFi users. PancakeSwap brings all the functionality of Uniswap to Binance Smart Chain (BSC), without the fees. Transaction fees are paid using the BNB token, but these fees are extremely low compared to Ethereum-based DeFi protocols.

DeFi protocols are generating an incredible amount of revenue. Furthermore, almost all of these platforms are less than two years old. Binance Smart Chain (BSC) is an exciting new platform for DeFi. PancakeSwap is one of many successful projects to emerge from BSC. As the industry develops, we can expect to see a further crossover between DeFi and CeFi and more high-quality projects integrating the best of both worlds!

Creating decentralized applications (dApps) isn’t as difficult as many people think. With the right amount of dedication, Ivan on Tech Academy has all the tools and resources you need to succeed in crypto. Check out the Ethereum Smart Contract Programming 101 and Ethereum Smart Contract Programming 201 course to learn how to create your own dApps!