The decentralized finance (DeFi) sector is arguably hotter than ever, and has grown at a tremendous rate in the past year. In fact, the DeFi industry has grown from around $1 billion in Total Value Locked (TVL) in March of 2020, to around $38 billion as of today, according to DeFi Pulse. This highlights how the DeFi industry is one of the hottest trends in crypto and how money is pouring into the sector. Not only has the amount of money locked in DeFi projects increased, so has also the number of decentralized applications and solutions. However, the sheer number of various alternatives creates problems for users, as functionality becomes spread out across many different platforms. To make the users’ lives easier, we have been provided with a solution in the form of Instadapp.

When navigating the regular financial world, users can perform most of the functions from their regular banks. This means that there is one single platform that provides various important functions. Some of which can be borrowing, making transactions as well as investing. This is seen by some DeFi skeptics as a potential drawback of the DeFi world, since functionality like this is often spread out among several different decentralized applications (dApps). This means that to perform different actions, the funds must sometimes be transferred from platform to platform, and this process can become somewhat annoying.

However, to bridge this gap, Instadapp was developed. Specifically, the development of Instadapp was set in motion to connect the decentralized web into one simple platform that anyone can use.

What is DeFi?

To understand the value of Instadapp, we must also explore and understand what DeFi is. In short, DeFi is a decentralized financial ecosystem that is built on blockchain technology. Most of the DeFi applications are built using the Ethereum blockchain, making Ethereum an essential part of this ecosystem. However, there are also other smart contract blockchains with DeFi applications of their own.

One of the main issues that DeFi aims to eliminate is the central authorities that control the traditional financial industry. One example of a central authority are banks and with blockchain technology and smart contracts, it is possible to rid them from the equation.

At the very center of the DeFi ecosystem are decentralized applications (dApps). These are quite similar to regular applications, but they are decentralized in nature, as the name might suggest. Thanks to dApps, a more innovative financial system is possible. It allows developers to create more advanced systems that can eliminate the need for intermediaries.

Some of the areas where DeFi is applicable are lending and borrowing, exchanging currencies, and insurance. There are existing protocols or dApps out there, such as Compound and Maker, that are already functioning, but we will get back to that later in the article. If you would like to learn more about DeFi, you can simply click here to find out more!

What is Instadapp?

Put simply, Instadapp is a decentralized application that acts as a bridge that connects several different protocols on the decentralized web. This means that Instadapp integrates different dApps into one single application to manage all their functions.

Some of the projects that are manageable in this application are Compound and Uniswap. Instead of switching between the protocols, it is possible to manage everything through the user-friendly interface of Instadapp.

Ultimately, Instadapp provides a user interface that enables people to interact with several different dApps in one single platform. This means that it will enable users to access the full potential of DeFi and make life easier for all users. By accumulating all these different protocols into one single dashboard they are able to create a much better customer experience.

How Does Instadapp Work?

It is quite easy to use Instadapp, and all that the user needs is a web3 Ethereum wallet. One example of a web3 wallet is MetaMask, an easy-to-install extension forselectingweb browsers. Once the user has a web3 wallet installed, it is possible to manage all assets from the Instadapp interface.

So, how does all of this work? As this application is decentralized and uses smart contracts to enable the integration of other dApps. Instadapp uses smart contracts that take the users’ simple input and translates it to perform more complex actions. The application then executes these contracts, which gives the users an easy way and experience of managing their assets. What’s even greater about this app is that they take no fees for their service. However, it will not be free for the users since they still have to provide the funds to pay for the gas needed to execute the contracts needed.

Furthermore, all the data from Instadapp is public, and the application does not hold any of the user’s assets. This gives the user the best of two worlds; the security benefits of decentralization with a centralized platform for managing assets which provides the consumers with a better user experience.

Thanks to the use of smart contracts to connect several different dApps, the user can manage functions such as:

- Lending

- Borrowing

- Swapping

- Leveraging

How to Get Started with Instadapp

The first step in getting started with Instadapp is to acquire a web3 wallet. One example of a neat wallet is MetaMask which is easy to install and provides the user with great functionality.

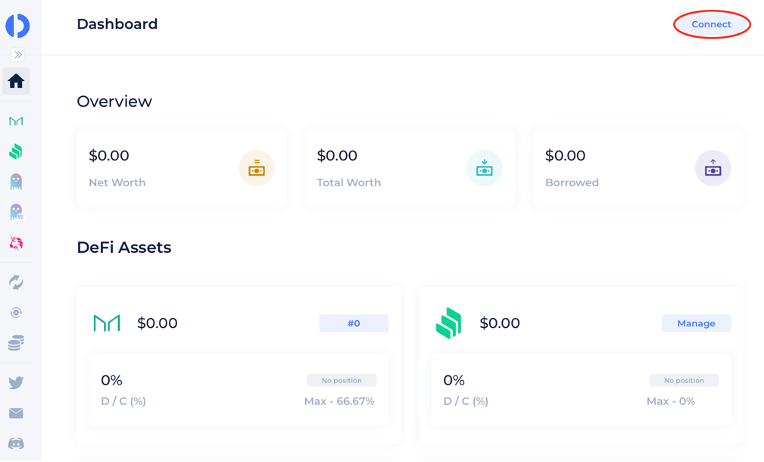

Connecting the Wallet

Once you have a wallet, you will also need to connect that wallet to Instadapp. This is a relatively easy process, and the first step is to press the connect button at the top right of the dashboard.

As you press the button, you will receive two alternatives (at least); one to connect a wallet using WalletConnect, and the other to link the wallets through Coinbase Wallet. However, if you have the MetaMask extension installed on your browser, you will receive a third alternative that allows you to connect MetaMask to Instadapp.

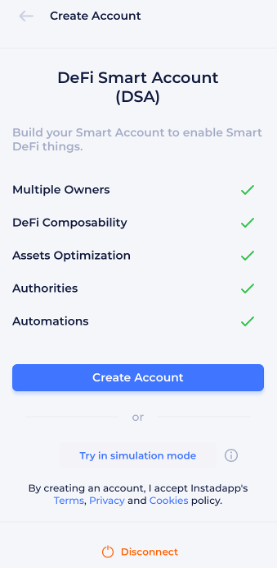

If you choose either of the first two alternatives, a QR-code will appear that you need to scan in order to connect your wallet. For the Coinbase alternative, you will need the Coinbase Wallet application. This application can be downloaded from both App Store and Google Play. As soon as the application is downloaded you are able to link your wallet to Instadapp by scanning the QR-code provided by Instadapp. As soon as you scan the QR-code the wallet will connect and the following will appear at the right of the screen, which allows you to create an account.

Create the Account

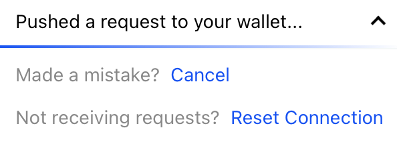

The next step is to press the “Create Account” button, which will trigger a push notification to your wallet mobile application.

However, to create the account and finalize the setup process, you will need to pay a miner fee. At the moment, the fee for connecting the wallet is about 0.0322 ETH, which equals approximately $53. This is quite a high fee, but it is because the gas fee for Ethereum is very high currently. The problem of the high gas price originates from the congested network effect that Ethereum is experiencing.

Furthermore, this ultimately means that you need to have sufficient funds in your account to connect your wallet to Instadapp. Once you pay for the gas, the request will be pending and will execute as soon as possible. The time might differ, and you can speed up the process by paying a higher fee than normal. As soon as the application confirms the transaction, your Instadapp account should be up and running.

Instadapp Functionality

As we mentioned in the introduction, Instadapp is a bridge between other dApps and protocols. Instadapp can be used to perform several useful actions such as lending and borrowing, swapping, and leveraging. However, what we did not go into greater detail about is how and through what services these functionalities are possible. Let us look at some of the most popular protocols that you can leverage when using Instadapp.

Lending and Borrowing — Compound

In essence, Compound is a protocol for lending and borrowing cryptocurrencies using blockchain technology. This makes Compound a money market protocol on Ethereum that allows the users to deposit and borrow currencies.

When performing these actions, it is possible to either earn interest rates or borrow funds for the price of the rates. Compound is also of an algorithmic nature, which means that algorithms control the protocol’s interest rates so that it fits the supply and demand.

Compound is actually one of the major DeFi applications, and as of now, the protocol has over $9 billion worth of assets that are earning interest on nine different markets.

Swapping — Uniswap

Another major protocol that is integrated with Instadapp is Uniswap. Uniswap is a decentralized exchange (DEX) that allows users to swap ERC-20 tokens. The exchange allows the users to swap tokens without having to find someone on the other side of the trade. This can be done since Uniswap has a global liquidity pool of ERC-20 tokens from which the users can be supplied immediately. For example, there is an existing pool of DAI and ETH which means that users can directly swap their tokens for either one.

Furthermore, another important function within the Uniswap system is the liquidity supply. Since they have a pool of assets, this pool must be filled, which is done through liquidity providers. In exchange for providing liquidity to the pool, the liquidity providers receive pool tokens that represent the liquidity provider’s share of the pool’s assets and a percentage of the trading fees. These tokens can then be traded or moved to the exchange.

What is great about Instadapp is that it has the ability to draw the benefits of the Uniswap decentralized liquidity pool and allow users to perform swaps directly through their interface.

Collateralized Debt Positions — Maker

One last function that we are bringing up in this article is the ability to perform actions regarding Maker’s version of a financial derivative which is a collateralized debt position or CDP. The CDP is a debt position that an underlying asset is backing. The debt position allows the users to input an asset as collateral into a smart contract to receive a loan on the Maker platform. As soon as someone deposits an asset, the depositor can generate the equivalent value of USD in DAI that they wish to borrow. Once they have been granted these tokens, they are free to trade them as they would like.

Through Instadapp, it is possible to create CDPs from both Maker and Compound.

Summary — Instadapp

The wider DeFi industry is growing rapidly, and the number of different applications can make it hard to navigate this new financial world. There are different applications for different purposes, such as lending, borrowing, exchanging currencies, etc.

Since there are different platforms to perform different actions, it does not particularly create a great customer experience. Unlike DeFi, the traditional financial ecosystem is a lot more unified. Using a single bank platform, it is possible to take loans, trade currencies, and invest in the stock market.

Since most important actions can be performed in one single spot, the traditional system holds somewhat of an edge over the decentralized counterpart. However, the DeFi sector is relatively new and is not only growing but developing rapidly as well. As more and more people are utilizing this decentralized system, the customer experience is getting better as well. An effect of this is Instadapp that is a decentralized application that has integrated several different smart contracts and protocols into one single interface. This is an important step in the right direction for DeFi. It provides the consumers with a more pleasing experience.

With Instadapp, it is possible to lend, borrow and exchange tokens, among other things, from one single platform. This makes the sector more appealing for customers and makes the experience more like the traditional financial market. All while still keeping the many benefits of decentralization.

However, there is much more when it comes to DeFi, blockchain, and Instadapp and if you would like to learn more, feel free to tune in to the number one blockchain education platform Ivan on Tech Academy. You will find a great selection of blockchain courses for both beginners and more experienced developers on the platform, so do not hesitate to sign up.