Akropolis is a DeFi protocol on a mission to help its users grow their wealth safely without depending on a central authority or multiple intermediaries. They seek to accomplish their goals with their lending and savings product set, namely, Sparta, Delphi, and the AkropolisOS framework.

Sparta offers undercollateralized loans, which is unique in a space so overpopulated with overcollateralized loan offerings. Delphi is under development, and it is a pool that executes automatic dollar-cost averaging (DCA) into Bitcoin (BTC) and Ethereum (ETH). It targets those looking to diversify their long-term investment portfolio.

Akropolis has also built a framework for creating for-profit decentralized autonomous organizations (DAOs) that works with a bonding curve mechanism. We’ll explore each of these in-depth in the next section.

First of all, however, you should look into the general fundamentals of DeFi. You’ve probably already heard of Ivan on Tech Academy, seeing as it is one of the largest online blockchain and cryptocurrency education platforms anywhere in the world. However, did you know that Ivan on Tech Academy offers dozens of world-class crypto, DeFi and blockchain courses? Enroll today and get 20% off with the code BLOG20!

AkropolisOS

AkropolisOS is an open-source Solidity framework for building decentralized applications (dApps) and protocols for investments, loans, pensions, and savings plans. It is based on the OpenZeppelin protocol and provides scalability without compromising security. The best part is, anyone can use it to set up automated liquidity pools.

The Sparta Pool

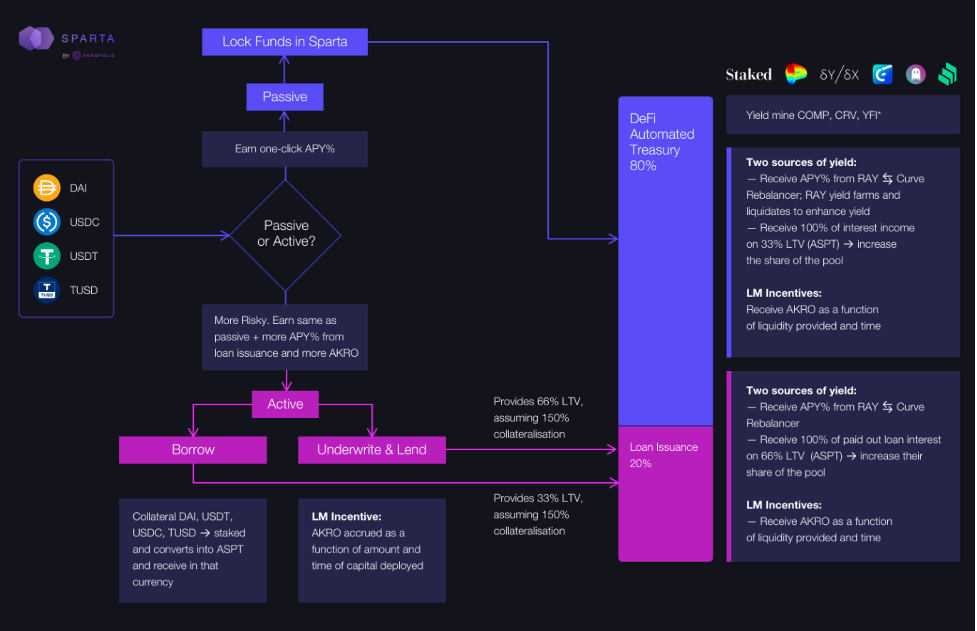

Sparta seeks to take the work that financial organizations typically do and automate it. The goal is to help its members earn high-interest rates by providing loans via pools of funds. With Sparta, borrowers can access undercollateralized loans, which are perfect for those who don’t have a lot of money to shell out for collateral. Borrowers will need to put up 50% of the loan amount, which should help solve DeFi’s over-collateralization problem.

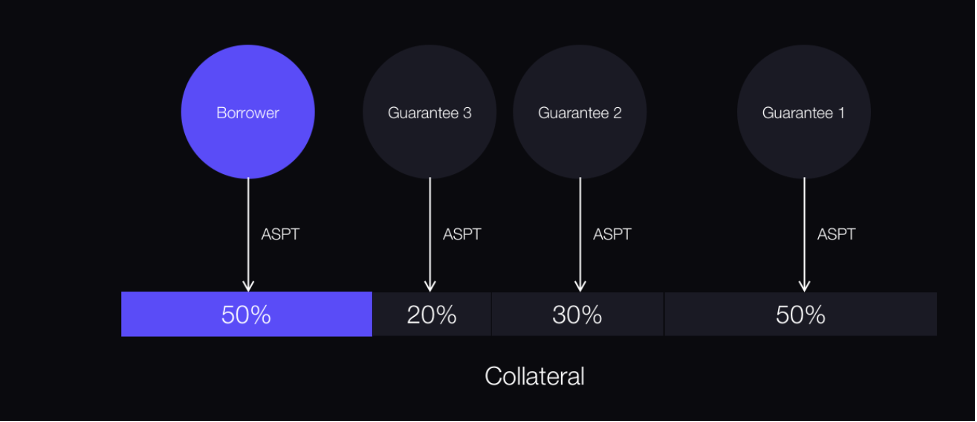

Sparta operates on the premise of collective responsibility and staking guarantees. Lenders vote for the borrowers they believe will repay the loans, and the protocol rewards them when they choose correctly. These lenders are Sparta’s risk assessors if you will. But they are at risk of the protocol slashing their funds when they pick borrowers who default on the loan. So the protocol has its built-in way of incentivizing responsible credit risk assessment.

Akropolis Sparta Pool Token (ASPT)

ASPT is the native token of the Akropolis DAO. Users enter and exit the Sparta Pool with this token, buying and selling at a price determined by a bonding curve algorithm. This Bonding Curve Mechanism gives users an incentive to join the pool early while also allowing them to exit without facing the problem of locked funds due to illiquidity. Akropolis defines this as “a mathematical curve defining the price/supply correlation.”

So the ASPT token price will depend on the amount of liquidity in the pool at the time. Increased liquidity will raise the ASPT price while lesser liquidity decreases it. And more borrowers entering a pool will incentivize its growth with lower interest rates.

The ASPT token also provides access to loans, offers voting rights, and provides staking functions. Sparta will offer the loans in well-known stable coins like DAI, not in ASPT itself. Nor will ASPT holders earn profits from holding the token, such as dividends, payments, or Akropolis returns. The protocol mints or burns ASPTs each time users deposit or withdraw stable coins from the pool.

The Loan Process

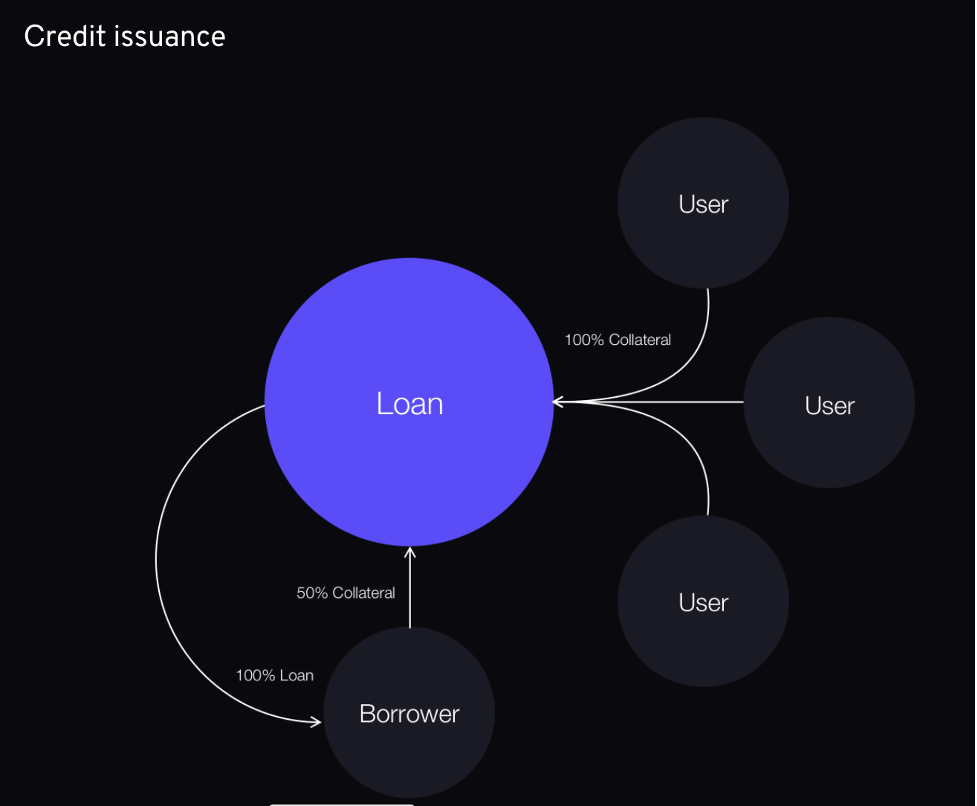

All loans will still be 100% secured, however. The borrower puts up 50% collateral in ASPT and cannot take more than 200% of the amount in his possession. Hence, if a borrower only had 50 DAI to put up as collateral, he/she could take a maximum loan of 100 DAI. This is different than other DeFi lending protocols.

The pool members who believe in the borrower will vouch for him by locking their ASPTs as collateral to cover the loan’s full amount. If the total amount of ASPTs locked by both borrowers and lenders equals the loan’s size, the borrower will qualify to receive the loan in stablecoins.

To request a loan, users would first go to the Pool info section and click the “Get Loan” button. Fill out the loan amounts and then confirm the transaction. Borrowers can follow their request on the “Proposals” and “My Loans” page.

The borrower will pay interest on the loan in ASPT tokens - 50% of which will remain in the pool. The lenders share the remaining 50% in the form of ASPT tokens depending on their percentage stake. In summary, ASPT tokens act as collateral and as currency paid out on any interest earnings.

Staking and Lending

If you want to earn part of the loan interest that the borrower pays, you can stake for a loan request. The Proposals page lists all open loan applications that you can participate in by becoming a guarantor. To participate as a lender, select the loan you like and click on the Stake button. Then choose an amount to deposit, confirm the transaction, and, presto, you are now a DeFi lender.

You can track your share of the interest received from the loan payments and all the loans in which you are the guarantor by visiting the “My Guarantees” page. After you see how much interest has accumulated, you can claim your earned interest in the “Earn” column. You can also see how much collateral is available for unlocking by clicking the Unlock DAI button.

If you change your mind, you can “un-stake” your funds and withdraw your deposit before the activation of a loan. Just navigate to the “Proposals” page, find the loan request card and click the “Unstake” button. Then you choose the amount you want to withdraw and confirm the transaction.

If you have a loan and want to repay it, you’ll need to visit the “My Loan” page and click on the “Repay” button. The protocol liquidates loans not repaid within 90 days after issuance, burns the collateral, and divvies up any partial repayments that exist amongst the “stakers.”

Entering and Exiting the Sparta Pool

Like other DeFi solutions, Sparta is non-custodial, so all funds are stored on-chain in smart contracts. To use Sparta, connect with your Web 3.0 wallet like MetaMask and deposit DAI to start. You will receive an equal amount of ASPT tokens upon entering the pool with the bonding curve calculating the token price.

To leave the pool, click the “withdraw” button. Your funds will return to your wallet in DAI. Think, “DAI in – DAI out.” However, when it comes to members’ funds staked for someone else’s loan, Sparta can’t return them until the borrower repays the loan.

One of the main questions people have is how to assess a borrower? Especially with the pseudo-anonymous state of people using the Ethereum blockchain. Often, all you have to go on is a person’s wallet address.

The assumption from the team at Akropolis is they expect lenders in the pool to know the borrower. They foresee a small DeFi community of people who know and trust each other to participate in the back-and-forth process of lending and borrowing.

The “Ragequit” Mechanism

Akropolis believes their protocol is an improvement over the traditional, legacy models for various reasons. And one of them is their Ragequit Mechanism. This mechanism allows users to leave a pool if they disagree with the other members’ decisions without the DAO locking up their funds. Users enter and exit by buying and selling ASPTs. The price set by the bonding curve solves the problem of “funds locks.”

The Akropolis team believes this is a superior mechanism in DeFi because it prevents borrowers from tying up funds. Sparta’s pool design makes it possible to “ragequit” at any time so long as the user hasn’t staked his or her funds on loan already.

The AKRO Governance Token

ASPT is not the only token at Akropolis. Their governance system allows users to participate by purchasing and staking AKRO pool tokens. AKRO holders can also make money from entry and exit fees, lending and performance fees, along with staking rewards. You can get the AKRO token on exchanges or by providing liquidity to the various products on AkropolisOS. These tokenomics are still evolving and subject to change, however.

The Delphi Pool

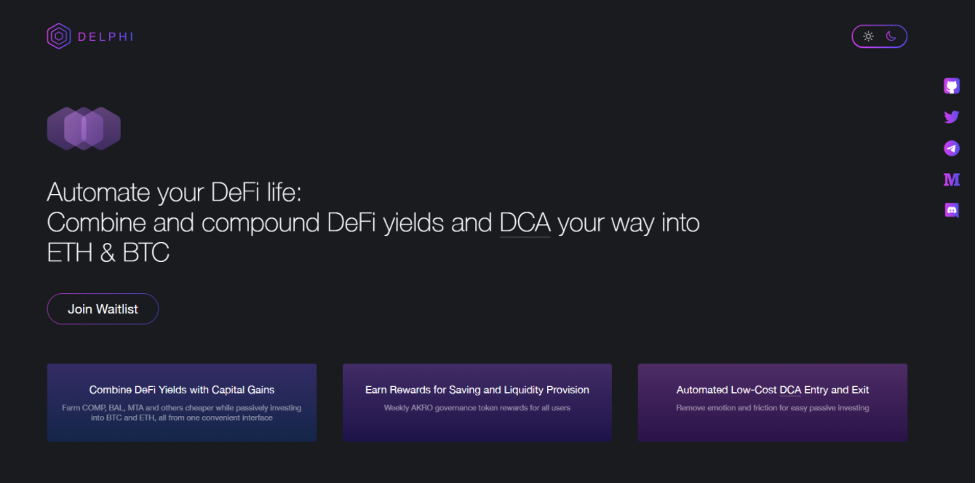

Delphi allows for automatic dollar-cost averaging into BTC and ETH. We’ve talked about DCA before, and while not financial advice, many like to trade the crypto markets this way. Delphi makes automated, periodic purchases of an asset, so users don’t have to.

The short version is, Delphi is a yield farming aggregator with dollar-cost averaging tooling built-in. With it, users can farm yield using a passive, dollar-cost averaging strategy. They allocate a set amount to invest weekly or monthly through a user-friendly interface. Delphi targets those looking to set up a long-term portfolio with built-in DCA to help remove the hassle of trying to time the market for the best price.

The DCA pools in Delphi are the same as the investment pools, but the logic works differently. The user’s deposit of USDC goes to the savings pool, where it earns interest. Delphi withdraws the weekly DCA amount to an exchange to buy BTC or ETH. Purchased DCA assets move to an investment pool, where they make interest. However, Delphi pools are not stablecoin pools. These are higher risk-reward pools, which mean they come with greater volatility.

Security Audits

CertiK is one of the firms that conducted the security audit for Akropolis. And Akropolis’s whitepaper lists flash loan attacks as “not possible” since they target flash loan platforms. Flash loans are unsecured loans that only last for a short time. Such attacks are listed only as a potential threat to the Akropolis governance module, but preventative measures were to be in place before launching.

However, just like the Titanic builders who boasted their ship was “unsinkable,” builders have to be wary of the unforeseen, especially when it comes to dealing with wily hackers.

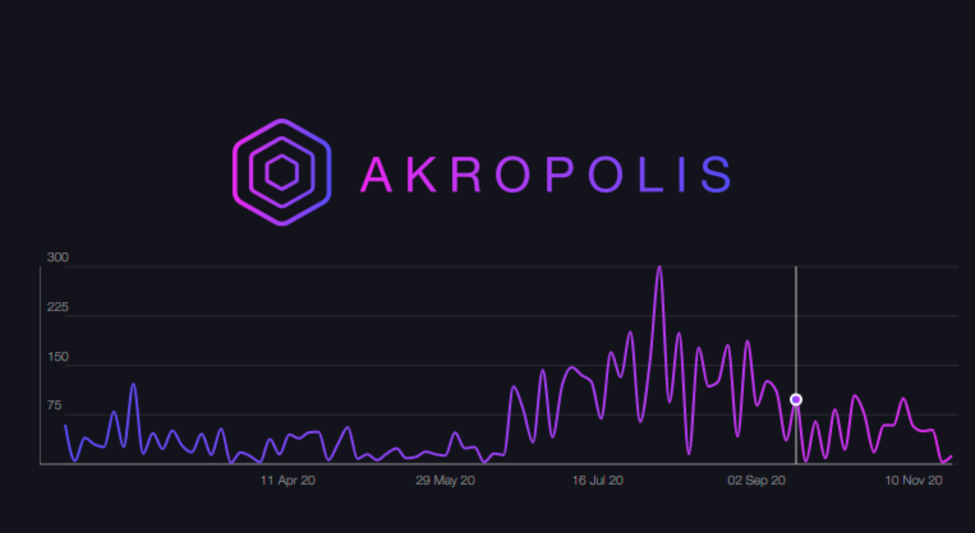

The Akropolis Hack

DeFi’s surge in popularity not only attracted more investors; it also attracted the unwanted attention of criminal hackers. Some reports even suggest that they account for 20% of all crypto losses. Unfortunately, for Akropolis, they fell victim to a sizable exploit. On November 12th, they stated on Twitter that they found a noticeable discrepancy in the APYs of their stablecoin pools. This discovery led them to identify that 2 million DAI had gone missing from their yCurve and sUSD pools.

The attacks surprised Akropolis. That’s because the pools in question had already undergone two independent audits. And none of the audits flagged either of the attack vectors. Curiously, one of the security auditing firms who missed these attack vectors also failed to identify weaknesses in the bZx protocol hit three times this year.

Other pools remained unaffected along with their native AKRO staking pool, but they paused all stablecoin pools to prevent further losses. Ana Andrianova, founder and CEO of Akropolis, doesn’t believe this attack mirrored the one carried out on Harvest Finance back in October.

Nonetheless, this attack is still considered a flash-loan attack that originated from dYdX and manifested as a combination reentrancy attack.

Flash loan attacks have become all too common in the DeFi space since they allow the users access to large sums of capital that can be used for nefarious purposes - namely to manipulate price oracles. 2 million DAI is equivalent to $2 million, so it’s a sizable heist, and the hacker immediately began transferring his prize to a different Ethereum address.

Akropolis informed exchanges of the hack and claimed they had identified the attacker’s Ethereum address, which makes it possible to track the funds as they move around the blockchain in an attempt to cash out.

The YFI Merger

The $2 million hack notwithstanding, Akropolis’s use case still had enough validity to elicit the interest of Andre Cronje, Yearn Finance’s Founder/Developer, who recently announced a merger between the two.

The main changes from this partnership are that AkropolisOS will go into the Open Source development section of Yearn. Akropolis will get access to Pickle Finance products and get to be the front-end for Yearn’s yield-generating products. And Yearn can leverage new DeFi strategies from the Akropolis developers and benefit from Akropolis’ business development expertise.

The Future – Serving the Unbanked

Like other DeFi platforms, Akropolis wants to, among other things, provide uncollateralized credit to the unbanked. That’s because acquiring unsecured credit is typically the only way to improve life quality in developing countries. It’s a lofty goal; however, anything seems possible with their recent merger with Yearn.

If you want to learn more about DeFi and how to become a blockchain developer, make sure to visit Ivan on Tech Academy today!

Author MindFrac