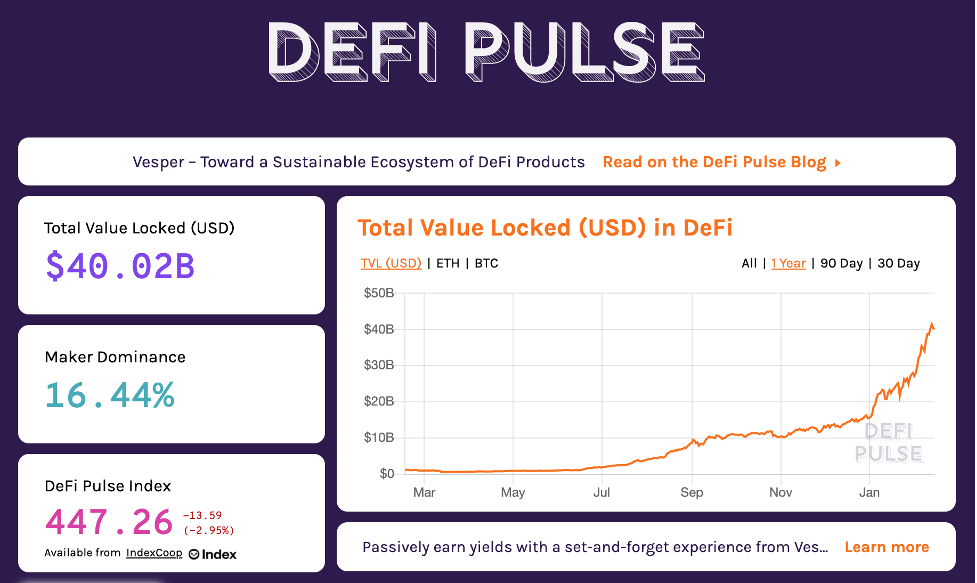

The decentralized finance (DeFi) ecosystem is growing at an exponential rate, with the Total Value Locked (TVL) extending from a little over $1 billion to $40 billion in just the past year (according to DeFi Pulse). While these kinds of numbers are great for people who got in early, the inflated prices can make it feel like one has already missed that boat. If you feel it’s too late to catch the DeFi train on Ethereum, there are some other promising projects on the Binance Smart Chain.

The Binance Smart Chain is still a new platform and could be the place to find projects that haven’t already skyrocketed out of reach in this bull run. Consequently, it can be worth it to inspect the Binance Smart Chain more in detail.

Nevertheless, before we look at any individual projects, let’s first take a look at Binance and the Binance Smart Chain, to find out exactly what the Smart Chain does.

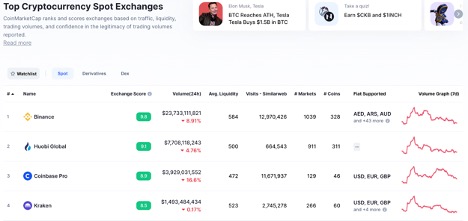

Binance, the Largest Crypto Exchange

Most people know Binance as the largest cryptocurrency exchange in the world. But in case you hadn’t noticed, Binance has evolved into a lot more than just an exchange. It has become an entire ecosystem. If you want to get a broad overview of Binance and its native token, BNB, make sure first to read our article, “What is Binance Coin (BNB)?” In today’s article, we’ll be focusing on the Binance Smart Chain.

Binance Chain vs. Binance Smart Chain

Binance developed the Binance Chain to bring about their vision for a decentralized exchange (DEX) as an alternative to the centralized Binance Exchange. If you’re unsure what the difference between a centralized exchange (CEX) and a DEX is, make sure to read our article “Decentralized Exchanges – What Is a Dex?“

However, if you’re looking for a complete education on DeFi, go to Ivan on Tech Academy and sign up for the DeFi 101 course.

As you can see from the CoinMarketCap chart below, Binance blows many other exchanges away in terms of the 24-hour trading volume. CEO Changpeng Zhao (@CZ_Binance) and the company muscled their way into the DeFi market by designing the Binance Chain to process transactions. Later, they developed the Binance Smart Chain to enable users to build and create decentralized applications (dApps). The Binance Chain launched in April 2019, while the Binance Smart Chain started back in September 2020.

As you can see, their Smart Chain is still relatively new, even in terms of DeFi. That’s why there may be some promising but undiscovered projects there. However, together, the Binance Chain and Binance Smart Chain appeals to researchers and developers as well as traders and investors.

The Binance Chain and Binance Smart Chain operate side-by-side, yet independently with interoperable features between them. Binance Chain seeks to match the transaction speeds of the typical CEX, while the Binance Smart Chain maintains an advantage in not having the same network congestion problems or high fees that Ethereum does.

Binance Chain Features

The Binance Chain has similar features to most other blockchains:

- It can send and receive its BNB token along with other digital assets.

- Its DEX can:

- a) Propose new trading pair listings.

- b) List various assets from other chains.

- c) Create maker/taker orders.

Binance Smart Chain Features

- Ethereum Virtual Machine (EVM) Compatible

The Binance Smart Chain works with EVM-compatible smart contracts and protocols, but it is faster and less expensive to use.

- Proof of Stake Authority (PoSA)

Binance Smart Chain provides safety and security with its Validators and Proof of Stake Authority (PoSA) system consensus. With PoSA, Binance Smart Chain can offer lower fees and shorter block times (approximately 5 seconds).

- On-Chain Governance

PoSA brings decentralization and community into the mix. The native BNB token will serve as the source of gas fees for executing smart contracts and be the token of choice for staking.

- Interoperability

Binance Smart Chain brings programmability and interoperability to the Binance Chain and high-performance, scalable dApps to market.

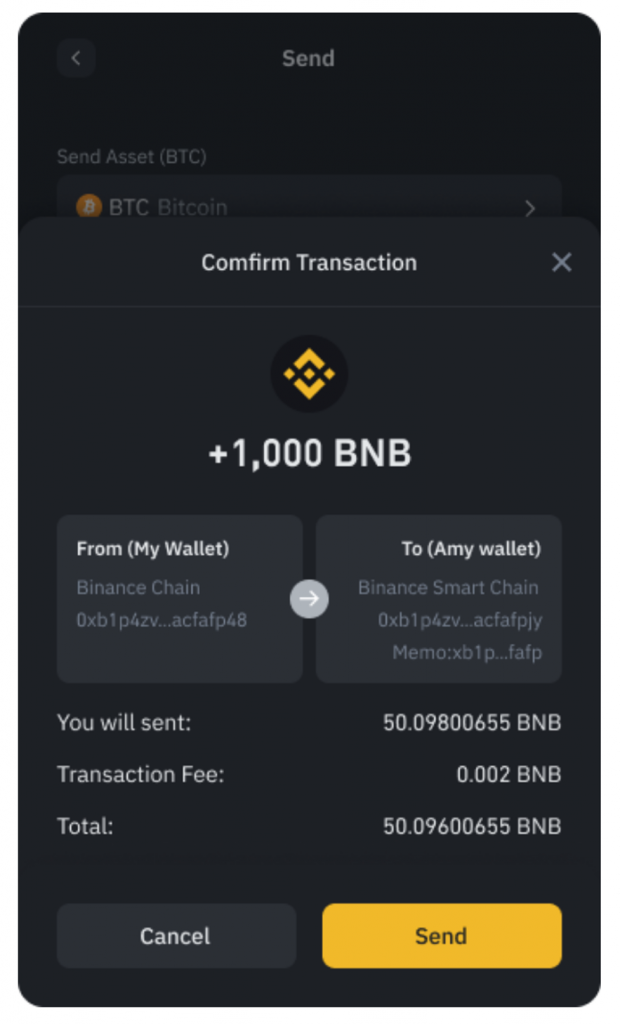

- Cross-Chain Transfer

Cross-chain transfers are made possible because of interoperability.

More on PoSA and Validators

PoSA is a proof-of-stake consensus mechanism. Dr. Gavin Wood (Ethereum co-founder and Polkadot creator) invented this consensus mechanism, limiting the number of Validator nodes, unlike typical proof-of-stake blockchains. This design also optimizes performance.

Dr. Gavin Wood

An appropriate authority (in this case, Binance) must approve these Validator nodes before they can operate on the network. The result is that right now; the Binance Smart Chain only has a small number of Validators. And it just so happens that Binance owns and operates them.

These Validators must stake BNB tokens to earn a percentage of the network’s transaction fees, with the allocation being proportional to their stake. Validators also earn voting privileges regarding the network parameters, which isn’t saying that much since Binance owns the nodes anyway. Not surprising that the DeFi purists aren’t too “jazzed” by this degree of centralization. It has prompted Binance founder, CZ, to refer to Binance DeFi as “CeDeFi,” an abbreviated version of “centralized, decentralized finance.”

What Is Binance CeDeFi?

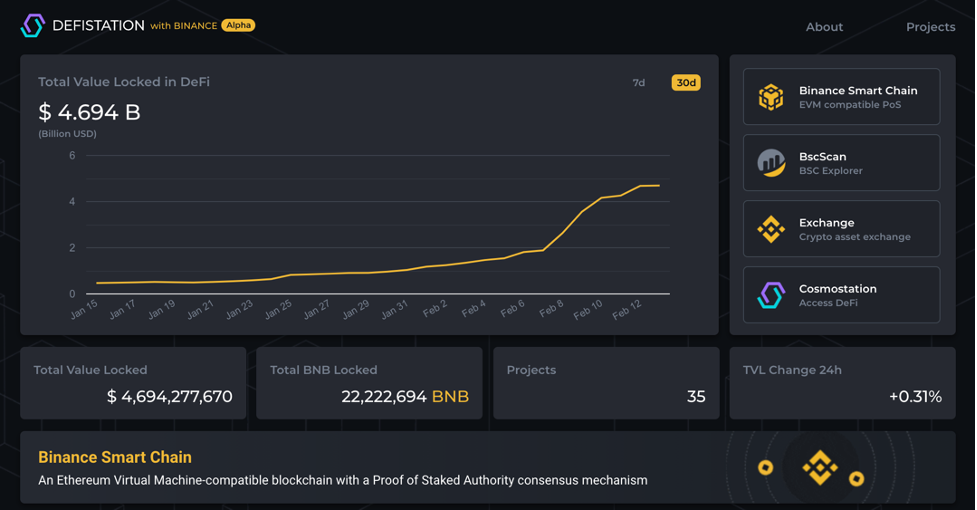

So, is the Binance Smart Chain decentralized like other DeFi platforms? Well, on the more democratic side of things, anyone who sees malicious behavior on behalf of these centralized Validator nodes can submit a slash request to punish them, but it is still a hybrid, centralized, decentralized system. And despite the corruption risks posed by any form of centralized authority, Binance fans also seem to be fans of CeDeFi. The Total Value Locked (TVL) in their CeDeFi protocols attests to this as it’s growing fast enough to hit the $4.6 billion mark recently, according to Defistation.

Technically, Binance CeDeFi began with the Binance Smart Chain, which is compatible with Ethereum’s blockchain. And it makes it a good platform for dApp development in NFTs, Gaming, and DeFi in general. Also, for investors who are willing to overlook the level of centralization they can enjoy faster block times and small fees compared to Ethereum.

If you want to become an expert in Ethereum, please sign up for Ivan on Tech Academy. The Ethereum 101 course is an excellent place to start!

The Binance CeDeFi Advantage

Looking more closely at the Binance Smart Chain, we can see its advantages and why it is becoming so popular.

Protocols Funded by Binance

One reason for its success is because Binance is funding many of the protocols on its Smart Chain. The team highlights existing and future projects they would like to sponsor with Binance Accelerator Funds. And not long after launching its Smart Chain, Binance offered up approximately $100 million to fund the projects they believed would bring value to the Binance ecosystem. This kind of support was a real “shot in the arm” for would-be CeDeFi founders, developers, and creators of all sorts.

By providing liquidity to many of these protocols through grants, Binance will generate economic activity that will attract more users and liquidity to the space. There are already new emerging CeDeFi projects with loads of profit potential.

Binance offers funds for CeDeFi projects that can pass the test of their due diligence process. This process includes security audits, and Binance will reward candidates with a range of resources across their ecosystem. This isn’t too shabby when you consider such things as Binance’s access to media outlets, millions of customers, education platforms, financial management, and the opportunity for creators to have a token listed on the Binance exchange.

Moreover, CZ announced the vetting process, which was supposed to rid the space of typical DeFi problems relating to scams and rug pulls. Security audits are there to help prevent attacks like the top DeFi hacks we saw back in 2020. Yet it still happened. A malignant CeDeFi project figured out how to abscond with user funds. Binance covered the losses, and the users weren’t hurt, but Yearn Finance’s founder, Andre Cronje, proved prophetic when he stated earlier that smart contract security audits are no guarantee for total security.

However, one thing is guaranteed, and that is the symbiotic relationship between the Binance Chain and Binance Smart Chain. This dual-chain architecture is perfect for users looking for quick trades on one side and a place to build dApps on the other.

Ethereum Fees and Network Congestion

Another reason that Binance CeDeFi is exploding lies with Ethereum itself. Ridiculously high fees on Ethereum have raised the cost of some DEX transactions to the hundreds of dollars, making it only worthwhile for whales to trade. Transaction times take longer due to network congestion, which means a transaction can take minutes rather than seconds to confirm.

Contrast that with Binance’s CeDeFi ecosystem. Fees can be so small they seem non-existent, and they only take about 5 seconds to confirm. These advantages are very tempting for the average DeFi user priced out of the space on Ethereum. Not everyone can drop a hundred dollars to interact with their favorite protocols.

Yield Farming

Binance CeDeFi is also gaining popularity because of yield farming. Farming yield involves a combination of borrowing, lending, and trading to maximize gains on the tokens that traders have locked up in various DeFi protocols.

Early in DeFi’s beginnings, and even as recent as the summer of 2020, annual percentage yields (APY) were insane. Users could find opportunities to earn more than 1,000% in some cases. Everyone knew these kinds of returns were unsustainable, and they have since subsided. However, on Binance Smart Chain, it appears the CeDeFi party is just getting started.

Some of Binance CeDeFi protocols have seen annual percentage yields above regular DeFi protocols in their heyday. And it’s not uncommon to find CeDeFi APY in the three-figure range. Some percentages are working out to 20x returns on funds locked for one day!

These reported returns are not financial advice nor an endorsement for anyone to run over to the Binance Smart Chain and start randomly pumping money into CeDeFi protocols. However, some of them might be worth researching for those who are curious.

Binance’s Network Effects

Network effects are another reason that Binance CeDeFi usage has exploded. The platform has a vast reach, and it doesn’t take a lot of “arm twisting” to entice regular Binance users over to the Smart Chain with the kinds of potential returns available.

Where to Find New CeDeFi Projects

If you’re prepared to do your research, Defistation lists some legit CeDeFi protocols and notes whether they’re audited. Again, it’s better to have an audit than not, but it’s still no guarantee.

Venus presides over the others at the top of the charts at Defistation. It is a decentralized stablecoin lending protocol that is similar to Maker. Pancake Swap is in second place. It is an automated market maker DEX similar to Uniswap or SushiSwap, with $1.6 billion locked in already. Autofarm sits in third place. It is a yield aggregator like Yearn Finance.

As with DeFi protocols on Ethereum, many CeDeFi protocols have questionable tokenomics with severe amounts of inflation to reward yield farmers who provide liquidity. Autofarm’s token, on the other hand, has a low maximum supply and is deflationary.

However, one thing to beware of is that most of the projects listed on Defistation have already caught investor’s attention. That means there may not be much “chicken left on the bone” regarding profit potential.

To find more obscure CeDeFi projects with more upside, check out BscScan’s Yield Farms section. BscScan is tantamount to Etherscan for the Binance Smart Chain.

And while BscScan has about 100 projects listed, Defistation only has about 25. Watch out as some of these projects have the “rug pull” label next to them. So they are either rug pull scams or deliberate misnomers posted by competing projects. When it comes to speculating, there is no sure thing in traditional DeFi, and the same is true with CeDeFi listings.

How to Buy CeDeFi Tokens

After you’ve done your due diligence, the next step is to find an exchange. Pancake Swap will be the best place to buy CeDeFi tokens most of the time unless they’re listed on Binance already. If that’s the case, the most significant gains may already be behind it.

Next, you’ll need a Web 3.0 wallet. The obvious choice is the Binance Chain Wallet Browser Extension. However, it may not be the best wallet for CeDeFi tokens as there are reports that it frequently disconnects from Pancake Swap.

In that case, if you’re already comfortable with MetaMask and don’t mind doing your own configuring, you can tweak your wallet to support the Binance Smart Chain network. It takes about 20 minutes.

Binance Smart Chain – Final Thoughts

So, is Binance Smart Chain the next “Ethereum Killer?” That isn’t very likely. But as long as network congestion and high fees plague Ethereum, more centralized exchanges will siphon off yield farmers and other speculators. At this point, quick transaction times and, more importantly, the small fees could easily entice them to switch allegiances.

On the positive side, Ethereum’s high gas fees indicate insane demand, but the negatives are obvious. High fees scare all the DeFi users except the whales and may cause them to seek greener pastures. Hopefully, this situation will accelerate the implementation of Layer 2 solutions for Ethereum. In the short term, though, Ethereum’s loss could be a win for the Binance Smart Chain.

Do you want to learn more about Ethereum, DeFi, and DEXs? Better yet, why not become a blockchain developer and start commanding a high salary in this hot job market? Get started today at Ivan on Tech Academy!

Author MindFrac