Decentralized Finance (DeFi) is all about creating an open-source, permissionless, transparent, financial ecosystem available to anyone with an internet connection.

DeFi offers a set of products and services similar to that of the conventional financial world except they’re built on a blockchain—notably Ethereum (ETH). And one of the most popular and fastest-growing sectors of DeFi is the money markets.

What are Decentralized Money Markets?

Traditional money markets exist for the borrowing and lending of assets—likewise, for decentralized money markets. However, the assets involved can be cryptocurrencies and it is smart contracts (not middlemen bankers) that dispense the interest payments and enforce the terms of the loan. No middleman means higher returns for the lenders.

Another big difference is that when you participate in DeFi you can make money off interest payments—unlike the current financial system that’s been operating on zero or even negative interest rates for quite some time.

But, here’s the kicker—you don’t need to fill out reams of paperwork and applications! You don’t need a credit score, a list of references, a steady employment history, or even a winning personality. All you need to do is download a crypto wallet from the internet. Just like when you drink black coffee and there is no milk or sugar involved—when you want to borrow on the blockchain, there is no credit score involved.

Collateralized Debt Positions

Blasphemy! How can this be? How can a person get a loan without a credit history? The blockchain’s answer to this quandary is Collateralized Debt Positions (CDPs).

To play the money market game on the blockchain, all you have to do is put up your crypto as collateral to borrow more crypto. It is a pay-to-play system of smart contracts that uses collateral (mostly ETH) to create stablecoins.

In actuality, you have to overcollateralize your position and have that collateral locked up in the DeFi protocol before you can borrow. And there is also a collateralization ratio involved, so if the price of ETH tanks and your ratio drops below a certain point, you will be undercollateralized. If that happens, you’ll be targeted by these nasty little bots that are constantly sniffing around like squiddies in “The Matrix.” Their job is to liquidate your position and scarf up your collateral…well hopefully not all your collateral—but we’re getting ahead of ourselves.

For now, just understand that with DeFi, an average person can access the same financial tools previously only offered through the banks. They can borrow or lend their crypto assets out and earn interest on what would otherwise be an idle asset. Decentralized money markets are simply an alternative to the traditional ways the banking system has been conducting lending and borrowing for ages.

Let’s look at the MakerDAO protocol to see how all of this works.

MakerDAO

You’ve probably heard of MakerDAO, if not, suffice it to say that it is the first DeFi application (dApp) to receive significant adoption and it has grown into one of the largest dApps on the Ethereum blockchain.

As mentioned above, MakerDAO operates in the decentralized money market space opening the door to anyone interested in the lending and borrowing of funds. In simple terms, MakerDAO locks in ETH and makes the stablecoin Dai that is pegged to the U.S. dollar. Users can then lend, borrow, or save Dai.

To dig deeper into the elements that make up the Maker Protocol, we’ll be looking at the Dai stablecoin, Maker Vaults, and some key actors: Oracles, Keepers, and MKR Holders.

Dai Stablecoin

Cryptocurrencies and volatility go hand-in-hand, and if you’ve been in this space for any length of time, then you’ve come to expect it. But when it comes to putting up collateral, you can’t use some volatile cryptocurrency that runs around “as mad as a March hare.” Stability is Dai’s role in the Maker ecosystem.

Dai is named after the same Chinese character and it means “to lend or provide capital for a loan.” It is a stable, unbiased, and decentralized cryptocurrency that is soft-pegged to the U.S. dollar. “Soft peg” means that it may not stay exactly equal to, but always stays close to the value of one dollar. As a floating peg, it may hover to $1.05 and then drift back to 98 cents, but it stays close.

Constant liquidity keeps it floating, but Dai maintains its soft peg through supply and demand—the creating and burning of new tokens to be exact. Dai is created by users depositing it into Maker Vaults and Dai is burned when users repay their Dai balance.

All in all, Dai can serve as the following: A store of value; a medium of exchange; a unit of account; a standard of deferred payment; a stable store of value (even when markets are volatile). It can be used as a medium of exchange for transactional purposes; as a unit of account and to settle debts within the Maker Protocol, or like any other cryptocurrency to purchase goods and services.

Originally, Dai was based on single collateral—Ethereum. But with the introduction of Multi-Collateral Dai (MCD), any Ethereum-based asset that has been approved by the MKR holders can be used as collateral. Dai now refers to MCD and SAI is used to refer to Single Collateral Dai.

We talked about over-collateralization earlier and this applies to the Maker Protocol as well. The value of the collateral must be higher than the value of debt, hence every Dai in circulation needs to be backed up by excess collateral.

For a user to generate their Dai stablecoin, they must open a smart contract known as a CDP and back up their created Dai with 150% ETH collateral (percentages may vary depending on the type of collateral). This collateral-to-Dai ratio is known as the collateralization ratio. Hence, Dai can only be created when users lock up collateral.

So, think of the CDP as the smart contract that makes Dai loans possible. Then think doubly hard to perform a rebranding exercise and mentally replace the term “CDP” with “Maker Vault” and you’re good to go.

Here are the steps:

– Borrow Dai through locking up crypto assets as collateral.

– Your collateral stays safe in a Maker Vault.

– Repay Dai plus a Stability Fee to retrieve your collateral.

What are Maker Vaults?

A core component of the Maker Protocol is the Maker Vault. For now, you can think of these Vaults as CDPs, but there are differences if you wish to explore why Maker prefers the term “Vault.” The Maker community describes it this way: “The Maker Vault in MCD is where a user deposits collateral and generates Dai.”

So, Dai is created and kept stable through the collateral assets that are deposited into Maker Vaults. As long as a collateral asset is accepted by the MKR holders, it can be leveraged to create Dai. Vaults are non-custodial, meaning that the user maintains control over their deposited collateral and they can interact with them directly to freely generate or payback Dai as they wish.

So, a user creates a vault and collateralizes it with the approved funds that will be used to generate Dai. After it’s been properly funded, a Vault is considered collateralized. When it comes time to withdraw the collateral, Dai must be returned and a Stability Fee must be paid and the Vault will remain empty until the next deposit is made.

Also, a separate Vault will be created each time collateral is deposited. It’s not as if there’s one big slush fund per user. Some users will command multiple Vaults with different types of the collateral inside.

Maker Vaults

To ensure that all the outstanding debt in the Maker Protocol has enough collateral to cover it, Maker Vaults that are deemed to be too “high-risk” are liquidated. Remember the story about the “squiddies” sniffing around? Well, the determination to liquidate is made by a class of key actors called Oracles and Keepers, that are tasked with keeping an eye out for Vaults that have become unsafe and when discovered, liquidating them.

Remember, the liquidation ratio for ETH is 150%. And the liquidation price is the lowest price the staked ETH can reach before the Vault becomes vulnerable. So, let’s say you want to generate 1 Dai. You will have to fund your Vault with at least $1.50 worth of ETH for it to be considered collateralized. Let’s say you accomplish that, but then the price of ETH drops to the liquidation price of $1.49. A Keeper running a bot will be forced to liquidate your Vault.

Liquidating Risky Maker Vaults

What happens when your Vault gets liquidated? Well, the steps are kind of like a going-out-of-business sale.

- An Oracle detects an unsafe (undercollateralized) Vault.

- A Keeper triggers the liquidation.

- A portion of the collateral is auctioned off to pay for the outstanding debt along with a penalty.

- Dai is burned to decrease the supply.

- The owner of the liquidated vault receives any remaining collateral.

There are different types of Vaults, each with their varying Liquidation Ratios which are determined by the MKR voters. These are, of course, based on the amount of risk associated with the collateral asset type.

The best way to avoid the above scenario and having your Vault liquidated is to keep ample collateral on hand and avoid getting over-extended on risky bets. Monitor your Vault regularly and even set up alerts on price movements. In the previous example, instead of cutting it close to the $1.50 liquidation price, why not deposit $3 worth of ETH as collateral against your $1 worth of Dai? Now, should the price of ETH drop, you’ve got some wiggle room in case you need to add to or exit your position.

Key External Actors

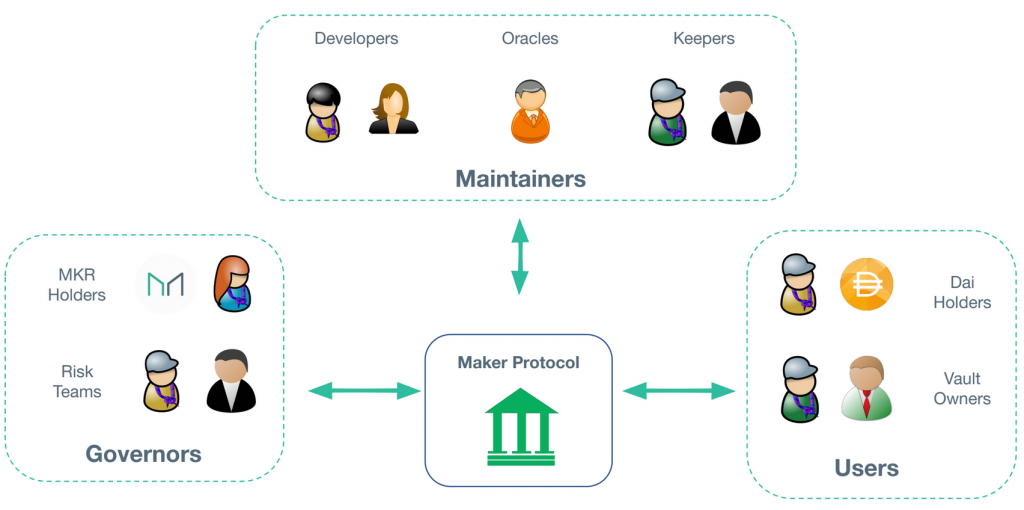

We’ve already mentioned some of their roles, but the Maker Protocol utilizes groups of external actors such as Oracles, Keepers, and MKR Voters to maintain the ecosystem.

Oracles

Price Oracles receive special permissions by MKR voters to maintain the price peg of the Dai stablecoin. They use data from real-time, independent Feeds (chosen by MKR voters) to stay on top of the market prices of the collateral assets being stored in Maker Vaults. Thus, they know when to trigger liquidations or how much Dai each Vault is allowed to generate. Each Oracle matches up with a single collateralized asset and its price.

Emergency Oracles are also chosen by MKR voters to defend against attacks. They can freeze out individual Oracles should they go rogue and try to maliciously withdraw assets, or they can trigger an emergency shutdown if necessary.

Keepers

If Keepers find a mistake with the Oracles, they can fix it. They are independent actors (usually automated bots) and anyone desiring to play this role can create their Keeper software. Keepers help provide liquidity, they can trigger liquidations, and most of their roles can run permissionless on the network.

Decentralized Governance

The Maker Protocol is managed by a global community of individuals who hold MKR, the governance token. Anyone can submit proposals to vote on, but only MKR holders can vote on changes to the protocol such as:

- Adding a new collateral asset type

- Adding new risk parameters to collateral asset types: The Debt Ceiling, Stability Fee, Liquidation Ratio, and the Liquidation Penalty

- Changing the Dai Savings rate

- Choosing Oracle Feeds

- Emergency Shutdowns

- System Upgrades

One locked-in MKR token allows one vote.

MKR holders are also responsible for Risk Mitigation for things such as a black swan event that can include an attack on the backing collateral, a massive price drop in backing collateral, an Oracle attack, and/or a malicious Governance Proposal.

If being a part of MakerDAO’s governance sounds appealing to you, you can watch their open governance calls on YouTube or stake your MKR tokens and start voting yourself.

To review the MakerDAO system:

- Developers maintain the protocol

- Vaults are for used to deposit collateral and generate Dai

- Users save or trade Dai

- Oracles determine the price peg of Dai

- Keepers trigger the liquidation of vaults

- MKR Holders provide governance

The Future of the Maker Protocol

The Maker Whitepaper compiles a non-exhaustive list of current and immediate markets for the Dai stablecoin that you can review in detail. Listed are Working capital, hedging, and collateralized leverage; merchant receipts, cross-border transactions, and remittances; charities and NGOs; gaming, and prediction markets.

If you want to find out more about MakerDAO or even learn how to develop a dApp on top of the MakerDAO protocol, make sure to visit the DeFi 101 course at Ivan on Tech Academy, the go-to blockchain education platform!

Author: MindFrac