The crypto industry started off 2021 with a bang. In fact, some of the biggest cryptocurrencies are already trading at all-time highs, less than a week into 2021. Just during the last month, Bitcoin has seen a massive price increase, with the price of Bitcoin surging by more than $13,000. As such, people are arguably more interested in the crypto market than ever before. The last few weeks' bullish crypto market shows there is a lot of potential in trading crypto, and everything points towards 2021 being an exciting year for cryptocurrencies. Read on for a full breakdown on how to trade crypto in 2021!

With the price of Bitcoin north of $32,000, a lot of investors are wondering whether they should join in on the crypto trading rage, or whether to wait out the current Bitcoin bull run. However, cryptocurrency trading is not without risk. The crypto market is characterized by volatility, meaning that there are some risks involved. Therefore, when trading crypto, you need to be prepared to take risks and adapt to a constantly changing market. Risk-taking, adapting and learning fast are some of the most important traits that you, as a trader, can have to become successful in this market.

Arguably the best way to prepare yourself for trading crypto is through educating yourself. Ivan on Tech Academy is one of the premier blockchain and cryptocurrency education platforms anywhere in the world. Join over 30,000 already enrolled students in learning everything from cryptocurrency basics to algorithmic trading. The Ivan on Tech Academy blog offers completely free, in-depth guides on things from Bitcoin DeFi to crypto derivatives. This brings us to the big question for all beginners and the central point of this article: How to trade crypto in 2021?

What is Crypto Trading in 2021?

Trading cryptocurrency is somewhat comparable to trading foreign exchange markets, or forex (FX). Foreign exchange markets and crypto markets are similar in many ways; they are open 24/7, you can use derivatives such as options, and it is possible to speculate on different currency pairs.

However, one of the ways that the crypto and forex market differ is quite substantial - namely that the traditional forex market only trades with fiat currency. This means that participants can only trade one fiat currency for another.

Meanwhile, in the crypto market, the user has two different opportunities. The first one is to trade fiat currency, such as the USD, for a cryptocurrency like Bitcoin. The other possibility is to make direct trades from one cryptocurrency to another. An example of this could be to trade Ether for Bitcoin.

Unless you are already familiar with crypto mining, odds are you will first purchase cryptocurrency using fiat currency. However, another important part is that fiat-to-crypto trading is mostly done on regulated coin exchanges, meaning that it can be easier for a beginner to grasp.

Why Trade Crypto in 2021?

Cryptocurrencies are based on distributed ledger technology (DLT) commonly known as blockchain technology. Blockchain potentially holds the keys to disrupting numerous different sectors, and the potential is huge. There are already countless real-life blockchain use cases disrupting billion-dollar industries. Since cryptocurrencies are built upon this blockchain technology, these currencies have many blockchain-based characteristics that arguably make them lucrative financial instruments.

Nevertheless, trading crypto in 2021 is about more than merely catching bull runs. Cryptocurrencies and blockchain technology underpin a wider ecosystem of decentralized finance (DeFi). Many believe that banking the unbanked with DeFi is possible, and if so, the crypto industry has the potential to completely revolutionize traditional financial systems. Let’s go through some of the many reasons to trade crypto in 2021, to properly answer the question “why trade crypto in 2021?”.

The Volatile Nature of Cryptocurrencies

Cryptocurrencies are generally more volatile than fiat currencies. Volatility holds risk, but there are high returns on risky investments, as most investors will point out. The volatile nature of cryptocurrencies will bring a risk to the investor since it is hard to predict when to buy/sell. However, if one can have great timing, this can be used to make large amounts of money.

This means that cryptocurrencies are a great choice for scalpers that look to take advantage of the fluctuating prices and sell/buy at the right point in time. Another great advantage of cryptocurrencies is that they are easier to liquidate than other assets in the same volatility class. One traditional stock market example of this mechanic would be pink sheet stocks. Nevertheless, compared to such stocks, crypto is easier to liquidate if the market turns sharply downward.

Dumb Money

Since the crypto industry is still fairly new, there are some unexplored areas and ways to trade the coins. This means that there is an overflow of so-called dumb money. Dumb money comes from investors who begin trading crypto without any previous experience, or without also enrolling in cryptocurrency courses to learn more about the industry. Due to dumb money, the market is still driven by emotions, hasty decisions, and rumors. However, the market is constantly developing and growing, so this might change in the near future.

Nonetheless, the abundance of dumb money makes the market more appealing since there is a shortage of smart money. This means that there are fewer algorithmic trade bots, hedge funds, and machine learning algorithms that influence the market.

Furthermore, the high number of dumb compared to smart money creates a great opportunity for someone entering the market with a well-thought-out strategy. Even though it is not the most developed strategy, a decent plan will place someone way ahead of the casual trader. Most financial markets are governed by greed, where you need to be smarter, better informed, or just luckier than others to make better investments than them.

Great Infrastructure

Even though the crypto industry is relatively new and only about a decade old, the market has seen a huge amount of development. The platforms built during the past 12 years are enough to satisfy the public's needs, making it accessible to almost everyone.

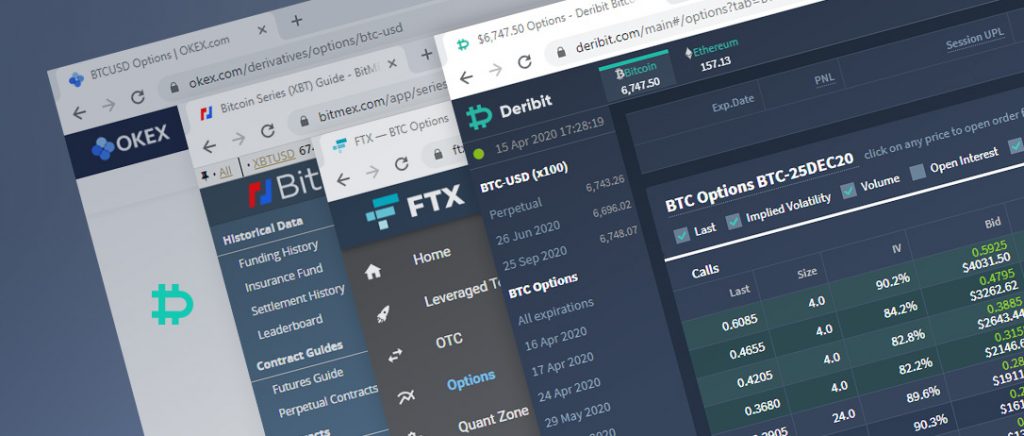

In the market today, there exist great platforms that allow for easy trading. Anyone can simply place market orders on the currency with the click of a button. Furthermore, experienced traders can easily go into more complex derivatives such as futures, swaps, and options.

In short, the tremendous and staggering growth has driven the demand for user-friendly platforms that allow users to invest both with a long and short term perspective in mind. In fact, the dramatic late 2017 Bitcoin bull run and subsequent crypto winter can be said to have prepared the market for this 2020/2021 bull market.

In addition to this, 2021 might be the year that the first Bitcoin exchange-traded fund (ETF) gets approved by the US Securities and Exchange Commission (SEC). This would be great for the crypto world since this would allow institutions to get involved in the industry without holding any coins themselves. If this occurs, then we might see another vast increase in the crypto market in the near future.

Ways to Trade Crypto 2021

You can use various tools to trade crypto in 2021. Some of these are more straightforward, and some are more complex. But nonetheless, we will go through some of the most common ways on how you can trade crypto:

Crypto Spot Trading

Spot trading is probably the best starting point for someone just getting into the world of cryptocurrencies. This is because cryptocurrency spot trading does not involve a derivative built on top of it. This ultimately means that the traders here do not use any leverage making the trades a bit more straightforward.

By buying crypto using a spot exchange, you can also withdraw the assets you are investing in. This makes it great for high-time frame traders and investors planning to hold on to the assets for a longer period of time.

However, it is vital to note that the fees for spot exchanges are generally higher and that there might be less liquidity. Some of the bigger exchanges for trading crypto in 2021 are:

If you want more information on crypto exchanges like Coinbase or Binance, be sure to check out this detailed Coinbase vs Binance article.

Crypto Futures

Another way of trading crypto is through crypto futures. A future is basically a derivative contract that obligates a buyer and seller to transact an asset, such as a cryptocurrency, for a set future date and price. Futures in crypto work like futures in the stock market, meaning that buyers can bet on a currency, both on the long and short side. Some of the characteristics of crypto futures are that they have low fees and high liquidity compared to the rest of the market. We've previously written about Bitcoin futures on the Ivan on Tech Academy blog.

However, there are two types of futures in the world of crypto. The first one is regular futures, and for this contract, the expiry date is set. The second type is called perpetual futures and, as the name suggests, there is no expiry date for this future. The perpetual futures are unique to the crypto market, and the vast majority of futures consist of this type.

Futures can be exchanged at platforms like:

Crypto Options

The last option that we are going through in this article is just that, crypto options. In traditional finance, an option contract allows an investor the opportunity to purchase a share at a price, at any time, as long as the contract is in effect.

This is a complex tool that traders can utilize to avoid some downsides but still draw benefits from the upsides. However, the complexity also makes this crypto options hard to understand, and is, therefore, not the best fit for novice traders who are just getting into the crypto market.

Here are some exchanges where crypto options can be traded:

The Risks of Trading Crypto in 2021

From Hero to Zero

One of the most severe risks with cryptocurrencies is that they can drop to a value of zero. Although relatively uncommon, this is something that has actually occurred in the past and might happen in the future. Some of the examples are Bitconnect Coin, SALT, and Medicalchain. Nevertheless, one should remember that widely recognized cryptocurrencies like Bitcoin and Ethereum are extremely unlikely to ever do this.

There are two reasons that a coin can become obsolete and drop to a value of zero. One is that it is built with poor technology or that there is zero adoption of the currency. Just like a stock on the traditional market, the value of a coin can become worthless. However, this likely does not happen overnight, meaning that with the right skills, you can avoid this problem.

The second reason that a cryptocurrency’s price plummets could be an exit scam by its creators. Since anonymous individuals often create these coins, there is a significant risk that an exit scam occurs. The danger occurs when the creators have a vast amount of the coins and suddenly dump the currency, which drives down the value.

One way to avoid this risk, or at least lower it, is to buy several different coins. As in traditional finance, one way of mitigating risk is to create a diverse portfolio, and the same goes for cryptocurrencies. However, looking at the market as a whole, cryptocurrency prices are correlated with one another. But still, diversifying a portfolio lowers the risk of losing everything if one coin goes obsolete.

Hacks

Even though the premise of blockchain technology is safe and not prone to hacks, there is still a risk of other weak points in certain systems. The highly technical space makes it so that people are not aware of exactly how the tools they are utilizing actually works. Along with this, it is possible to be completely anonymous when trading in these virtual currencies. This anonymity means that there is a somewhat greater possibility that someone can get away with fraud or theft.

The most prominent hacks are exchange hacks where someone takes control over an account. To get rid of this risk, it is important to choose a well-known exchange and activate two-factor authentication. Ivan on Tech Academy recently compiled a list of the top DeFi hacks of 2020.

Exchange Exit Scams

The last risk that we are taking a closer look at is that of exchange exit scams. If you choose an exchange or trading venue that is less known, they may turn their backs on their users. Some previous exchanges such as COSS and MapleChange suddenly disappeared, leaving their users with no funds left.

The simplest way to make sure that this does not happen is to choose a well-known, trustworthy exchange. Some of these well-known exchanges are the ones mentioned above in the article, like Coinbase or Kraken.

Conclusion on How to Trade Crypto in 2021

The potential for Bitcoin and crypto trade in 2021 is still high. Even though Bitcoin, for example, is at an all-time high, there is still potential for further development in the market. There are several different ways to trade crypto in 2021, even if you are a beginner to the market or a more experienced trader. Consequently, now is a good time to look into “how to trade crypto in 2021”.

The cryptocurrency industry has come a long way, and crypto trading is all the rage at the moment. However, it is not only important to know how to trade crypto in 2021 - you should also be aware of the risks associated with crypto trading. The most important risk might be the volatile nature of cryptocurrencies, but this also presents a great opportunity for investors. Along with this risk, there are also other important factors to take into account before considering crypto trading in 2021. Some of which can be avoided by choosing trustworthy exchanges and investing in more well-known currencies.

A safe bet for someone new looking for how to trade crypto in 2021 is to choose a trustworthy exchange, buy some of the biggest coins, and also create a vast portfolio of different assets to spread out the risks. If you want to know more about those exchanges, check out our article on the top crypto exchanges 2021. Along with this, learning more about the technology behind the crypto industry and cryptocurrencies is a positive factor.

If you would like to expand your knowledge on blockchain technology, how to trade crypto in 2021 and the wider crypto industry, feel free to sign up for courses at the number one blockchain education platform Ivan on Tech Academy. On the website, you will find a vast selection of blockchain courses for both experienced and novice developers. What are you waiting for?