As the public’s perception of Bitcoin evolves from former stereotypes as the currency of cybercriminals to a legitimate financial asset, wider acceptance will bring newcomers into the space looking to profit.

If you’ve been wanting to buy Bitcoin but aren’t sure how to go about it, or you’re nervous because you’ve heard stories about people losing all their money, then read on.

Yes, Bitcoin has received more than its fair share of bad press from the mainstream, but a little education goes a long way in avoiding big problems. Bitcoin is an exciting space to be in, but before you jump in, just follow the steps below and you can save yourself time, money, and a lot of headaches.

1. Secure Your Phone

Since you’ll be using your cellphone in at least some of your transactions, and since hackers have been known to steal Bitcoin by compromising cellphones, at the very minimum, you’ll want to do the following:

- Password protect your phone with a PIN and

- Download the Google Authenticator app

With Google Authenticator, you can set up 2FA (Two Factor Authentication) to communicate more securely with your exchange. And since this article is more of a checklist than an in-depth tutorial, whenever you run across something you don’t understand, just check out the how-to videos on YouTube or the text versions on Google.

2. Secure Your Computer

If you haven’t already done so, install antivirus software and also add the NoCoin browser extension to block coin miners. Of course, you can do a deeper dive into securing your system, but just taking care of these two things will help immensely.

3. Set Up a New Email Account

If you’ve been using the same email address for years, then your info is already plastered all over the internet and it’s likely that your credentials may have been leaked in a data breach. Nothing may have come of it thus far, but now that you’re investing in crypto, why risk losing your coins?

Also, since your old inbox is probably stuffed full, the sheer volume of emails there can make it that much easier to accidentally click on a bad link. So, start your journey into crypto with a clean slate by setting up a new email address.

Don’t post to social media with it, don’t give it to your friends, don’t sign up for newsletters—don’t use it for anything other than your crypto transactions. You might dislike the extra hassle at this point, but it will make you a harder target for potential hackers.

4. Buy Bitcoin From Reputable Sources

Now that your systems are secure, you’re ready to go. There are many ways to purchase Bitcoin, you can even find kiosks that sell it inside of your local grocery store. However, even if the kiosk is legit, you’re likely to pay higher fees.

Even worse than using kiosks is contacting strangers from ads on Craigslist or email solicitations. If you buy from these sources, you’re basically asking to get scammed. Sure, you might get lucky and come across an honest dealer now and again, but there are charlatans o’ plenty in this space, so it’s typically not worth the risk.

Your safest bet is to go with a reputable exchange. The larger, well-known ones are places like Binance, Coinbase, Kraken, or Gemini, but the quickest way I’ve found is to use Cash App. Cash App was developed by Square Inc., which is owned by Twitter CEO, Jack Dorsey—a known advocate for Bitcoin.

When you download Cash App to your phone you just fill out the KYC info, link your bank account, transfer cash, and exchange it for Bitcoin. There are slow exchanges out there, but Cash App is not one of them. It’s quick and easy.

5. Don’t Leave Your Bitcoin on an Exchange

Regardless of which exchange you choose, once you’ve purchased your Bitcoin, don’t leave it there for too long. The reason being, exchanges can get hacked and if it happens, there’s little you can do about it. So, move your funds to your own personal, cold-storage wallet.

The only exception to this rule would be if you are investing smaller amounts. After taxes and shipping, you are going to spend $100 plus for a good wallet. So, if you are only buying small amounts of Bitcoin, the wallet might end up costing as much as your investment, in which case it makes more sense to leave it on the exchange until your holdings increase.

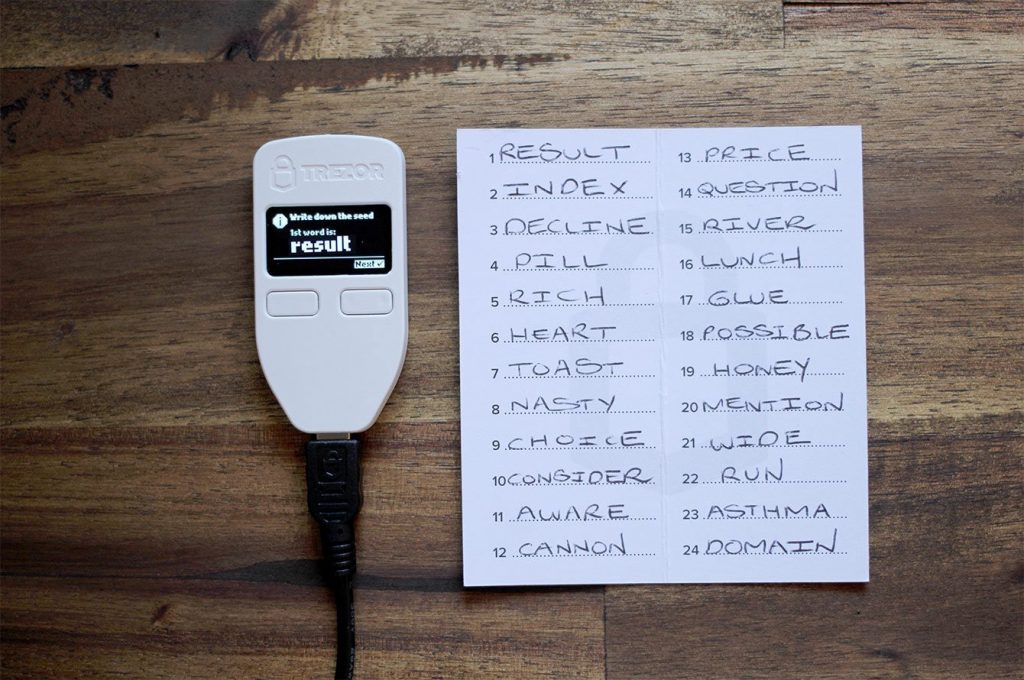

6. Choose Your Wallet Wisely

Hardware wallets look like USB devices that you’ve seen before. When shopping for one, go with a company that’s been around for a while. Sure, there may be some great new companies out there, but their wallets haven’t been battle-tested and they could be exploited by hackers. Check out Trezor and Ledger as they’ve been around for a while and their less expensive models start around $59—just don’t forget to factor in the cost of taxes and international shipping. And please, don’t buy used wallets on eBay. Now is not the time to try and save a few bucks.

7. Bookmark Important Websites

Try using one browser for your crypto purchases with the NoCoin extension installed. Chrome works well with the exchanges, but if you want more privacy you can try Brave. Just create a bookmark folder and name it something like “Bitcoin” or “Crypto” and bookmark your important sites there.

Why should you bookmark? First off, if you type in a URL manually there’s a chance you could misspell a word and inadvertently end up on a hacker site that looks exactly like the official website you were trying for. It’s one thing to mistype your favorite sports team and end up on a porn site with your girlfriend looking over your shoulder. It’s another thing to misspell your Bitcoin exchange and end up logging in to a bogus site and having your credentials stolen.

Secondly, once you sign up for a wallet and an exchange, you will begin receiving emails from these parties. Most likely these emails will be legit and you can click on their links and be fine. However, there is always the chance that you could receive a phishing attack from a site posing as your wallet or exchange.

So, even if you get an official email with a link in it, it’s best to fall back on your bookmarks and get in the habit of logging in from there instead of clicking links.

8. Keep Your Seed Phrase Private

Of course, she’s telling you she loves you now, but when the honeymoon is over and she walks out the door with your vinyl collection and your mom’s prized set of crystal, the last thing you want is to have her abscond with your Bitcoin as well. And believe me, when she does leave, she will have already rationalized the thievery. After all, you owe it to her for all the pain and suffering you’ve caused.

This is a silly example that obviously favors the side of male victimization, but it works both ways in relationships. Regardless—if you don’t want to see your ex with her new boyfriend big pimpin’ it in a Lambo that’s been financed with your freshly nicked Bitcoin, then pay attention to this part.

When your wallet arrives and you set it up for the first time, you will receive what’s known as a seed phrase that you will need to write down. You will want to write this on a piece of paper (not on a computer where it can be hacked), and you’ll want to wrap it in a sandwich bag in case of water damage. It might help to hide multiple copies in multiple places or even in a fire-proof vault if your holdings are significant.

The main thing to remember is, do NOT give this seed phrase to anyone you don’t trust 100%. That is because whoever has this seed phrase has the keys to your Bitcoin kingdom and can take all of it. So keep it safe. You don’t want to go bragging to your friends about it as they may tell it to others who aren’t so nice. And like I said, the partner you’re so madly in love with today may not prove to be the right person, in the long run, so be careful who you trust with this information.

On the other hand, you don’t want to go to the other extreme either. If you keep it a total secret and no one else knows where to find your seed phrase, what happens to your Bitcoin if you die or go into a coma? Your loved ones will have no way of recovering your funds. So, before you deny your favorite nephew his inheritance, think about a way for loved ones to access your Bitcoin should something happen to you.

You could even draw a treasure map in your will and make your relatives wander through the Mojave desert looking under rocks and cacti for the next clue that ultimately leads to your wallet and seed phrase. Now that would be fun! Heck, you worked hard building up your stash, why shouldn’t they have to work for it too?

9. Triple-Check Your Addresses Before Sending Bitcoin

After you’ve followed the tutorials in setting up your wallet and you’re ready to transfer your tokens off the exchange, you’ll retrieve an address to send your funds to. I won’t dig too deeply into this part, because it requires a more extensive tutorial, but you will need to make sure this address matches up.

Your address will be a long list of alphanumeric characters that you will need to confirm on your wallet and then copy and paste to your exchange. Again, never type your address in manually! Always copy and paste. On Cash App you can snap a photo of the barcode and procure the address that way, but check that it matches the address on your wallet anyways.

Why so thorough? Because this is your own, personal wallet and you are now your own, personal banker. If you accidentally send your Bitcoin to the wrong address, it’s an irreversible transaction. It’s not like you can call your bank and tell them to cancel your check or do a chargeback on your credit card. Once it’s done it’s done. You might get lucky and your mistaken transaction may never get validated on the blockchain, but why risk it with carelessness?

This is not meant to scare you, it’s just meant to make you take it seriously. In the same way that it’s not wise to drink and drive, it’s also not wise to drink and send Bitcoin. Also, there are stories about hackers who can change the copy and paste feature to make it paste their address and steal your Bitcoin. So, again, check the address even if you think you copied and pasted correctly.

If this all seems too nerve-wracking for you, then start small. Transfer small amounts to yourself like $10 worth of Bitcoin at a time. When it shows up on your wallet as confirmed, you’ll know you’ve done it right. Do this multiple times until you’re confident enough to send larger amounts. In no time, you’ll be spotted on Whale Alert sending massive transactions with ease.

10. Overtrading: FOMO In, FUD Out

Once you gain confidence, you may want to start actively trading on your exchange. Everyone gets into Bitcoin to make money ultimately, so of course, trading might seem appealing to you. That’s fine if you know what you are doing but a lot of people don’t. When you hear people crying about losing money trading Bitcoin it’s likely because they were ruled by their emotions and jumped in due to FOMO (Fear Of Missing Out).

What typically happens is Bitcoin breaks through a price resistance point, the news media starts talking about it, social media starts buzzing, scammers get activated, and people start piling in trying to get a piece of the action. And you (if you’re an undisciplined trader), will start to experience the phenomena known as FOMO.

When you fear missing out on big gains, it’s easy to get greedy and start making big trades. And typically what happens is that just as you jump in to get rich quick, the price reverses. Now, because you put money in that you can’t afford to lose, panic sets in and you slip into the state of FUD (Fear, Uncertainty, and Doubt).

When FUD kicks in, you’ll likely pull your funds out just as the price starts to bottom out. So what have you done in essence? Well, you just did the opposite of what you’re supposed to do—you bought high and sold low. If you continually chase Bitcoin prices in this manner you will lose, and unless you’re a humble person who can learn from his or her mistakes, you’ll blame Bitcoin instead of yourself.

11. Margin Trading

If FOMO-In FUD-Out trading isn’t bad enough, some exchanges offer margin trading which can cause traders huge losses if they don’t know what they’re doing.

Bitcoin is quite volatile so when it gets hot, it’s easy for traders to slip into a fantasy world of quick riches which causes them to overextend themselves on margin, buying coins they couldn’t otherwise afford. The fantasy continues until the price violently reverses and slaps them back to a painful reality.

Trust me, you don’t want to be one of those people who loses the exchange’s money. If you can’t pay, the creditor will unleash their Dogs of War on you. And instead of living in a world of mansions, bling, and Lamborghinis, you’ll find yourself social distancing hundreds of miles from the nearest human on a remote island dressed in little more than a fig leaf whilst fighting off angry snapping turtles aiming for your genitalia.

But seriously, margin trading is the quickest way to get financially wrecked.

Cryptocurrency Investment Guide Summary

Bitcoin can be a great investment and many believe it’s poised to become the world’s currency or store of value—digital gold if you will. You just have to do it right.

And don’t be intimidated by the number of steps in this article. Once you’ve gone through the process a few times, buying and sending Bitcoin can be accomplished in minutes. All you have to do is wait for the confirmation on your wallet and you’re done.

As in life, there are no guarantees when investing, but you can take steps to protect yourself. After all, you don’t want to end up as one of these knuckleheads like Peter Schiff, who claims to have lost his Bitcoin because his wallet magically gobbled them up.

Have fun, stay safe, and always remember, “You don’t want to go to Rekt City.”

To educate yourself on Bitcoin and other cryptocurrencies, please visit the Ivan On Tech Academy, the premier online blockchain academy. Moreover, the Ivan on Tech Academy is also home to information regarding everything from Ethereum privacy tools to IOTA Smart Contracts.

MindFrac