The volatile cryptocurrency market requires traders to conduct in-depth research to navigate it properly. However, performing such research takes time and effort. Fortunately, you can now bypass much of the research thanks to Moralis Money. This tool allows you to set customizable filters and get real-time access to on-chain data to identify the most promising assets. It also provides a Token Shield feature which provides security scores for each coin so you can stay safe! In turn, this is one of the best crypto for dummies tolls!

You can use the frame below to take Moralis Money for a spin. Either set your own filters or use our presets!

So, are you ready to make the most out of this “crypto for dummies” guide? Let’s do this!

What is Crypto Trading?

Crypto trading is the act of speculating on the price movement of cryptocurrencies with the goal of making profits. So, if you are familiar with trading traditional markets, you can project your understanding of it on the crypto markets. But since crypto assets live on the blockchain, there are some specifics you ought to consider.

Due to the high volatility (large and fast price changes) of crypto markets, crypto trading is considered a high-risk, high-reward venture. So, this is definitely not a “game” for everyone.

However, the potential upside that this market offers is literally like no other opportunity. After all, during bull runs, most altcoins increase 50x-70x in price. But some coins even do 100x and 1000x rallies.

As a “crypto for dummies” reader, you may not yet be familiar with altcoins. However, you’ve definitely heard of Bitcoin (BTC) before, right? Bitcoin remains the leading cryptocurrency representing approximately 50% of the crypto market.

All other cryptocurrencies are known as altcoins or simply “alts,” which is short for “alternative cryptocurrencies.”

Two Main Ways to Trade Crypto

It’s also worth pointing out that there are two ways to trade cryptocurrency. One is performed via a “contract for difference” (CFD) trading account, and the other by actually buying and selling the crypto coins and tokens.

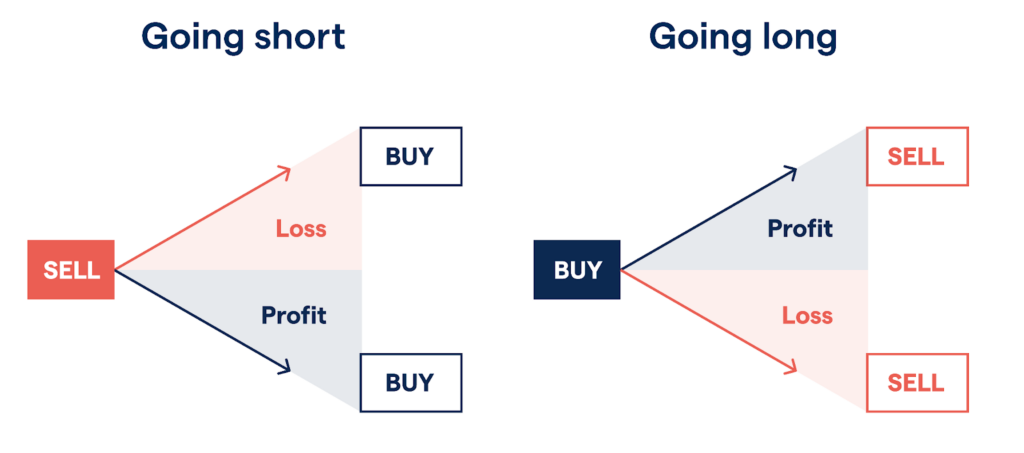

You can think of CFD trading as a sort of derivative that allows you to bet on the price of a particular cryptocurrency. You can basically profit from price movement without actually owning the underlaying asset, and you either take a long (predicting that the price will rise) or short (predicting that the prices will fall) position.

When focusing on CFD trading, you can even apply leverage (using exchanges’ funds to increase your position). However, leverage trading further increases your risk as it magnifies both your potential earnings and losses. So, if you are on the “crypto for dummies” level, you better stay clear of leverage trading.

Buying cryptocurrency via a centralized exchange puts the crypto in your account. In that case, they initially land in your custodial wallets controlled by the exchange. You can then transfer them to your non-custodial wallet as well. However, when using decentralized exchanges (DEXs), the purchased assets land directly in your non-custodial crypto wallet. This means that you are in full control of those cryptocurrencies.

How Does Crypto Work for Dummies?

Even if you are completely new to crypto, odds are you’ve heard of Bitcoin (BTC) before. The latter went live in 2009 and was the first-ever cryptocurrency. Bitcoin is also the first blockchain technology use case.

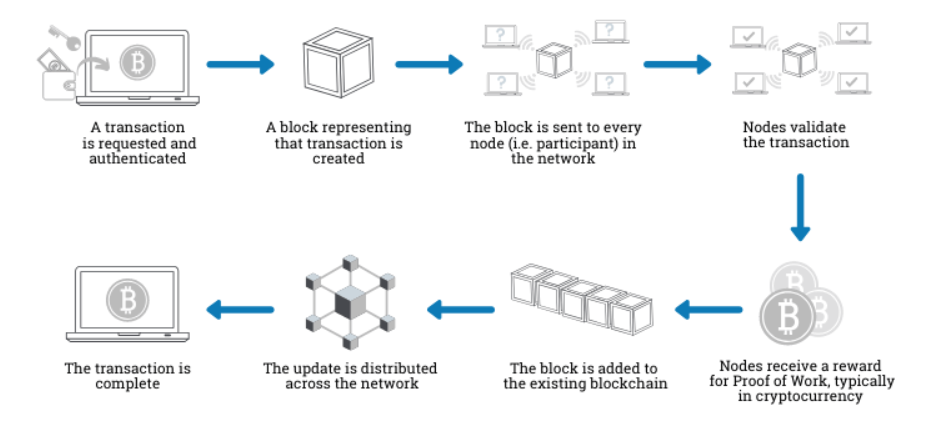

Blockchain is essentially a distributed digital ledger that records transactions between two parties efficiently and in a verifiable and permanent way. In the case of public blockchains (such as Bitcoin and Ethereum), these digital ledgers have no central authority and are open. Meaning anyone can join the network.

So, most cryptocurrencies live on public blockchains. However, it’s important to note that not all projects are equally decentralized.

Properties of public blockchains:

- Open

- Distributed

- Ledger (bookkeeping)

- P2P (peer-to-peer)

- Permanent

- Immutable

- Decentralized

- Secure

The decentralized nature of blockchain networks is a true game changer. By supporting direct P2P interactions and transactions, blockchains aim to cut out intermediaries and empower people across the globe. Essentially, anyone with internet access can join these P2P networks!

While Bitcoin was primarily designed to handle financial transactions in the form of BTC, it’s evolving and is now able to host simple programs. However, we now have many so-called programmable blockchains meant for that specific purpose.

Among these programmable blockchain networks, Ethereum was the first one and continues to be the most popular choice. Programmable blockchains are the home of smart contracts (on-chain programs), which are the key to automation. Furthermore, smart contracts are also used to create so-called crypto tokens. That is why networks like Ethereum are not only home to native crypto coins but also host many other cryptocurrencies.

Diving deeper into blockchain tech and smart contracts would exceed this “crypto for dummies” article. However, feel free to learn more about this world-disrupting technology on our blog.

Trading Crypto vs Investing in Crypto

On one side of crypto trading, you have scalp trading, which refers to entering and exiting trades during extremely short timeframes (typically minutes). On the other side of the spectrum, you have long-term investing.

Investors generally seek larger returns over an extended period through buying and holding. Traders, in comparison, take advantage of both rising and falling markets to enter and exit positions over shorter timeframes, taking smaller, more frequent profits.

However, for the sake of this “crypto for dummies” guide, we will drop the semantics and refer to crypto investing as long-term crypto trading.

All in all, both short-term and long-term crypto trading can yield gains and losses. Deciding on a strategy depends on your preference!

If you are interested in pocketing your profits as soon as possible, then your goal should be to focus on short-term trading. However, keep in mind that the shorter the timeframe, the higher your skills need to be in order to be profitable.

Still, with a basic understanding of technical analysis (TA) and using the right tools to let you rely on real-time, on-chain data, you can learn to make profitable crypto trades. We recommend starting with swing trading and only consider day trading once you’ve mastered the basics.

Crypto Technical Analysis (TA) for Dummies

The great news is that TA for the traditional markets is no different than TA for crypto. After all, TA is all about looking at the charts that indicate an asset’s prices over time. Based on that past market data, you can determine how you should react to the current market moves to increase your chances of a successful trade.

If you dive deep into TA, you will soon learn that there’s a lot to cover. There are countless tools, indicators, chart patterns, candle patterns, etc. Typically, the more you learn, the more you realize that the ability to determine the basic market structure can often be more than enough to make profitable trades.

So, we recommend you primarily focus on the following:

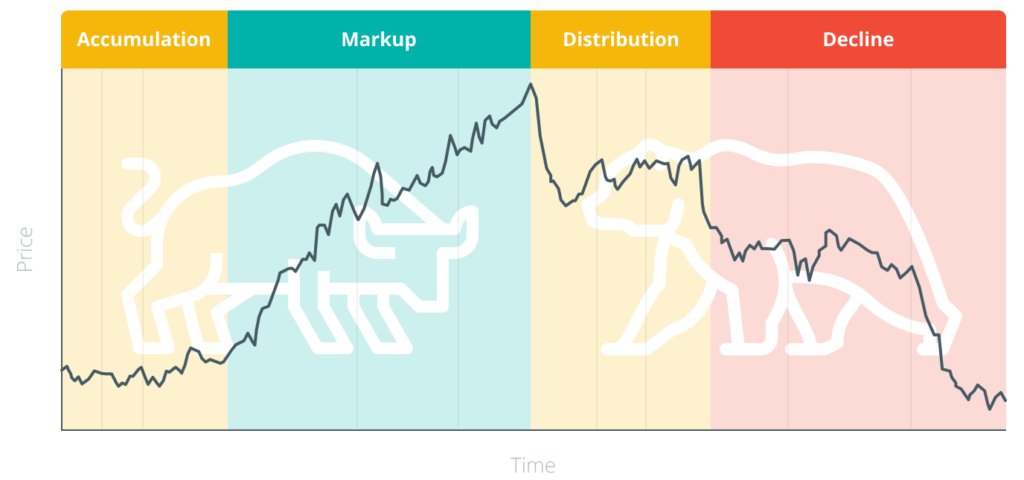

- Properly reading the market structure – bull market vs bear market:

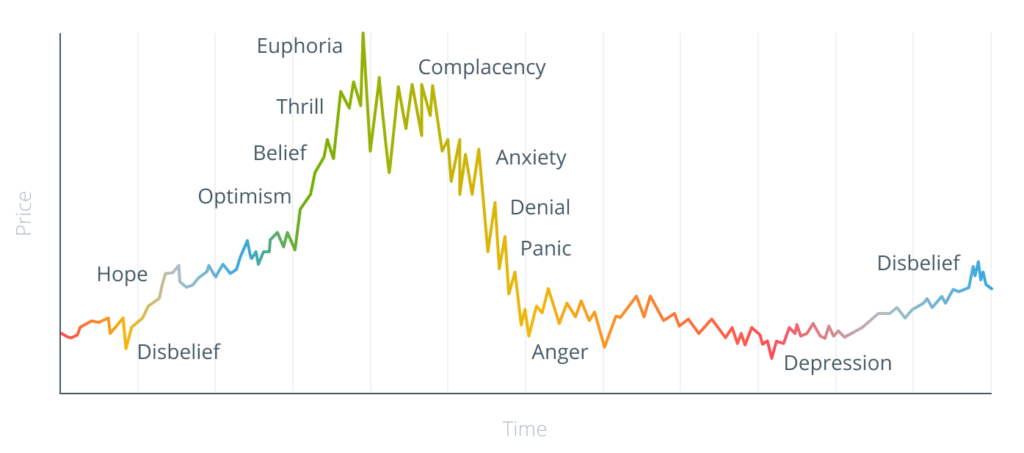

- Considering psychological cycles:

- Being familiar with Bitcoin cycles:

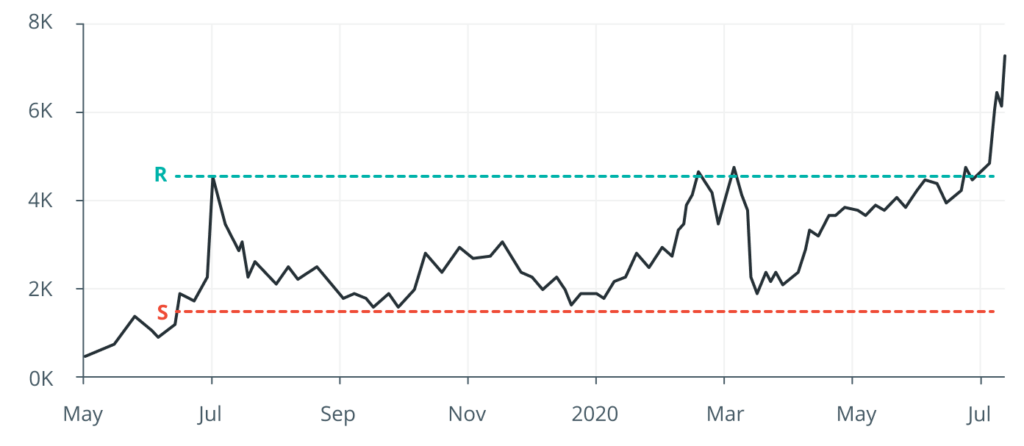

- Determining support (S) and resistance (R) levels:

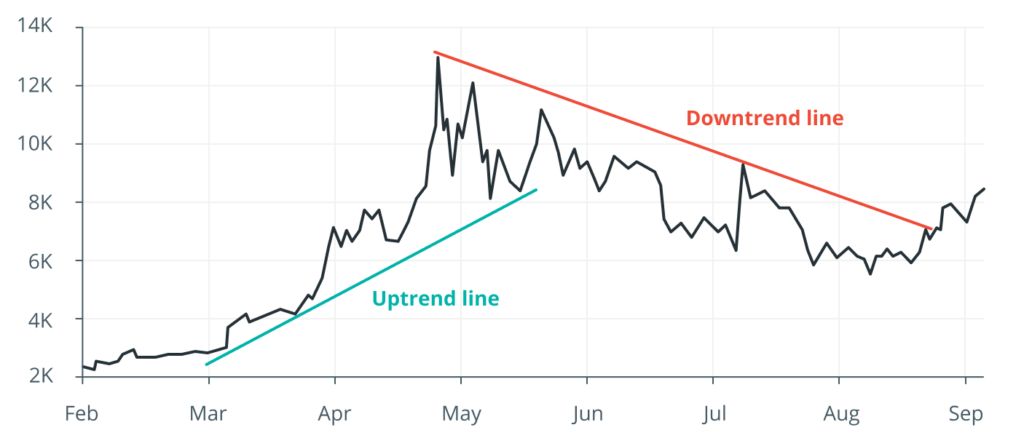

- Charting uptrend and downtrend lines:

Particularly in crypto, the above-listed TA basics will get you far if you combine them with real-time, on-chain indications. The latter is the main difference between traditional TA and crypto TA. After all, on-chain activities always precede price action. Thus, it is also important to take on-chain metrics into account when conducting crypto technical analysis.

In the past, you could only access highly complex and “analysis-paralysis-inducing” tools made by data scientists with zero trading experience. However, now you can use Moralis Money – the first tool that combines the power of on-chain data and simplicity.

The team of experienced altcoin traders and industry-leading Web3 developers joined forces to create Moralis Money. Thanks to this tool, casual traders can time their entries and exits before any price pumps or dumps!

Moralis Money 101 – How to Use the Power of On-Chain Data

This crypto for dummies guide would not be complete without demonstrating how to get the most out of Moralis Money.

This tool allows traders to uncover on-chain signals to buy or sell assets. If a token starts gaining momentum and its price has not rallied yet, it might be a good buy. On the other hand, if the token is losing momentum and its price has already rallied, it’s probably a good time to exit your position or short the market.

You can use Moralis Money to catch the current momentum of many different crypto assets, both new and older ones. So, you can now spot the next move for the MATIC, HEX, or other popular alts.

This powerful tool also gives you the power to find new crypto gems. This could be tokens such as the Verse token, MC token, BitDAO, and countless other newly minted coins. Finally, you can find new crypto coins before everyone else!

The Essence of Moralis Money

Moralis Money’s three primary features enable you to overcome the three main trading obstacles: FOMO, scams, and time scarcity:

- With Token Explorer, you can use on-chain data to spot opportunities early and never FOMO into coins again!

- Token Shield helps you avoid scammy projects!

- With Token Alerts, you save time as it allows you to keep an eye on new opportunities on autopilot!

The above three features ensure that Moralis Money provides you with easy-to-understand and actionable on-chain data. It gives you the edge to find tokens before they pump!

While no one knows what the future of crypto in the next five years will look like, on-chain data does give you a sneak peek into the short-term future. Hence, you can determine what the best cryptocurrency to invest in right now is at any given moment with a much higher probability.

Quickstart Guide

In a true “crypto for dummies” spirit, we want to demonstrate the simplest and fastest way to get going with Token Explorer.

Here’s how you can simply select one of the preset filters on the Moralis Money homepage with a single click:

While preset filters are a great place to start, they are available to all Moralis Money users. Thus, you want to get comfortable using your unique search criteria. So, here’s the four-step process that will help you spot unique opportunities:

- Access Token Explorer.

- To target more established coins, apply the Market Cap metric. Or, use the Coin Age filter to search for newly minted coins.

- Use the “Add Another Filter” button. You can use metrics like Holders, Buyers, and Experienced Buyers to refine your candidates.

- Polish your list further by adding extra filters. Just select a metric and a filter, enter a value, select a timeframe, and hit “Run Query”!

Get comfortable using the above four steps and you’ll be able to spot which crypto will explode in 2023 and beyond!

Do not limit your search to the Ethereum chain. After all, Moralis Money lets you explore all the leading chains. You can switch among supported networks with two simple clicks:

Crypto Trading for Dummies – Full Beginner’s Guide – Summary

So, how to trade crypto according to today’s “crypto for dummies” guide?

- Use TA basics to determine where we are according to market cycles.

- Use Moralis Money to determine which coins are gaining traction or losing momentum to enter/exit your positions.

- DYOR – do your own research on every token before entering a trade.

- Use your favorite DEX or CEX to execute trades.

Now, go out there and practice these steps! Of course, this is not financial advice. That said, from our own experience, these four steps have the potential to help you make unimaginable profits.

Make sure to share this “crypto for dummies” guide with your friends who want to enter crypto!