Use the interactive widget above if your main goal is to find altcoin opportunities and determine which cryptos are gaining momentum. By selecting one of the preset filters or applying your unique combo of search criteria, you can generate your first dynamic list of tokens in just a few clicks! That’s the power of Moralis Money! However, if you wish to learn more about how to analyze cryptocurrency projects and tokens, dive into the following sections. In the second part of today’s article, we will explain how to accomplish crypto data analysis using Moralis Money. After all, it is the best on-chain trading tool that gives you the ultimate edge when investing in altcoins.

On-chain insights are so powerful that both technical and fundamental analysis just can’t compare. However, using all three approaches will help you create strong convictions and enter trades with maximum confidence.

So, are you ready to learn how to analyze cryptocurrency tokens? Let’s dive right in!

How to Analyze Cryptocurrency – Primary Steps

Before you go through the primary steps outlined below, make sure you know what your main focus is. Do you plan on entering a long-term HODL? Do you wish to make scalp trades? These two types of strategies are two extreme ones, but there are many other options in between, and it’s important to know your tactic. But why is that?

Well, how to analyze cryptocurrency varies depending on the tactic you choose. For instance, if you decide to focus on HODLing (long-term position trading), then you must perform a proper and thorough fundamental analysis (FA). If focusing on such a trading strategy, technical analysis (TA) can be quite basic.

On the other hand, if you plan on performing scalp trades (short-term trades), you can usually ignore FA, to a certain extent, anyways. However, in that case, your TA needs to be on point.

In both cases, however, you should examine on-chain activity to get your timing right.

With that in mind, there are no ultimate steps for analyzing cryptocurrency tokens or projects. The sequence in which you approach your crypto data analysis is highly flexible. As such, pick those steps that suit your tactic and perform them in an order that best suits you. That said, here are the most popular steps to analyze crypto:

- Find Cryptocurrencies with Moralis Money

- Visit the Crypto Project’s Official Website

- Explore the Project’s Socials

- See if You Can Legally Participate in the Project

- Take a Closer Look at Tokenomics

- Consider the Token’s Current Price and its Price History

- Use Real-Time, On-Chain Data to Time Your Entries

Step 1: Find Cryptocurrencies with Moralis Money

Before you can start analyzing any crypto, you need to find it. You may be familiar with tools like CoinMarketCap (CMC) and CoinGecko, which are great for finding cryptocurrencies in general. However, if you wish to find altcoins that have been minted seconds or minutes ago, or to detect alts that are gaining social or on-chain traction, then Moralis Money is the tool to use!

Here is a sneak peek at how to find crypto with Moralis Money:

Step 2: Visit the Crypto Project’s Official Website

A project’s website can tell you a lot about the project. For instance, a unique website that works smoothly is typically a good sign.

You can also find the project’s whitepaper, info about the core team, a roadmap, and other useful details on the website. Of course, you also need to take all that information with a grain of salt, as anyone can create a website and put any kind of content on it.

Still, here are some questions you should keep in mind when exploring the project’s website and whitepaper/litepaper (they are some of the most important “how to analyze cryptocurrency projects” guidelines):

- Is the project solving an actual problem?

- Can you find any legit info about the team? If the team is doxxed, that typically increases the probability of the project’s legitimacy.

- Is the whitepaper/litepaper clearly explaining the tech, the purpose of the project, and how it’s solving a particular problem?

- How realistic is their roadmap? Is it updated?

- What is token allocation like? Was there a presale? If so, at what price? Are tokens locked (vested)?

- Does the project have any venture capitalists (VC)? Are they involved with other reputable crypto projects or with pump-and-dump ones?

Step 3: Explore the Project’s Socials

When analyzing crypto, you want to look at their social status. If it isn’t trending and has no people engaging with its announcements, it’s usually a bad sign. So, you want to see the project active on their social channels – posting regularly and engaging with the community. It’s also great to see if some reputable channels or influencers are following and engaging with the project.

The most popular channels for crypto projects are Twitter, Telegram, and Discord.

Ideally, you want the project to have a solid and healthy community. In fact, a strong community is usually the most important key to success. A highly engaged community often creates the foundation for strong “pumpamentals.” And if crypto markets taught us anything, pumpamentals often outweigh fundamentals.

Step 4: See if You Can You Legally Participate in the Project

Crypto is still much of a “wild wild west,” and regulations are often unclear. Several countries around the globe clearly prohibit their citizens from participating in various crypto ventures. As such, it’s important to know whether you can legally participate in a project before you analyze it in further detail.

Step 5: Take a Closer Look at the Tokenomics

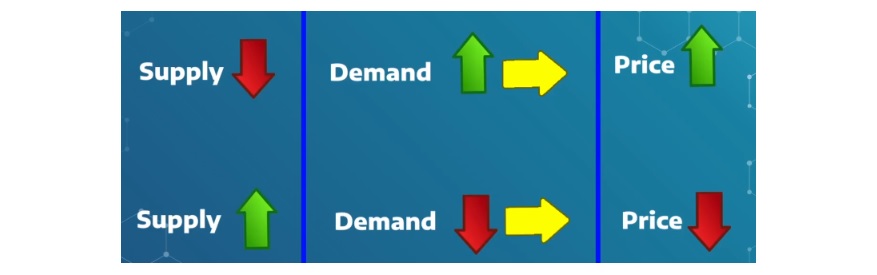

The tokenomics are an important part of crypto data analysis, especially for tokens with actual use cases. Tokenomincs include the token’s supply and demand, the incentive to buy and hold a token, token allocations, and the token’s market cap.

Here are some general rules of thumb:

- The more scarce the token supply and the higher the demand for the token, the more the token’s price can soar.

- The lower the token’s market cap, the higher the risk of being a scam.

- Capped supplies and deflationary cryptos deserve extra attention.

- You ought to be more cautious with tokens with high total supplies.

Step 6: Consider the Token’s Current Price and its Price History

This is where TA enters the scene. TA is quite powerful, especially when you want to trade cryptos with larger market caps that offer a lot of historical price data. The latter is a prerequisite for proper TA. However, with new coins, TA is not that reliable. Still, you should consider the token’s current price and compare it with other tokens with similar total supply and use cases.

Step 7: Use Real-Time, On-Chain Data to Time Your Entries

The above steps (2-6) focus on FA and TA, which are both very important. However, once a memecoin season hits, most of that flies straight out of the window. Do you think FA or TA expertise could have helped you spot the PEPE token when it launched? No! However, on-chain data would have.

Of course, the power of on-chain data insights goes way beyond spotting meme coins. It’s always applicable, and it is the key to timing your crypto investments properly. After all, on-chain activity always precedes price action, and there can be impressive price action even if there are no fundamentals. As such, real-time, on-chain data is the only “how to analyze cryptocurrency” tactic that is always applicable.

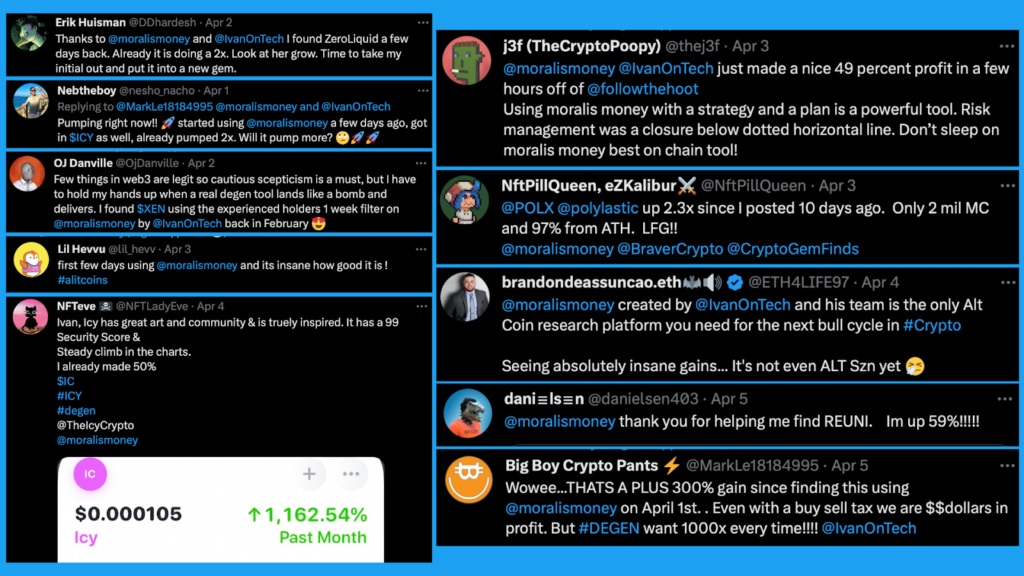

That is why Moralis Money users, especially those on the Pro plan, have been so successful. These are just some success stories of the first half of 2023:

Despite the unmatched power of on-chain data, ideally, you should always aim to combine the power of on-chain crypto data analysis with TA and FA or at least one of them to spot great opportunities.

Crypto Data Analysis 101 – Technicals and Fundamentals

If you are new to crypto and haven’t been trading or investing in other assets before, all this talk of fundamental and technical analysis may be a bit confusing for you. If so, make sure to go through the following two subsections to learn the gist of FA and TA.

However, if you are already up to speed and ready to learn how to analyze cryptocurrency by using the best on-chain trading tool, jump into the “Crypto Data Analysis Using Moralis Money” section. There, you’ll learn what Moralis Money is all about and how to get going with this powerful tool in just a couple of clicks.

Fundamental Analysis (FA)

FA comes from traditional markets and is the process of determining the intrinsic value of an asset. But since cryptocurrencies are unique, FA for this new asset class demands a rather different approach to FA.

FA for crypto is vital when, for example, an investor aims to invest in a new or upcoming cryptocurrency for a long-term HODL. Furthermore, FA enables you to filter out blue-chip projects from trash coins.

The following are the core aspects of crypto FA:

- Venture Capitalists (VCs)

- Market Cap

- Token Supply/Demand

- The Project’s Team

- Technology (Layer-0, Layer-1, Layer-2, Layer-3, DeFi, CeFi, Consensus Type, etc.)

- Tokenomics

The most popular websites/tools for basic FA:

- CypherHunter – To find VCs.

- Dovemetrics or Messari – To see where smart money is investing.

- DefiLlama – To determine TVL (total value locked).

- CryptoRank – For presales.

- CoinMarketCap/Coingecko – For market cap/supply insights.

- LunarCrush – For tracking social activity.

- Moralis Money – To find the latest altcoins.

Technical Analysis (TA)

Just like FA, TA also comes from traditional markets. TA helps you increase the probability of profitable trades, but it does not accurately predict exact price points. As such, always focus on price ranges rather than the exact price points.

So, no matter what kind of trade you plan on executing, whenever you have a chart (price vs time) that offers a decent amount of historical price data, you should perform at least basic TA:

- Knowing what support and resistance levels are and how to spot them.

- Being able to spot market structures, trends, and chart trendlines.

- Understanding trading volume.

- Knowing how to use basic tools and indicators.

- Being able to spot and make sense of the most common chart and candlestick patterns.

While many tools can be helpful, too many can be overwhelming and confusing. As such, aim to use as few tools and indicators as possible, as you need to build up confidence!

The best tool to view charts and perform TA is TradingView – its free version can take you far.

If you don’t have the TA skills under your belt yet, we recommend you enroll in our Technical Analysis 101 course. Plus, some of our past articles can help you grasp essential concepts like market cycles, bull vs bear season, etc. For instance, the “Altcoin Trading Strategy,” “Crypto Bear Market Strategies,” “Crypto Trading for Dummies,” and “Will Crypto Recover” articles are great starting points.

Crypto Data Analysis Using Moralis Money

Before we outline the steps that will help you get going with Moralis Money, you should know the gist of this powerful yet simple on-chain tool. So, make sure to go through the following list:

- Moralis Money is free – everyone with internet access can use it.

- It provides easy-to-interpret, actionable results.

- Moralis Money is extremely user-friendly and offers a highly intuitive user experience.

- It offers access to real-time, on-chain data in the form of dynamic token lists.

- Moralis Money offers preset filters.

- With Token Explorer, you get to find tokens early with high potential to overcome FOMO.

- Moralis Money helps you avoid scams with the Token Shield feature.

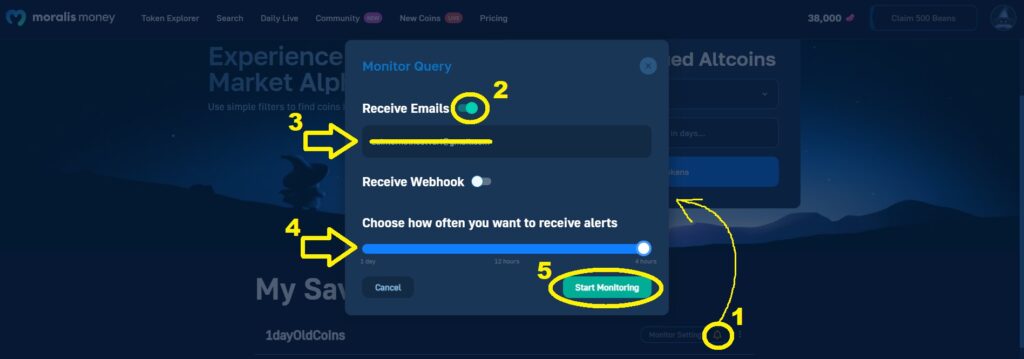

- With Token Alerts, you get to run on-chain queries on autopilot to overcome the lack-of-time challenge.

- Moralis Money enables you to search for any token and wallet address.

- It’s also a portfolio dapp.

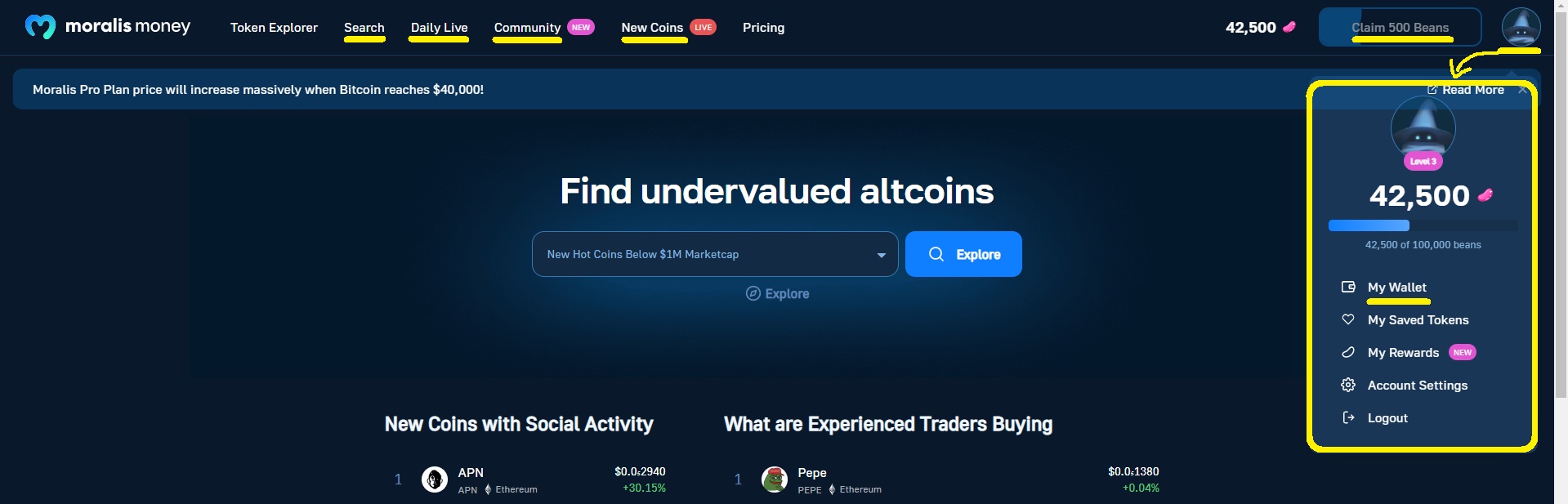

- Moralis Money gives you a chance to collect magic beans (daily rewards).

- It is also your ticket to becoming a member of one of the most amazing crypto-degen communities.

- With Moralis Money, you get to see new coins as they get minted.

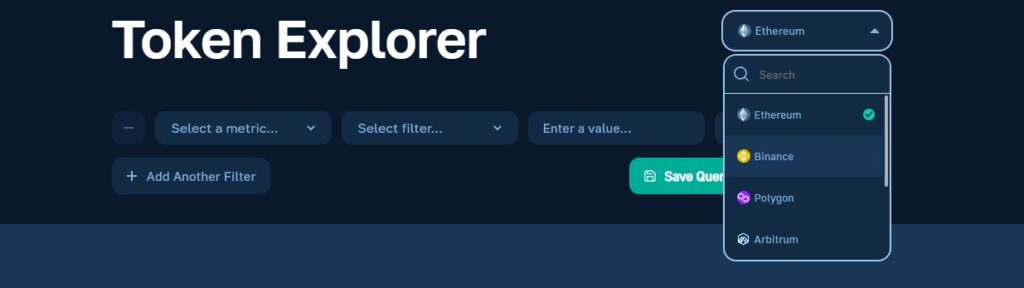

- This tool allows you to explore multiple chains.

- Moralis Money is the ultimate edge when it comes to spotting those 50x-plus altcoin gems early.

Now is the best time to master this amazing on-chain tool and take your crypto data analysis game to the next level. So, are you ready to learn how to analyze cryptocurrency with Moralis Money? Let’s get started!

How to Analyze Cryptocurrency with Moralis Money

Here are some useful tips that will help you get going with Moralis Money without breaking a sweat:

- To generate your first dynamic list of tokens, use one of the preset filters that await you on the Moralis Money homepage:

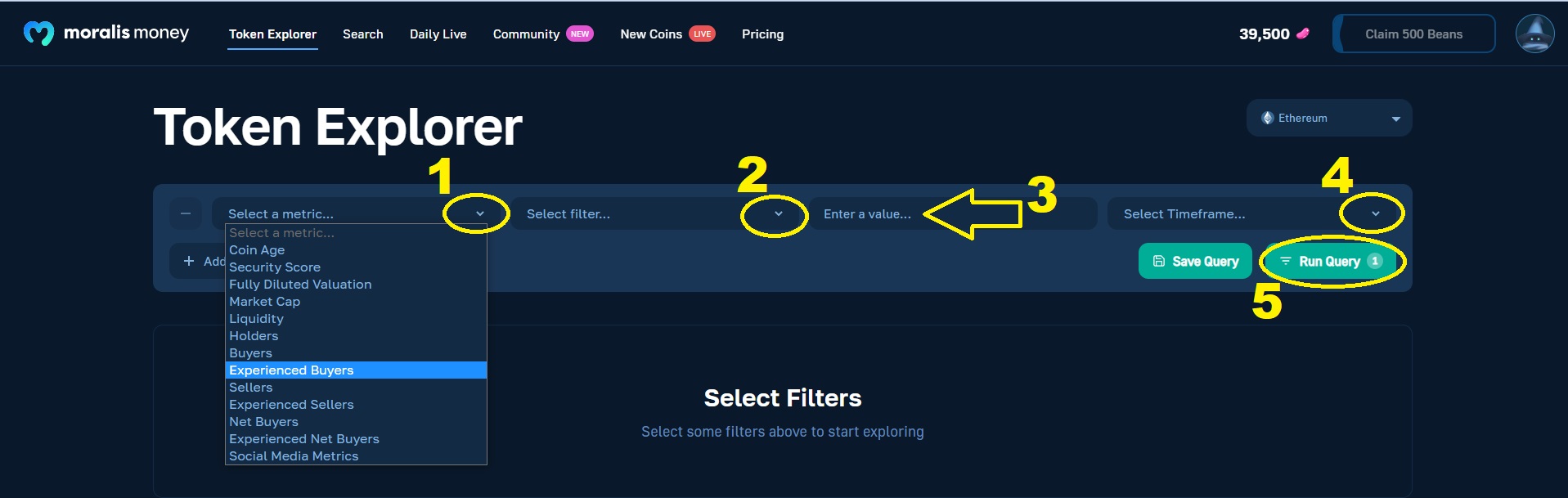

- Visit the Token Explorer page and get comfortable with the following five-step process:

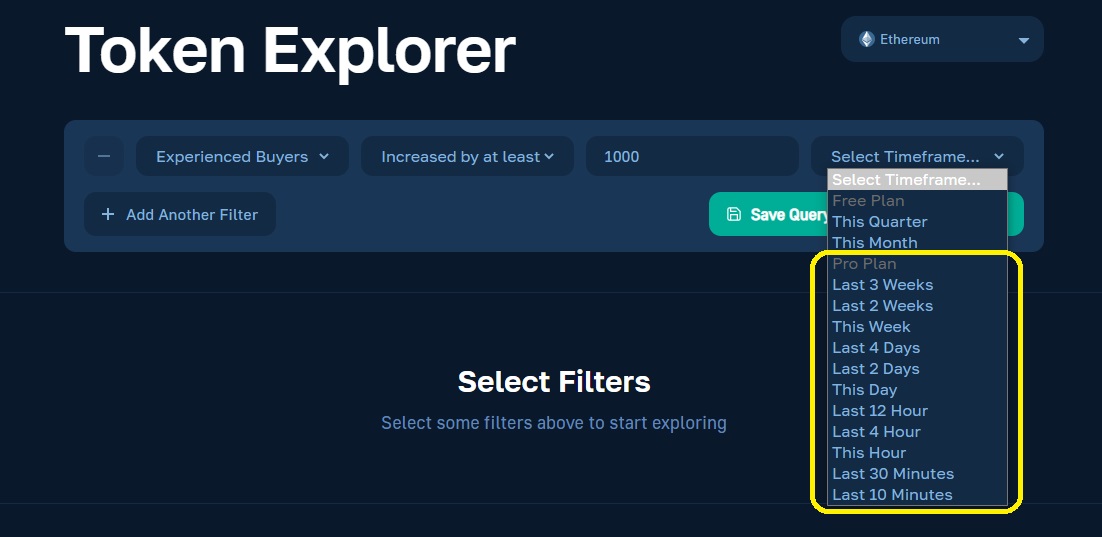

- Select a metric.

- Select the metric’s filter option.

- Enter a value for that metric.

- Select the timeframe.

- Hit “Run Query.”

- Make sure to apply multiple filters by using the “Add Another Filter” button:

- Apply the Coin Age filter to focus on newly minted altcoins.

- Use the Market Cap metric to target more seasoned altcoins.

- Apply metrics like Liquidity, Holders, Buyers, Experienced Buyers, and similar to spot altcoins that are gaining/losing on-chain momentum.

- Play around with different combinations of Token Explorer metrics, their values, and timeframes to spot unique altcoin opportunities.

- Make sure to keep an eye on Token Shield’s security scores and reduce your risk of being scammed:

- Save your winning queries and use Token Alerts to run them on autopilot:

- Switch to other popular chains and expand your method of analyzing cryptocurrency opportunities:

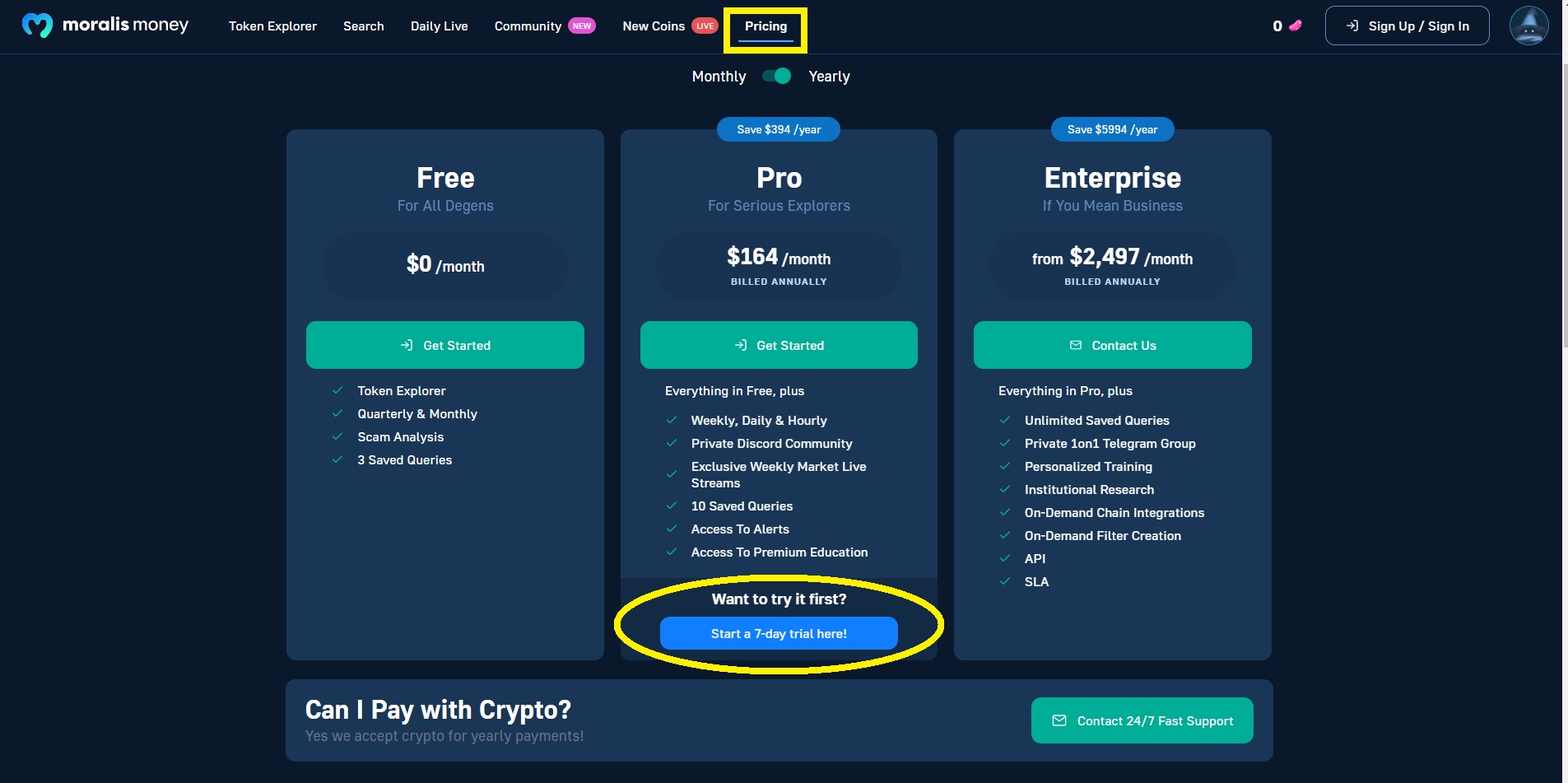

- Lock in the Moralis Money Pro plan to access the real-time, on-chain data on the best timeframes:

- You can even take the Pro plan for a seven-day test spin:

- Make the most of Moralis Money by utilizing all features and perks:

Crypto Data Analysis – How to Analyze Cryptocurrency – Summary

The sections above taught you how to analyze cryptocurrency opportunities with technical analysis, fundamental analysis, and on-chain data. By this point, you know that TA and FA aren’t always applicable. However, you can and should always time your trades based on real-time, on-chain data. Moreover, there’s no better tool to help you do that than Moralis Money, especially if you opt for the Pro plan.

All in all, thanks to this article, you’ll always consider at least some of the following seven steps when performing crypto data analysis:

- Find Cryptocurrencies with Moralis Money

- Visit the Crypto Project’s Official Website

- Explore the Project’s Socials

- See if You Can Legally Participate in the Project

- Take a Closer Look at Tokenomics

- Consider the Token’s Current Price and its Price History

- Use Real-Time, On-Chain Data to Time Your Entries