Moving forward, we’ll first explain what the Convex crypto project is to get you all up to speed. However, the main focus of today’s article will be the CVX coin. As such, we will do a full $CVX analysis. Of course, we will start with the basics – explaining what the CVX crypto asset is all about. However, we’ll also look at the coin’s tokenomics and use cases.

Now, since most of you are primarily interested in making profits by trading altcoins, we’ll devote a decent part of today’s article to analyzing the CVX token price. Using basic technical analysis (TA), we’ll examine the price levels the CVX coin has covered so far. And we’ll also offer some less and some more speculative CVX token price predictions.

All in all, the following sections will help you determine if the CVX crypto asset deserves your attention. Also, to decide if and when to buy $CVX, you’ll want to use Moralis Money.

What is the Convex Crypto Project?

You may not have heard of Convex before; however, odds are you’ve heard of Curve Finance. Well, the Convex crypto project is a DeFi protocol that allows Curve liquidity providers to use their LP tokens and staked CRV to earn additional CRV and CVX coins. Essentially, the above image explains the gist of this project. So, at its core, the project is a boosted Curve staking.

Convex Finance

As you can see in the images above, the official name of the project is Convex Finance. However, following the example of commonly used “Curve” instead of “Curve Finance,” you’ll often only see “Convex.”

This DeFi project created a protocol (smart contracts) to allow users with Curve LP tokens to put them to use. By depositing those tokens, users earn Curve trading fees and boosted CRV and CVX tokens. Furthermore, DeFi users also get to stake and earn additional CRV. By staking the CVX coin rewards back into the platform, users get to earn the Convex crypto platform fees.

For those of you interested in learning more about this protocol, make sure to dive into our past article. The latter will help you answer the question, “What is Convex Finance?”

However, it’s worth pointing out that Convex also offers opportunities for liquidity providers on Frax Finance.

Convex Crypto Roadmap

The CVX crypto project went live back in 2021. As such, it has already achieved its primary milestones and has a functioning protocol up and running. So, that said, the project doesn’t offer any roadmap for future development.

However, Convex has been adding some additional integrations (Frax), and it has been active via its social media accounts. So, if you want to be informed regarding the upcoming or ongoing development of this DeFi project, make sure to follow it on their social media accounts, such as X (formerly Twitter). You can also check out the Convex blog on Medium.

Full CVX Coin Analysis

At this point, you all know what Convex Finance is all about. As such, it’s time we dive into the protocol’s native cryptocurrency – the CVX crypto asset.

In the following sections, you’ll learn what the CVX coin is all about, what its tokenomics look like, and what the coin is used for. With these basics under our belts, we’ll dive into some CVX token price action. So, if you are interested in trading this altcoin, these are the sections you ought to focus on.

What is the CVX Coin?

The CVX coin is the native cryptocurrency of the Convex Finance protocol. At its core, the CVX crypto asset is an ERC-20 token. This means it lives on the Ethereum chains and follows the ERC-20 token standard that manages all fungible tokens on this leading programmable blockchain.

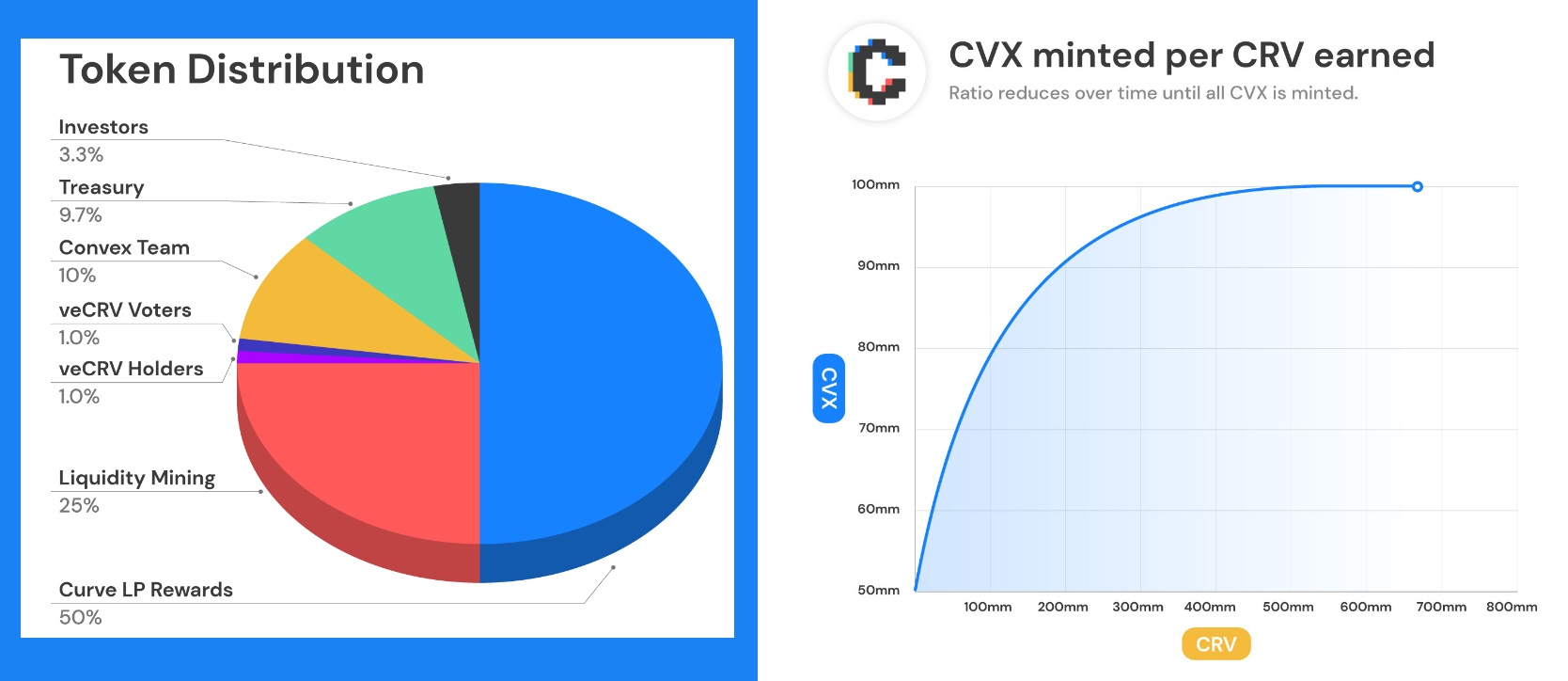

The token was launched on May 17, 2021. However, this crypto asset is mintable, meaning that new instances of $CVX are still coming to life. The protocol automatically mints CVX “pro-rata” for each CRV token that Curve LPs claim on Convex. Also, the CVX/CRV mint ratio reduces every 100k CVX as per the curve in the chart below.

Tokenomics

- Token name: Convex Token

- Symbol/ticker: CVX ($CVX)

- Network: Ethereum

- Token’s smart contract address: 0x4e3fbd56cd56c3e72c1403e103b45db9da5b9d2b

- Max supply: 100,000,000 $CVX

- Initial token distribution:

- 50% Curve LP rewards – rewarded minted pro-rata for CRV received on Convex

- 25% liquidity mining – distributed over four years (incentive programs, currently CVX/ETH and cvxCRV/CRV)

- 9.7% treasury – used for future incentives or other community-driven activities (vested over one year)

- 1% veCRV holders – instantly claimable airdrop

- 1% veCRV holders who vote to whitelist Convex – instantly claimable airdrop

- 3.3% investors (vested over one year) – 100% of investment funds used to pre-seed boost and locked forever (no cvxCRV minted)

- 10% Convex team (vested over one year)

The image below indicates the above-listed distribution in a pie chart. On the right-hand side of the image, we can see the curve indicating how CVX is being minted until the maximum supply of 100 million $CVX is reached:

This article wouldn’t be complete without us mentioning other tokenized assets that come to play via the CVX crypto project. So, these include cvxCRV (Tokenized veCRV), cvxFXS (Tokenized veFXS), cvxFPIS (Tokenized veFPIS), and veCRV rewards, also known as 3Crv.

CVX Token Use Cases

On the one hand, users of the CVX crypto protocol may stake $CVX. This enables them to receive a share of platform fees as cvxCRV and cvxFXS. On the other hand, CVX is also a governance token as it allows its holders to vote on various proposals. Convex Finance calls this “vote-locking CVX.” So, it’s not enough to just hold $CVX to get the voting right. Instead, users must vote-lock their CVX crypto tokens for 16 weeks or more to earn the right to participate.

With that said, there are also two ways to obtain Convex crypto tokens. One is to buy them on DEXs or CEXs, while the other is available to CRV and FXS stakers who decide to use this protocol.

Note: If you wish to dive deeper into the mechanics of using Convex for Curve Finance and Frax Finance, as well as its vote-locking, make sure to dive into the project’s documentation.

Convex (CVX) Crypto TA

The above chart indicates the full CVX token price action since it started trading in May 2021. The listing price of the asset was just below $5, but the value increased by 4x by June 4, 2021. After that local peak at $20-ish, the CVX token price pulled back by approximately 90%. The token found its bottom on July 20, 2021, at $1.8-ish.

After that low point, $CVX started trending upwards as Bitcoin and the entire crypto market went on another run. Of course, there were several retracements along the way, even as large as 50%, but the asset was in a clear uptrend until November 11, 2021. On that day, the CVX token price spiked to nearly $50.

However, the token ran out of steam and pulled back hard and fast to the $21-ish region, with candle wicks as low as $18.6. Though the CVX crypto found sufficient buy pressure to pull off another 3x rally. The latter ended at $60.1-ish on January 1, 2022.

Then, as the entire crypto market entered a bear season, the CVX token price reacted accordingly. There were some relief rallies on the way down. But eventually, the $CVX price returned to the $3-ish level by June 18, 2022. In the following month, the asset managed to climb up to $8-ish, where it turned around and returned to the aforementioned support at $3-ish.

The asset started to show some signs of strength in early January 2023, when it again managed to cross $6. Though, it again returned to its lowest region by mid-June. At the time of writing, the CVX crypto is also sitting in that region, just on top of the strong support.

CVX Coin Price Prediction

As you can imagine, the price of $CVX greatly depends on the success and stability of Curve Finance. If that protocol remains healthy, CVX has the potential to start another leg up from its current level. However, in case of any bad news regarding Curve, $CVX could easily drop to $2.3-ish.

In case the token manages to build up its momentum, the above-outlined levels (blue lines) are the most likely price targets. So, there are many levels to break through on the asset’s way to its ATH ($60-ish), which is nearly 20x above the current price.

Due to the decrease in CVX minting rate, two factors are at play. On the one hand, this means that the price per token can increase faster as there are not many new instances of CVX entering circulation. However, on the other hand, this also means lower APY and, therefore, decreased incentive for CVX to stake the asset.

Still, as a native currency of one of the popular DeFi projects, the CVX coin has the potential to set a new ATH in the upcoming bull run. And the most optimistic price target – the Fibonacci retracement tool’s “4.236” extension – points to $245.

However, that is a highly-unlikely target, but not impossible.

Should You Buy the Convex Crypto?

The above sections should help you determine whether or not the CVX crypto asset deserves your further attention.

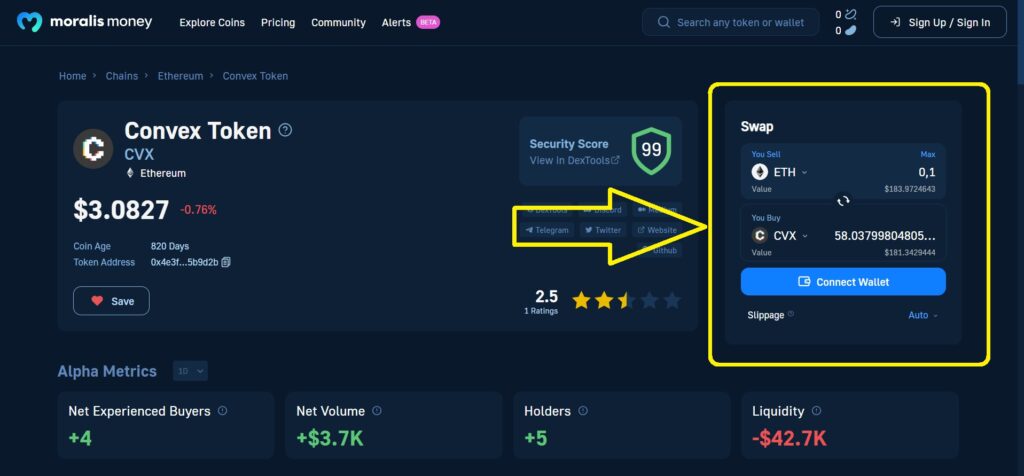

If yes, then you need to research the project and the token further to answer the above question with confidence. And there’s no better place to DYOR than the many Moralis Money token pages. As such, make sure to visit Moralis Money’s Convex ($CVX) token page.

There, you’ll find all the tools and resources to explore the ins and outs of the asset in question. Nonetheless, if you end up determining that you should get a bag of $CVX, that page will help you determine if the time is right for such an action.

This is where Moralis Money’s alpha metrics – real-time, on-chain data – enter the scene. They help you see whether the token is gaining or losing on-chain momentum. And, since on-chain activity precedes price action, you get to time your trade effectively!

So, follow the above link to the $CVX page or use the interactive widget below to DYOR.

On the other hand, you may already know that you do not want to buy the CVX crypto. In that case, you shouldn’t waste any more of your precious time on this token. After all, thousands of other altcoins are out there, with many new ones entering the crypto market daily.

If only there was a tool that would enable you to spot the best altcoin opportunities before it’s too late. Well, fortunately, there is!

Aside from the above-mentioned token pages, Moralis Money offers the Token Explorer feature, which is all about finding altcoins with potential. It enables you to scan the crypto market in a heartbeat!

So, whether you decide to buy $CVX or not, you should take that ultimate on-chain analysis tool for a spin today!

Where to Buy $CVX?

Most leading CEXs and DEXs offer $CVX. So, you have many options to buy that cryptocurrency. However, since you’ll already be on the above-presented Moralis Money’s page for that asset when researching, the best way to buy $CVX comes in the form of the platform’s instant crypto swap feature. The latter awaits you in the top-right section of the page:

Note: If you haven’t been swapping tokens yet, we recommend checking out our step-by-step guide on how to swap ERC20 tokens.

Convex (CVX) Crypto Analysis and CVX Coin Price Prediction – Key Takeaways

- Convex Finance, or simply Convex, is a DeFi project that has a special protocol that allows users to boost their stake in the CRV token or FXS coin.

- The project also has its native cryptocurrency – the CVX coin.

- Anyone can buy $CVX on DEXs and CEXs or earn it by using the Convex Finance protocol.

- The token holders can also use it to participate in the protocol governance issues.

- $CVX is currently sitting on top of the support near the bottom of the assets trading range.

- Curve.fi’s stability and success determine the success of $CVX.

- To find out if you should buy CVX or not, research it using Moralis Money.

- Explore other altcoin opportunities with Moralis Money’s core feature – Token Explorer. If you are serious about your altcoin trading, don’t forget to opt for a Starter or Pro plan.

As of early 2023, Moralis Money has been helping new and experienced altcoin traders pocket large profits. Thanks to this game-changing tool, folks have been able to find tokens before they pump. This includes all the best meme coins of the 2023 memecoin season (e.g., PEPE, BOBO, LADYS, etc.) as well as other tokens with more serious use cases (e.g., Rollbit, UNIBOT, etc.).

So, join these traders in the know and make the upcoming bull market count!