IOTA, which stands for Internet of Things Application, is a Distributed Ledger Technology (DLT) from the IOTA Foundation. Put exceedingly simply, IOTA is a cryptocurrency technology for facilitating transactions. As such, this is reminiscent of other cryptocurrencies, which have quickly made names for themselves over the past few years.

However, one of the main obstacles cryptocurrencies have to overcome is their scalability issue. As crypto becomes more popular, the networks that support them – basically the blockchains – need to become more resilient and support larger volumes. This is absolutely necessary in order to avoid rising fees and slowing transaction times.

There are already numerous solutions to boost the scalability of various blockchains. Some of the most well-known scalability solutions are technological solutions such as the Lightning Network or Sharding. IOTA is taking a different route to solve the scalability issue, however.

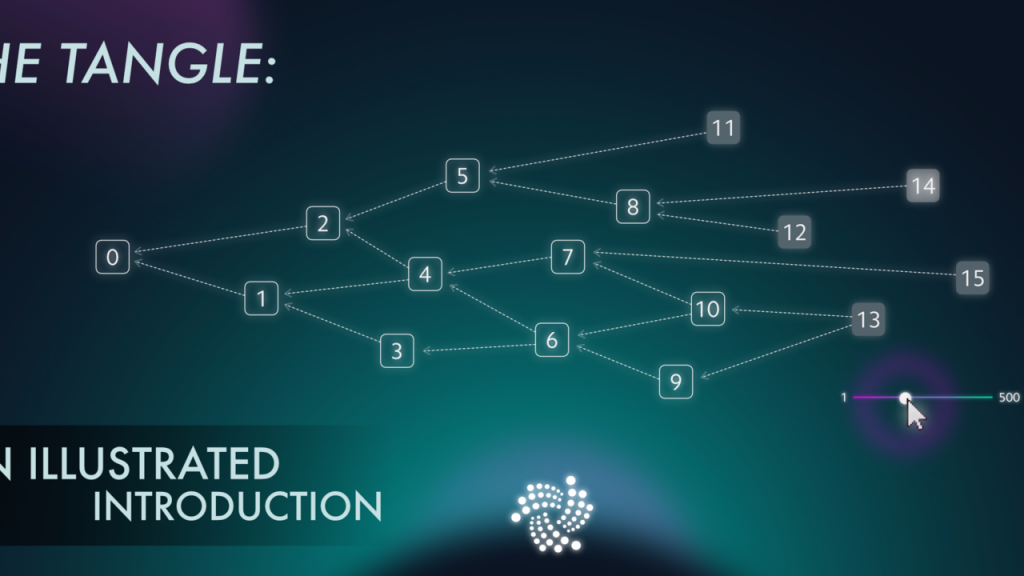

Instead of relying on a blockchain network, IOTA employs something known as the ”Tangle”. The Tangle is essentially a ground-up rebuild of what a blockchain is meant to be. In fact, the Tangle and a blockchain share many of the same traits, and are both made to form a record of transactions. However, unlike a blockchain, IOTA’s Tangle is not made up of blocks or a chain.

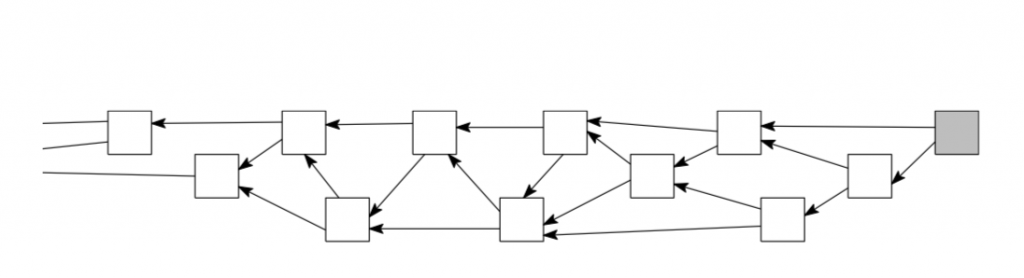

Instead, it consists of a ”tangle” which can be seen as a stream of transactions. The Tangle distributes the transactions, much like a blockchain, and stores them on a network run by the participants. As such, it is clear that the notion of the Tangle is very similar to the concept of a blockchain. The previous image, from IOTA’s description of the Tangle, illustrates the difference.

Tangle Definition

However, the Tangle definition that is given in IOTA’s Whitepaper is that the Tangle ”succeeds the blockchain as its next evolutionary step and offers features that are required to establish a machine-to-machine micropayment system”.

The novel structure of the Tangle is something known as a Directed Acyclic Graph (DAG). In layman’s terms, this denotes a data structure that spreads out in one direction without circling back onto itself.

Moreover, the Tangle’s DAG spreads from the ”genesis transaction”. This was the first-ever transaction on the Tangle network, and all other transactions approve this original transaction either directly or indirectly.

A ”normal” blockchain essentially requires two different types of users to function. These are both transaction issuers (everyday users performing transactions) and transaction verifiers (miners). As such, a blockchain essentially requires two different classes of users.

The IOTA Tangle solves this through effectively making the users and the miners one and the same. Using a DAG, instead of a blockchain, removes miners completely from the equation. Moreover, this means that the number of miners does not have to keep up with the number of everyday users.

In summary, one can conclude that the Tangle definition is not the same as a blockchain. Although it fulfills roughly the same function as a traditional blockchain, the Tangle is very different. For example, the IOTA Tangle removes the blocks, the chain, and the miners from the equation.

Otherwise, the Tangle works roughly analogous to a blockchain, with some minor tweaks. For example, a blockchain is able to confirm a transaction by several blocks approving the transaction. In the Tangle, however, this is instead done through something known as ”cumulative weight”. Cumulative weight is a concept we will now go into greater detail regarding.

Cumulative Weight

The web-like nature of the Tangle can be hard to fathom or comprehend. Although this stream of transactions may seem unorganized at first, it is actually the very opposite. The seemingly unorganized nature of it forms a complex network organism with direct and indirect verifications which is exceedingly intricate.

As such, the Tangle almost appears as a growing organism or cell. Specifically, growing makes the network stronger and allows it to become more resilient. This is mainly due to Tangle’s use of cumulative weight.

Put simply, this means that the system becomes harder to trick, hack or otherwise attack as it continues to grow. Whereas blockchains can become subject to 51% attacks or other malicious hacking attempts, the Tangle is built in another way.

With various nodes continuously confirming, or validating, each other, it becomes hard to find even a single weak spot to attack the tangle. Moreover, a potential attacker would not only have to equal the weight of a single verification to corrupt the system. Rather, it would need to compete with the cumulative weight of the transaction it targets.

With that said, however, cumulative weight can be understood as the sum of a transaction’s weight together with the weight of all other transactions directly or indirectly approving that transaction.

The ”weight” of a single transaction can be thought of as the effort put in by an issuer. As the Tangle keeps on growing, the cumulative weight of the Tangle itself keeps on increasing. Consequently, one could argue that the network becomes even safer as it keeps growing.

This notion of weight is central, as the IOTA Whitepaper points towards a ”large weight attack” as a potential means of attack against the Tangle, which would require a the attacker to issue a large, computational-intensive double-spend.

Tangle Scalability

One of the most persistent arguments for using IOTA’s angle, rather than a blockchain, relates to the issue of scalability.

It is worth keeping in mind that a blockchain has an inherent weakness when it comes to scalability. Those familiar with the cryptocurrency and blockchain landscape will know that discussions over how to solve scalability issues are commonplace.

Moreover, significant resources are already being spent on solving blockchain scalability. There are some promising solutions already in use or development, such as the Lightning Network and Sharding. Additionally, more are sure to follow in the coming years.

Nevertheless, the Tangle eliminates the need for resource-intensive or costly workarounds like these altogether. The interconnectedness of the Tangle is also one of the premier reasons it is so successful in large-scale situations.

Seeing as new Tangle verifications go on to approve, or verify, previous ones, the more users on the Tangle network the more securer it becomes. Furthermore, the mechanism through with the Tangle is continuously growing, whilst directly and indirectly approving transactions, also makes the network more stable.

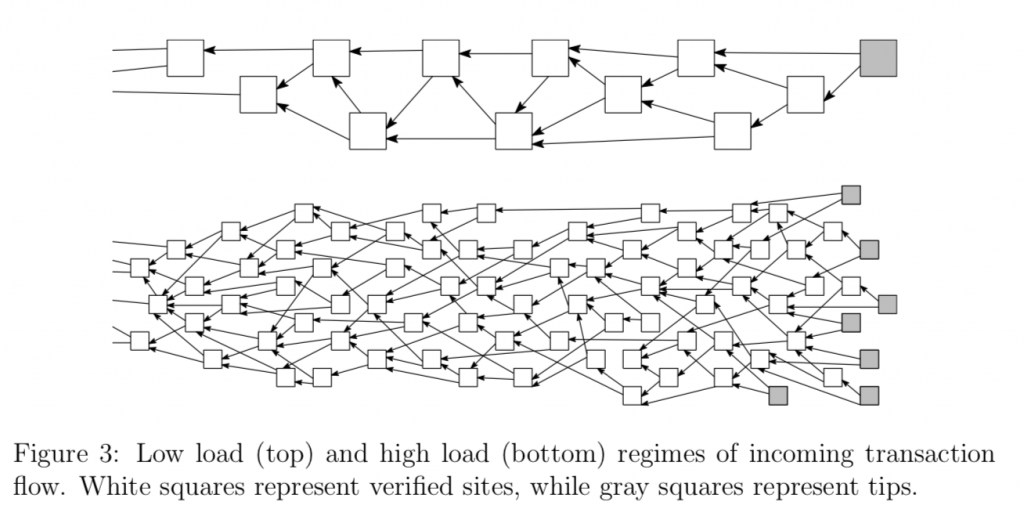

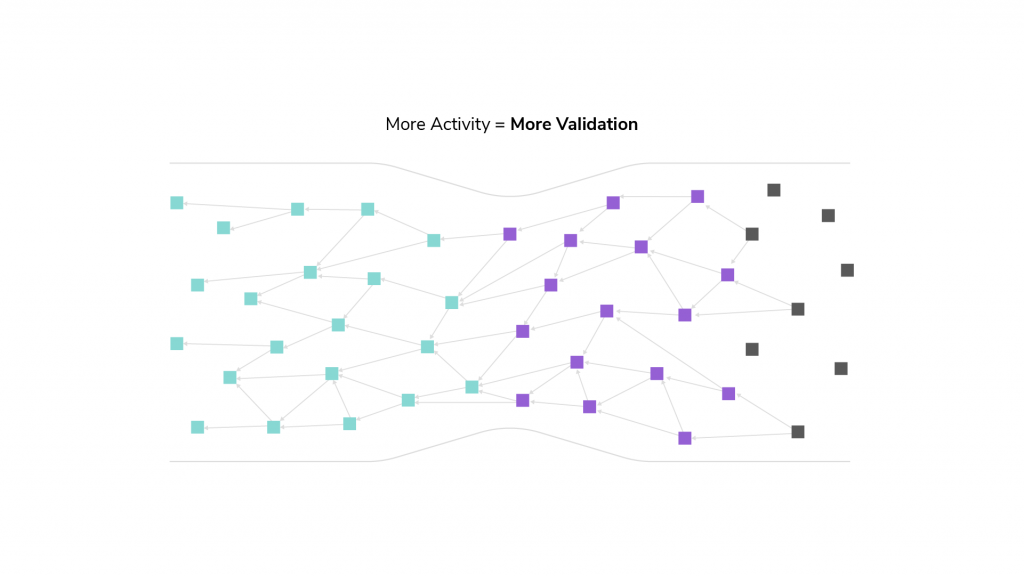

The previous picture once again demonstrates what the Tangle looks like. Seeing as it is able to ”spread out” at times of high load, the resilience of the Tangle becomes more evident. Although this could look chaotic to the untrained eye, there is order to the complexity.

It clearly shows how transaction verifications stretch back – ultimately towards the genesis transaction – effectively validating previous nodes and transactions. One can imagine that these verifications just make the network even safer.

Those transactions that still lack an an arrow, or approval, are known as ”tips”. These are still waiting for approval. However, this is just temporary – seeing as squares, or vertices, in the Tangle always approve two other transactions.

The Tangle vs Blockchain

As previously explained, the Tangle works through structuring its stream of transactions like a graph. In fact, IOTA’s stream of transactions becomes the very definition of a ”tangle” as the web of transactions continues to grow.

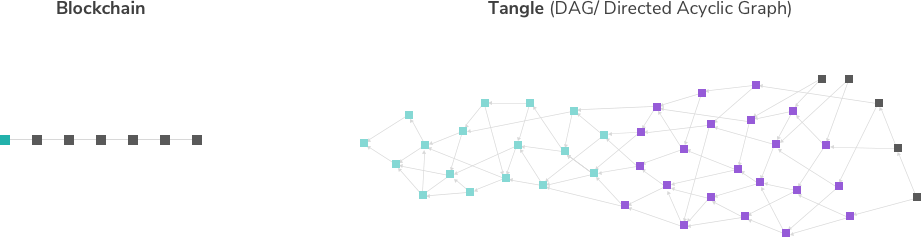

Moreover, the following picture shows how one transaction – seen as a square – approves two transactions. Doing so means that it adds two new edges, or ”arrows”, to the graph. This is a central concept to how the Tangle works.

Requiring actors to validating two transactions every time they want to make their own transaction has a profound impact. Specifically, it means that the Tangle uses a ”pay-it-forward” system of validations.

As such, there is no real need for any financial rewards for validating transactions. Consequently, IOTA promises that transactions will always remain ”fee-free” when using the Tangle.

The perhaps most important aspect of the Tangle is how ready the network is for high scalability. Seeing as the number of transactions simply increases the validations in the network, high volumes are not a problem for the Tangle.

Rather, the novel structure of the Tangle actually encourages high volumes of transactions. The more activity and transactions that take place in the network, the faster transactions can be confirmed. As such, there is no risk of the Tangle becoming overly crowded and sluggish.

Transaction settlement times will only decrease as network activity increases. Additionally, the Tangle has notably low resource requirements – meaning there are fewer environmental concerns than with energy-intensive networks.

Put together, this showcases that there are numerous interesting facets to compare when looking at the Tangle and various blockchains. Clearly, there are distinct advantages and disadvantages to both techniques.

Blockchain vs Tangle – Pros of Tangle

There are definitive advantages and disadvantages to both the Tangle and a blockchain. What you will prefer to use ultimate boils down to your preferences, and what you are looking to accomplish. Nevertheless, let us break down the blockchain vs Tangle dilemma for you to solve it once and for all. First off all, lets take a look at some of the benefits of using Tangle:

1. Scalability

One of the most persistent issues with blockchains is the scalability issue. Traditional blockchains have severe bottlenecks, and it can take a long time to achieve consensus by creating new blocks. Although new solutions are allow blockchains such as those underpinning Bitcoin and Ethereum to handle more transactions per second, Tangle is already capable of handling several hundreds of transactions per second. Moreover, the Tangle is essentially able to scale infinitely large.

2. Low Transaction Fees

Tangle does not have any miners or transaction fees. This means users can send extremely small amount, or extremely large amounts, without ever having to pay transaction fees. As such, there is no ”gas” cost or need to ”tip” miners in order to conduct a transaction faster. This means that the IOTA Tangle can handle minuscule transactions without requiring anything in return – except for new transactions to verify two existing transactions.

3. Data Marketplace

IOTA claims that users will be able to control and sell their data, through giving users to ability to subscribe to someone’s data for small amounts of money. Seeing as many suggest we’ve entered an age where ”data is king”, this could be a powerful idea.

Blockchain vs Tangle – Cons of Tangle

With that said, however, the Tangle is not without its own distinct drawbacks. Blockchain technology has been all the rage for the past couple of years – with good reasons. As such, it is important to also look at some of the disadvantages of the Tangle in comparison with blockchain.

1. Smart Contracts

This might come as somewhat of a surprise, but smart contracts haven’t exist for Tangle more than a few months. Moreover, they are still extremely experimental, even though IOTA Smart Contracts are now becoming a thing. This is an especially noticeable problem for developers, who wish to leverage smart contracts and build dApps. One should note, however, that this is likely just a temporary technical hurdle – but still one worthy of mention.

2. Vulnerability

First and foremost, one should note that there is no documented successful attack against the Tangle. Moreover, the IOTA Foundation argues that the Tangle is safe even against the ”next generation of attackers”. With that said, however, some observers note that the Tangle could technically require 34% of the total hashing power to successfully attack the Tangle. The corresponding percentage for Ethereum or Bitcoin would be 51%.

The Directed Acyclic Graph (DAG)

The very heart of the Tangle’s success is the Directed Acyclic Graph, commonly known as the DAG. This can perhaps most easily be understood as an alternative to the blockchain. Instead of structuring the verifications in the network as a straight chain of blocks, they resemble a graph.

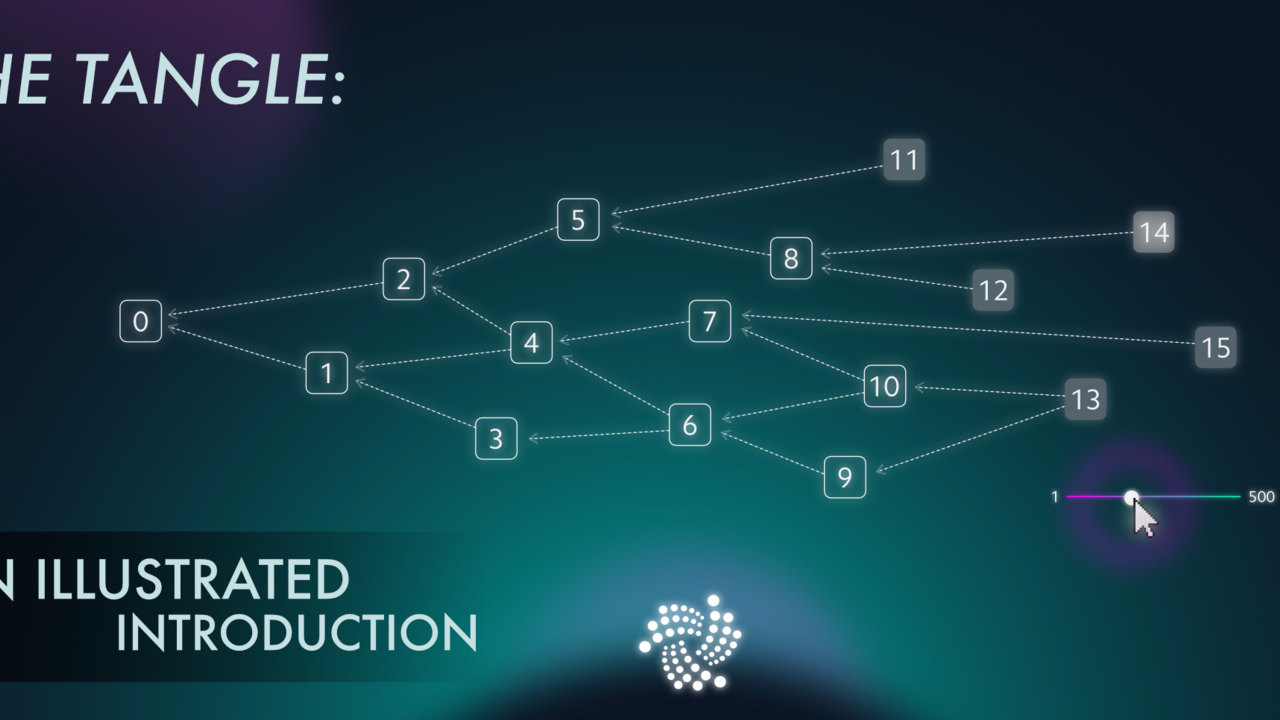

Seeing as the DAG is ”acyclic”, it can only move in one direction. Consider the following visual representation of the DAG. The boxes represent transaction verification nodes on the Tangle network. Here, these nodes are both miners and users, unlike in a traditional blockchain.

Moreover, time passes as the chart progresses towards the right. As such, the boxes – or nodes – furthest to the left are generally speaking the oldest. The DAG is reminiscent of a web, and consists of interconnected nodes that verify each other.

Furthermore, the ”acyclic” nature of the DAG means that progressing from one node to another, it is impossible to encounter the same node twice. Consequently, the graph is a non-linear flow, which does not loop back onto itself.

Looking at the DAG, or Tangle vs blockchain, it seems clear that both hold vast potential. However, the system most suitable for you will depend on your preferences. Until you make up your mind, be sure to keep an eye on the Tangle!