Stellar Lumens are seldom in the spotlight within the crypto space. Despite groundbreaking partnerships and integrations, the XLM token is not spoken about as often as some flavor-of-the-month cryptocurrencies. However, the Stellar Development Foundation (SDF) has been around since 2014, which means they must be doing something right, right? The Stellar Foundation is creating an ecosystem that empowers people with financial services that have been absent in many parts of the world for a long time.

In this article, we’re going to explore Stellar Lumens (XLM) and the Stellar Development Foundation (SDF). Furthermore, we’ll discuss the role of the XLM token within the Stellar ecosystem and how it benefits users worldwide!

For anyone new to the crypto space, the Blockchain and Bitcoin 101 course at Ivan on Tech Academy is the perfect place to learn about the fundamentals of blockchain technology on a technical level. Also, if you want to learn how to safely buy, sell, and store your crypto, the Crypto Basics course at Ivan on Tech Academy provides all the information you need to start your crypto journey!

Background

Stellar was founded by Jed McCaleb, who is also the co-founder of Mt. Gox and Ripple Labs. Following the highly-publicized Mt. Gox hack back in 2011, the Mt. Gox exchange eventually went under. Following that, the board of Ripple Labs suggested that McCaleb should depart the project, as damage-limitation from association with the Mt. Gox bad press.

Shortly thereafter, McCaleb founded Stellar, originally rumored to be a fork of Ripple. McCaleb cleared up these rumors confirming Stellar operates on a not-for-profit business model. Moreover, Stellar is focused on targeting individuals for improving everyday online banking services. Ripple, on the other hand, is primarily focused on banking institutions and corporations. Founded with a $3 million investment from Stripe, Stellar has since partnered with the likes of IBM, Deloitte, and Samsung.

What is Stellar?

The Stellar Development Foundation (SDF) is based in San Francisco and New York City, employing a multi-national team of sector-wide experts. Launched in 2014, Stellar is a decentralized open network built for the movement and storage of money. Designed with developers in mind. Stellar provides all of the tools and support needed to get a project up and running in no-time. Also, Stellar facilitates the creating, sending, and trading of digital representations of money of all kinds. Dollars, Bitcoin, pesos, Ethereum, the list goes on.

The Stellar network is designed to combine all of the world’s financial systems into a single, borderless, interoperable network. Furthermore, Stellar's application programming interface (API) and software development kits (SDKs) allow businesses large and small to gain autonomy over their money, without a high technical barrier for entry. However, from the user-end, Stellar creates a familiar experience similar to many popular payment apps.

Using just a few simple lines of code, Stellar makes it possible to build global payment applications, asset exchanges, and micropayment services. Moreover, Stellar network fees are very low compared to other blockchains. Also, transaction times are super-fast, which benefits both developer and app users.

As Stellar is decentralized, there is no single-point-of-failure and the network is effectively publicly owned. Also, the way the Stellar network operates is cheaper and more energy-efficient to run than many blockchain systems (discussed later).

Stellar Development Foundation

Established in 2014, the Stellar Development Foundation (SDF) non-profit organization was created to provide equitable access to traditional financial systems and help support the development and growth of the Stellar network.

The Stellar Development Foundation (SDF) promotes financial freedom by empowering people with censorship-resistant, borderless, and stable financial services. This could seriously benefit the unbanked and help fight global poverty by acting as a hedge against economic instability, regardless of geography, religion, race, status, gender, or politics.

Also, the SDF communicates with institutions and regulators, while supporting the business communities of the Stellar network. Furthermore, The SDF helps to maintain the Stellar codebase, assisting with many of the technical aspects of the project.

Blockchain is helping businesses around the world. From multinational corporations to rural farmers, blockchain is changing the way we transact on a global scale. The Fintech 101 and Blockchain Business Masterclass courses at Ivan on Tech Academy are designed specifically to teach you how to implement blockchain into your current business model and the benefits of using the technology in the future.

Stellar Lumens - XLM Token

The Stellar network was designed to accommodate digital representations of practically any global currency. However, the native Lumens token (XLM) can be thought of like the proverbial oil that keeps the Stellar network moving smoothly. Users are required to hold a small amount of XLM to use Stellar’s services.

Stellar Lumens are both a medium of exchange and a tradable asset. More importantly, however, is the role these tokens play in the Stellar ecosystem. Fundamentally though, the Stellar Lumens is intended for denominating network requirements and transaction fees.

Stellar Lumens are available to buy on most popular centralized exchanges such as Coinbase or Binance, plus directly from Stellar. The XLM token is currently ranked as the 12th largest cryptocurrency by market cap according to CoinGecko. At the time of writing, the XLM token is trading at approximately $0.39 following a two-week bull rally, with a market cap of around $8.9 billion.

Why Does Stellar Need the XLM Token?

So, why does Stellar need the XLM token? A completely free-to-use blockchain system would be ineffective for most serious operations. To prevent the Stellar blockchain form from being congested with spam, a small cost for use was built into the design of the Stellar ledger system. This enables Stellar to remain a fast, efficient payments service while adding utility to the XLM token.

A minimum balance of Stellar Lumens is required by every account holder to prevent bad actors on the network. Transaction fees are a fraction of what users might expect to pay in Ethereum gas fees. However, these fees are large enough to prevent large-scale attacks on the Stellar network.

Furthermore, the Stellar Lumens removes any preference toward any one national currency, promoting global financial freedom and equality. Rather than using a ‘safe’ currency that would favor a particular national currency, the use of the Stellar Lumens serves as a haven for citizens of struggling economies, impartial to political and economic biases.

Stellar Lumens Supply

Stellar operates by using a unique consensus mechanism known as the Stellar Consensus Protocol (SCP). Unlike most blockchains, the Stellar protocol does not mine tokens periodically (more explained further on).

Rather, when the Stellar network launched in 2014, 100 billion Lumens were minted. As dictated by the Stellar protocol, the supply of Lumens increased by 1% per year for approximately five years after launch.

After a community vote in October 2019, this inflation mechanism came to an end. The following month, the Stellar Lumens supply was reduced to 50 billion. Currently, the circulating supply of the XLM token is approximately half this at 22.3 billion.

Also, the remaining approximate 30 billion Lumens have been allocated to the Stellar Development Foundation (SDF) for research, development, and marketing.

How Does Stellar Work?

Blockchain technology was first popularized by Bitcoin in 2009. Bitcoin uses the consensus algorithm known as Proof-of-Work (PoS). Consensus mechanisms allow every node in the blockchain to reach an agreement that a transaction is valid and can be stored on the blockchain.

However, as with all new technologies, there is room for improvement. In the case of Proof-of-Work mechanisms, a significant upfront investment in hardware and running costs is required before seeing a return. Except for early adopters, PoS limits participants to high-net-worth individuals who can afford such substantial investments, plus the consistent running costs. One of the problems with PoS is the potential of a 51% attack. Often, the more money a miner has, the more hash power over the network they can achieve. This could potentially leave the network vulnerable to a 51% attack.

Since then, we have seen innovations of new consensus algorithms that aim to combat the high entry barrier and the risk of hash power becoming monopolized. Proof-of-Stake has become a popular alternative as it does not require the initial investment in firmware and hardware. Rather, Proof-of-Stake algorithms operate by nodes staking a certain amount of native tokens to secure the network and validate transactions. That being said, the number of tokens and the token value can also be a high entry-barrier for some. For example, validators are required to stake a minimum of 32 ETH to operate on the Ethereum 2.0 Network. At the time of writing, this would equate to approximately $55,500.

Stellar Consensus Protocol

Stellar recognizes the shortfalls with current consensus algorithms and has, therefore, decided to create its own mechanism, known as the Stellar Consensus Protocol (SCP). The SCP is a construction of another innovative consensus mechanism, the Federated Byzantine Agreement (FBA). Unlike Proof-of-Work and Proof-of-Stake, however, the SCP requires far fewer upfront costs and aims to open up opportunities to new financial systems.

Stellar uses a novel consensus algorithm for fast and efficient transaction speed and cost. The Stellar Consensus Protocol has created a way for all nodes to reach a consensus on the validity of transactions, without the use of any closed-systems when recording the financial transactions. You can read an in-depth report describing the underlying technicalities of consensus algorithm comparisons by David Mazieres from Stellar Development Foundation (SDF).

Anchors

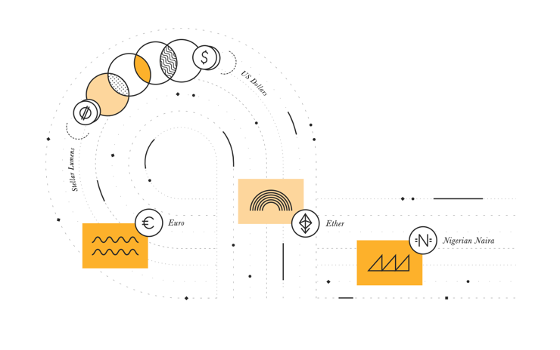

Another key feature of the Stellar ecosystem is the anchors that facilitate a ‘bridging’ service between traditional financial infrastructures and the Stellar network. One of the issues with the current financial model is how fragmented it is.

Stellar hopes to use anchors to interoperate with global payment systems and services such as SWIFT and SEPA, and connect these as one global decentralized network. The ability to cryptographically tokenize any type of native currency means that the Stellar blockchain can offer a transparent and secure, efficient alternative to traditional cross-border ledger services. Anchors can be regulated financial services or institutions, money service businesses, or Fintech companies. However, anchors must meet a minimum of one of the following criteria:

Issue 1:1 fiat-backed tokens, or stablecoins and hold sufficient funds to back the issued tokens should a user wish to redeem their tokens at any time.

Connect the Stellar network to the anchors’ national banking system providing a fiat on-ramp/off-ramp for users.

Why Use Stellar?

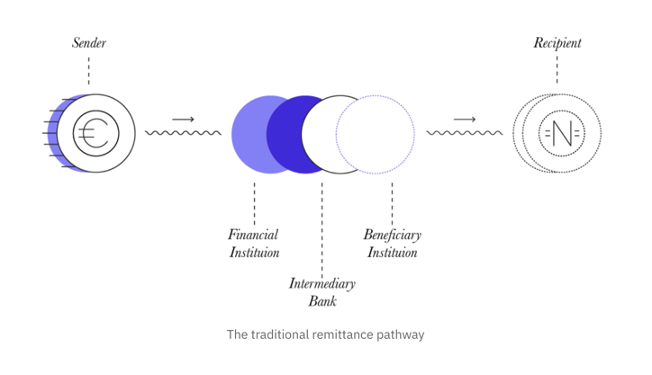

One of the primary use cases for Stellar is the issuance of assets, and the tokenizing of any money. Stellar makes it easy to transfer money around the globe, removing unwanted intermediaries and delays experienced with the legacy system. When making international payments or purchases, US dollars don’t actually leave the bank. Balances are adjusted as debt, then remittances are fulfilled at a later date.

Tokens on the Stellar blockchain, however, are decentralized and actually move from one wallet to another. Also, transactions are settled in seconds, not days, with minimal fees compared to a traditional broker or remittance service. For those living in countries with struggling economies, being able to store your wealth in stablecoins can be priceless. For people working abroad sending money home to their families, Stellar can save time and costs associated with a family receiving payment.

Furthermore, users can make use of the Stellar decentralized exchange (DEX). The Stellar DEX allows users to swap any token on the network for another. This includes stablecoins, tokenized coins, XLM tokens, Bitcoin, and more. All transactions and balances are stored on the Stellar blockchain rather than an exchange. Moreover, transactions are completed without an intermediary or custodian and users have full access to their private keys.

An additional advantage of using Stellar is the ‘path payment’ option. This means that users can send one type of token, and the recipient can receive the same value amount in a different type of token. For example, Alice wants to send $100 of digital US token dollars to Bob. Bob, however, can choose to receive the $100 in Bitcoin instead. The Stellar blockchain creates opportunities for sending and exchanging money in a single transaction, known as an atomic transaction.

Stellar Summary

Stellar has remained a strong cryptocurrency project over the years. The Stellar Lumens token performed extremely well during the previous bull run of 2017-2018, survived the bear market, and has since emerged with exciting announcements and partnerships. Stellar aims to create a single decentralized global payment network that is compatible with all national currencies. Using Stellar, you can send one currency to a recipient and have them receive a different currency with no hassle. Additionally, this process occurs without a third party taking a cut.

The technology of the Stellar Development Foundation (SDF) even caught the eye of the Ukraine Ministry of Digital Transformation last year. In December 2020, Stellar Development Foundation and the Ukraine Ministry of Digital Transformation signed a Memorandum of Understanding and Cooperation. The SDF will assist in implementing a local CBDC (Central Bank Digital Currency) and raising the nation’s reputation for financial and technological development in Eastern Europe. Development plans for this partnership began in January this year.

Stellar has fluctuated throughout the ranks over the years. However, the XLM token now firmly sits in the top 15 coins by market capitalization. Earlier this year, we saw Stellar briefly enter the top 10 list! Stellar is a great choice for the adoption of financial institutions for its ease and efficiency of cross-border transactions.

Perhaps we may see Stellar enter the top 10 list again? Let us know what you think by reaching out to us on Twitter @Academy_IOT!

Ivan on Tech Academy is the ultimate blockchain educational suite. To learn how to make your own decentralized applications, check out the Ethereum Smart Contract Programming 101 course! Also, if you want to take your blockchain game to the next level, why not learn programming from scratch with the Javascript Programming for Blockchain Developers course, only available at Ivan on Tech Academy.