A warm welcome to any and all crypto newcomers! We understand that many of you are probably at the point of wanting to get your hands on some Bitcoin at this exciting time. Still, perhaps you’re not exactly sure how cryptocurrency exchanges work – and would like to know a little bit more before converting your beloved fiat currency into invisible magical coins.

In this article, we’ll explain the uses and applications of different centralized and decentralized exchanges and take a look at what actually happens on the blockchain when you make a transaction. By the end of this article, you should have the confidence and the knowledge to venture out into the wild, wild land of crypto.

Different Types of Cryptocurrency Exchanges

The first thing to note is that there are several different types of exchanges that operate alongside one another, shifting toward a new financial paradigm of digital finance on the blockchain bringing together fiat currency and cryptocurrencies. Some exchanges aim to make it as easy and safe as possible for anyone beginning their crypto journey, while others can be a little trickier to grasp at first.

The different exchange models all carry out the basic underlying function of converting one cryptocurrency to another. However, they often vary in their offerings and features. Some exchanges offer a modest selection of coins while others boast hundreds. Some require just a few clicks to make a transaction, while others require a copy of your ID and an email address.

The combination of different exchanges ensures that any demographic can be allowed to be involved in cryptocurrency with minimal effort and stress, from a teenager fresh out of college looking for their first piece of Bitcoin – to a seasoned stock market trader venturing across into crypto.

If the exchange allows you to use your fiat currency (USD, EUR, GBP, AUD, etc.) to purchase Bitcoin or any other crypto, this is often referred to as a “fiat on-ramp” exchange, or known as offering a “fiat gateway”.

Likewise, if an exchange offers you the chance to convert your cryptocurrency back to fiat currency, this is called an “off-ramp” option.

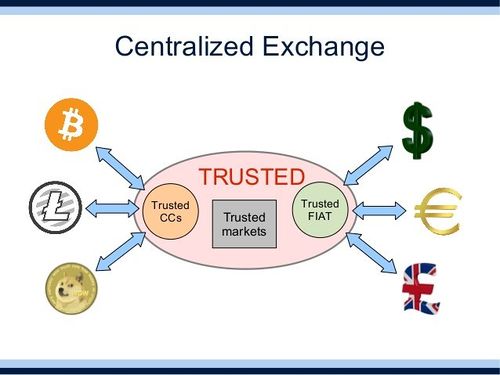

Centralized Exchanges

These tend to be the more well-known, beginner-friendly crypto exchanges, available on web browsers and mobile apps.

Centralized exchanges generally cater for people who would prefer to have the peace of mind and assistance of a support team, should anything go wrong. Centralized exchanges often have a dedicated support team across different social platforms, with many offering 24/7 support through an online chat portal.

The main selling point of centralized exchanges for beginners and first-time crypto investors is the custodial responsibility of the exchange to hold your private keys. Centralized exchanges have a large team working behind the scenes and have spent millions on cybersecurity to keep their customers’ sensitive data private and secure.

Some people prefer this option rather than having the responsibility of looking after their private keys or recovery phrases. If you accidentally input an address incorrectly when making a decentralized exchange transaction or forget your seed phrase, your money is essentially gone. This can be largely circumvented by the use of centralized exchanges such as Coinbase, Binance, or Kraken.

Such responsibility fills a lot of newcomers with fear; therefore, many people feel more comfortable by trusting a large, reputable organization with the custody of their funds in a centralized wallet.

Risk

However, this does come with the risk that, should the exchange be hacked or become insolvent, your funds could be lost too – technically, you do not have full ownership of your coins when they are held with a centralized exchange. In the same way that if you had gold stored in another person’s vault, you have to trust the exchange to hold your keys and your coins securely.

Despite the security features offered by big-name custodians, there are inherent risks associated with using centralized exchanges. 2019 was a terrible year for hacking scandals on centralized exchanges. At the beginning of the year, New Zealand’s major crypto exchange Cryptopia was hacked and lost over $3.5 million in ETH and their native token CENNZ.

Cryptopia never revealed any technical details about the attack, and though they attempted to restore trading thereafter, the exchange never recovered and is now insolvent.

On the other hand though, when one of the world’s largest crypto exchanges Binance was hacked in May of the same year and fell victim to $40million of crypto being stolen from customers wallets, the crypto giant was able to fall back on the Secure Asset Fund for Users (SAFU) established in July 2018, whereby the company reinvested their profits into a secure fund as contingency, should they fall victim to a hacking attack.

Each customer that was affected had their funds swiftly restored by Binance’s SAFU fund, with Binance only taking a small knock to their reputation. Today, Binance is regarded as one of the most successful and trusted centralized exchanges on the market.

Are Cryptocurrency Exchanges Regulated?

Coinfirm, a regulatory-technology firm working with digital currencies, carried out a survey on exchange licensing and published their results earlier this year, stating that regulators license only 14% of roughly 216 global cryptocurrency exchanges.

Blockchain and cryptocurrency is a relatively new, open-source, and universal technology, with businesses and regulators promptly working together to educate and inform each other about the practicalities of cryptocurrency and the way blockchain technology will shape the future of global financial infrastructure.

Centralized exchanges can hold various licenses and participate in regulatory procedures, however, there are two basic security principals each of these exchanges follow (most of the time):

Centralized exchanges have KYC (Know Your Customer) regulations, which means completing a short identification process to confirm your ID when you sign up to have full access to the exchange options.

AML (anti-money laundering) laws require an exchange to analyze each transaction to ensure they are not related to money laundering, sanctions, or fraud.

The Coinbase website displays a list of licenses held in these US jurisdictions.

Last December, Binance CEO CZ published an article about privacy and regulations for crypto exchanges, explaining that, “Some countries issue a clear ‘crypto exchange license’. Others require the exchanges to ‘register’ with a specific agency in the country, while a few just ask the exchanges to get traditional financial services licenses. Again, each country is a little bit different.”

Cryptocurrencies To Be Treated As Any Other Digital Asset

Many of the laws that govern cryptocurrency were passed long before the invention of digital assets. The legal status of cryptocurrency remains vague and uncertain in several jurisdictions, with some countries embracing the technology while others question its validity.

An excellent report published by loc.gov notes the different approaches taken towards cryptocurrency by over a hundred countries. There is a stark contrast between regions advancing the adoption of cryptocurrency, while others actively prohibit its use.

In recent weeks, the Office of the Comptroller of the Currency (OCC) published a letter to all large chartered banks in the US advising new policies that would allow banks to offer custodial services to their customers’ cryptocurrency holdings.

This is a massive driving force for crypto adoption, with the OCC publicly acknowledging that cryptocurrencies are to be treated like any other digital asset. (They also confirmed, “Fiat money refers to instruments that do not have intrinsic value but that individuals and institutions are willing to use for purposes of purchase and investment because a government issues them.” – but that’s a post for another day.)

List of Centralized Exchanges:

- Coinbase (Largest Bitcoin exchange by number of users)

- Binance (Largest Bitcoin exchange in terms of trading volume)

- Gemini (Voted 2019 Markets Choice Awards “Best Crypto Exchange”)

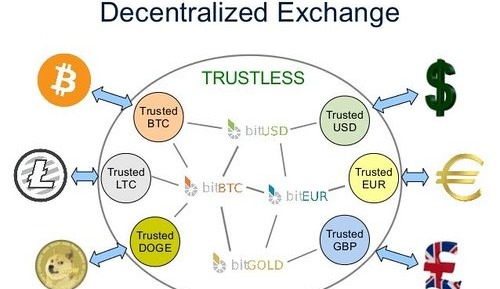

Decentralized Exchanges

Blockchain technology was created for decentralization. Following the Ethereum Network launch in 2015, the technology has enabled developers to build decentralized applications on the blockchain, known as Dapps.

Decentralized exchanges are platforms or applications built on the blockchain (Dapps), which allow users to purchase and exchange their cryptocurrencies, known as DEXs for short.

Most decentralized exchanges offer a wider variety of coins than their centralized counterparts. DEXs also provide access to liquidity pools through smart contracts at the click of a mouse, but these naturally come with more risk.

DEXs don’t often use KYC regulations, which creates a much faster, smoother experience. This is a common concern for crypto-newbies as they prefer the feeling of security and accountability. Due to the direct peer-to-peer transactions between crypto addresses, there is little need for most DEXs to implement it.

Centralized exchanges make transactions through a controlled centralized server. Decentralized exchanges allow people to make direct transactions on the blockchain by using smart contracts.

This may seem intimidating to some; however, the process is often masked by a sleek user interface and simple, self-explanatory options for trading your crypto.

Due to the decentralized nature of the technology, DEXs are generally not financially regulated. There is no phone number, no email, and no customer service. You are your own bank.

To make transactions on a decentralized exchange, you will need to connect your wallet, either through an online browser wallet, i.e., Metamask, or by using your offline hard wallet, i.e., Ledger or Trezor. On centralized exchanges, your wallet is stored against your profile within a centralized server.

Using a decentralized exchange means that you have possession of your own private keys, and are responsible for your own cryptocurrency security, both online and offline. You hold complete total ownership of your coins.

How Different Cryptocurrency Exchanges Work:

Different types of decentralized exchanges cater to different types of use-case applications.

Often with centralized exchanges, you are restricted to specific ‘trading pairs’. This means that you must hold either ETH, BTC or a stablecoin such as USDT to trade with other coins. For example, if you were holding $VET (VeChain) and you wanted to swap it for $LINK (Chainlink) on Binance, you would need to exchange your $VET to another coin first before converting it to $LINK.

Instant exchanges do all of this for you behind the scenes. When using an instant exchange, you are often not restricted to certain trading pairs and are free to swap any token available on that platform (e.g. $VET to $LINK)

A decentralized aggregator offers the best exchange rates for your cryptocurrency and does the hard work in the background. Aggregators are the future comparison sites, providing a seamless user experience while finding the best deal for your exchange.

List of Decentralized Exchanges

- UniSwap (One of fastest-growing DEXs)

- 1inchExchange (Aggregator)

- Kyber (Offers a fiat gateway)

What Happens On The Blockchain:

Have you ever wondered how cryptocurrency exchanges work on a technical level? In this section, we’ll go over the basics of how a wallet constructs transactions, sends them to the blockchain, and adjusts balances accordingly.

Firstly, it’s critical to understand that you do not own any coins. You own small pieces of code called UTXOs. UTXO stands for Unspent Transaction Output.

For every transaction, there is an input and an output.

This is the place where the money is being sent from and where the money is going to.

When someone is on the receiving end of a transaction, they receive the output, which they can then spend in another transaction later down the line should they wish to.

If that person decides to hold, or “HODL”, their coins, that transaction output is unspent. If that person wishes to exchange their coins, that output is spent, as it becomes an input for a new transaction.

Cryptocurrency “coins” are a collection of unspent transaction outputs that are stored on the blockchain – a decentralized distributed ledger.

In the first instance of making your transaction, you sign (confirm) the transaction with your private key as a digital signature. Your wallet will then ask the blockchain which UTXOs this private key can spend, and the amount that can be transacted.

The blockchain then confirms the amount of available UTXOs in the wallet before sending the transaction to the nodes in the network to verify the transaction makes sense.

Nodes are computers or other digital devices that hold the information of the blockchain network. These nodes mathematically verify the transaction by reaching consensus about the validity of the transaction, avoiding any double-spending, and ensuring that people can only spend what they have.

Once the nodes prove that the transaction request is valid, the transaction is then sent to a mempool, a space for all unconfirmed transactions waiting to be picked by the miners to be appended into a block, and sent to the blockchain.

Transactions are unconfirmed until they are appended by miners. Once appended, they require several transaction confirmations to be established after the initial transaction, to ensure immutability.

Your wallet will then display your balance by reading the blockchain and requesting the available UTXOs related to your wallet address.

Conclusion

There are various exchanges where you can purchase Bitcoin and other cryptocurrencies, with a wide array of features catering for all levels of experience.

One of the current challenges of cryptocurrency adoption is a lack of fiat gateways for decentralized exchanges. While some cryptocurrency exchanges work by combining the best elements of both centralized exchanges and DEXs (i.e., Kyber) they are currently few and far between.

Decentralized exchanges offer a new personal learning curve with maintaining the security of private keys and seed phrases, presenting people with individual responsibility for their finances by using mathematically verified transactions, completely removing the element of trust and the need for intermediaries.

Centralized exchanges are great if you’re new to Bitcoin and cryptocurrency; however, the technology is moving toward a more decentralized future. Centralized exchanges are needed for on-ramping, but if you’re not using DEXs in the future, you’ll probably be behind the curve.