Despite its recent upswing in popularity, blockchain is still a relatively new technology that can be hard for some people to grasp. Bitcoin is probably the reason why most people know what blockchain is. However, Bitcoin as a currency relies on its vibrant community and underlying blockchain capabilities to keep growing and attracting users.

Ethereum, on the other hand, is the reason why DeFi is growing at a tremendous rate. Ethereum’s support for smart contracts and the ability to tokenize it makes Ethereum perfect for a financial revolution, and is the reason why Decentralized Finance (DeFi) is hotter in 2020 than ever before. Let’s, therefore, take a look at decentralized finance in 2020 and what it means for the future of blockchain and finance!

How Decentralized Finance Works

Central authorities still largely dominate the traditional financial system. The role of these central authorities is to regulate the system, and act as middlemen between various parties. The most common example of this is that of a bank. Banks have several urgent tasks, and some examples are to lend funds, enable transactions between people as well as make it possible for people to invest. These are essential functions in the economy of today, and banks are, therefore, hard to replace. Nevertheless, new technology has recently begun to allow us to replace banks with technology.

The rise of blockchain and Ethereum makes it possible for developers to create and code platforms that can replace banks. The thinking is that code will take over the role of intermediaries from banks, set all terms and solve every dispute between the parties involved.

So, without banks in the equation, people will instead interact directly with each other through a Peer-to-Peer system (commonly known as a P2P system). A P2P system consists of nodes in a network that share the workload, which also means that the information is spread out across several locations. This means that no single entity is in control of all the information. This makes it harder to hack and will prevent people from committing financial fraud. Everyone involved in the P2P system also has the same rights. Sharing equal rights makes it impossible to exclude people from the system since no single entity can make an executive decision.

The emergence of peer-to-peer systems is only one vital aspect of why Decentralized Finance in 2020 seems set to soon go off. Another important reason is dApps. dApps stands for “Decentralized Applications”, which are applications that are built on blockchain. Since the introduction of Ethereum and smart contracts, dApps have grown substantially more common.

What is Decentralized Finance in 2020?

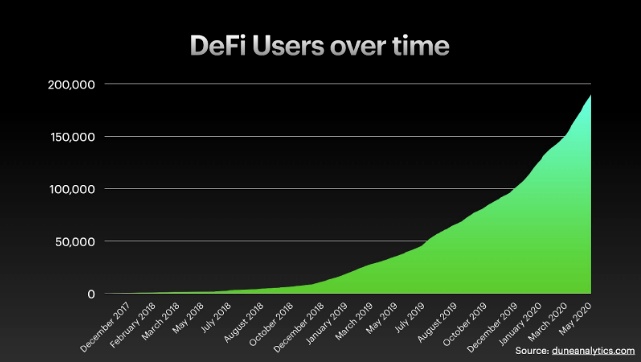

At the beginning of 2020, the total value locked into the Decentralized Finance market reached approximately $680 million. As of today, the DeFi market is worth $6.68 billion, which, in just 2020, means that the market has grown with around 982%.

What is even more impressive is the fact that the staggering growth has been exponential. In the last month, the total value locked into the system almost doubled from $3.5 billion to $6.68 billion. This rapid increase in funds and exponential growth give you an idea of the potential that DeFi in 2020 holds.

The three most significant projects in terms of dollars hold over 50% of the money in DeFi. These projects are the following; Maker, Aave, and Curve Finance. Together these three projects lock in $3.5 billion, meaning they are huge in the Decentralized Finance network. Both Maker and Aave are platforms for lending and borrowing money; meanwhile, Curve Finance is a DEX. DEXes are known more commonly as Decentralized Exchanges, which essentially means they are exchanges where people trade assets directly between each other.

The projects above are just the top three in terms of locked-in funds, and the number of Decentralized Finance projects is increasing at a rapid rate as well. This is not strange since it correlates with the rapid increase in money being poured into this sector. The increase in both the number of projects and funds will likely increase the innovation rate within the industry as well. Developers of dApps will come up with new solutions that are innovative and further improve the Decentralized Finance sector.

How Will DeFi Reshape Finance?

As mentioned in the section above, there are currently several massive projects out there on the DeFi market. These are already projects that are out there making strides to revolutionize finance forever. But how are they transforming finance and in what sectors can we expect changes and innovative ideas?

First of all, one of the main effects that decentralized finance in 2020 will have on finance, is the fact that an intermediary will no longer be necessary. Lines of code are literally replacing the roles of banks and other institutes with the help of smart contracts. The elimination of the middleman will lower costs for the consumers. This will allow more and more people to become part of the financial system since it will be more affordable to people.

Furthermore, perhaps the most critical improvement that decentralized finance in 2020 will bring is that of financial infrastructure. In society today, almost a fourth of the population remains unbanked, which means that they are unable to make transactions, save money with interest, and invest money. These are fundamental for growing wealth and these functions can be provided by a decentralized financial system.

The main reason why 25% of the population is not in contact with a bank is due to the lacking infrastructure within the financial sector. People do not live close enough to a bank to become members, and in some cases, it is hard for them since it can be too expensive. DeFi can solve both the issue regarding the infrastructure and the costs by decentralizing finance for good.

What Sectors are Becoming Decentralized?

Several sectors are going to be affected by the decentralization of the financial system such as; Lending, Decentralized Exchanges, Asset Management, Financial Data, and Insurance.

Decentralized Lending

This area is already a considerable sector when it comes to Decentralized Finance in 2020. Three of the top five DeFi projects fall under the lending category, and together they make up more than half of the current market cap. The biggest of them being Maker which locks in $1.46 billion.

Again, the technology that allows the lending sector to decentralize is the Ethereum blockchain. Thanks to the Ethereum blockchain and the smart contract that are available, it is possible to construct secure and transparent protocols for lending and borrowing funds.

Thanks to the lending protocols that are developed, we have seen innovative platforms that provide collateral loans, higher interest rates than traditional banks as well as Peer-to-Peer lending. All these are great for the consumer, and in the case of P2P lending, the cost for transactions will be significantly lower.

Banks dominate the lending market, and they are not too many of them out there. Since dApps are developed on open-source networks, this also allows for more healthy competition which is always positive when it comes to business.

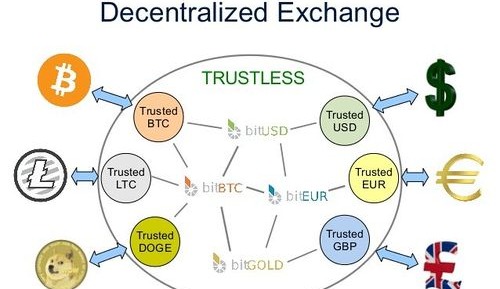

Decentralized Exchanges

Decentralized exchanges, or DEXes, are one of the most exciting innovations in DeFi. As the name suggests, DEXes are decentralized exchanges. This means that there is not a central authority in the process at all. Instead, people can make transactions through a Peer-to-Peer system and trade directly with each other.

Banks usually fill this role, but the traditional process is unnecessarily complicated. Instead of trading money directly between one another, banks act as intermediaries. One reason is for safety which is beneficial for everyone. But this process takes up a lot of resources since the money often needs to be transferred between two banks. And this process is not free of charge, which will bring additional costs for the consumers.

One of the benefits of a decentralized exchange is the fact that no money needs to be transferred to the exchange. If money is allocated in an exchange, the funds are prone to hacking; this is a risk that DEXes eliminate.

Furthermore, as more and more assets are becoming digitalized, we can assume that they are going to be tradable on a decentralized exchange in the future which is great for the consumer.

The most significant decentralized exchange today is arguably Curve Finance, and this project allocates just above $1 billion. The platform’s rate of growth is also staggering, where the total funds in the exchange have more than doubled in the last 30 days.

Asset Management

In asset management, DeFi also plays a significant role. Decentralized Finance will allow people to own an asset without anyone else having custody. For example, when buying a stock, you get ownership of the stock, but a bank still holds the asset.

Another benefit that DeFi will provide for the asset management sector is the fact that people can hold assets completely anonymous as well as more global accessibility. This ties back to the fact that 1/4 of the population is without a bank. Not having a bank means that they are unable to invest and hold financial assets. As this will become more accessible in the world, it will also provide investment opportunities for the people not in contact with a bank.

Asset management is Decentralized Finance does not come entirely without risk. One negative is that people are completely responsible for their activities. If one loses a wallet or sends money to the wrong address, there is no turning back. There is, therefore, currently not an existing safety net for the users.

But even though the positives with asset management in decentralized finance do not entirely come without risk, the sector is continuing to develop. The platforms for asset management are becoming more user-friendly, and in the future, we might see a safety net for the users designed.

Financial Data

In traditional finance, there is only a small group of entities and people that control financial data. The market for financial market data is enormous, and in the US alone, the market is worth around $15 billion. To clarify, market data is the information provided by a stock exchange. They give information on things like the price of stocks, commodities, and currencies.

Decentralized Finance will help make this data more democratic and change how the information is presented as well as sourced.

Decentralized Insurance

As mentioned in the section regarding asset management, there is no safety net in place when it comes to managing assets in a decentralized system. However, thanks to DeFi insurance platforms, the risks for the users can become significantly lower.

You are now able to apply insurance to personal wallets, pools, and smart contracts that are for lending and staking. There are several different insurance projects within the Decentralized Finance field, and their goals are generally to provide accessibility and transparency.

Huge corporations dominate the insurance industry today, and they routinely use their monopoly to take advantage of the consumers. Another goal for DeFi insurance is to make the market more competitive, which will lower the costs for the customers. It will also mean that more people will have the opportunity to insure their assets since it will become more accessible to people around the world.

Nexus Mutual is one example of a Decentralized Finance insurance project. They create insurance by creating a risk-sharing pool, and the members manage this pool of assets. Nexus Mutual provides coverage for any smart contracts on the Ethereum blockchain, which means that anyone can get protection on, for example, their funds being lent out on Maker or Aave.

Decentralized Finance in 2020 Conclusions

DeFi in 2020 has had tremendous growth of almost 1000%, and as the decentralized financial system gains more traction, this number will only increase. If DeFi can continue to grow at an exponential rate, it might not be long before everyone knows what it is.

Decentralized Finance in 2020 has already made strides in areas such as lending, DEXes, and insurance. And as the funding increases, the number of projects is likely to follow. This will only make developers more creative and more competitive, which will be great for the consumers.

One of the problems for DeFi is the fact that it might be hard to grasp for the average person. It is a bit abstract, but this is something that companies are working on. The idea of creating systems that will clarify and visually demonstrate how this is working in the real world was something that was discussed at the DeFi Conference 2020. To be able to explain and show people how Decentralized Finance works is one of the key aspects for more growth since it will mean that people can start mass adopting the concept of a decentralized financial system.

Nonetheless, DeFi is an area showing immense promise, not only in numbers but also in that it works in the real world. One way of learning more about DeFi is to enroll in Ivan on Tech Academy. Ivan on Tech Academy is the number one blockchain education platform, and we offer several Decentralized Finance and blockchain courses.