Cake DeFi is a revolutionary concept in bringing cash flow to crypto holdings. The platform was launched over a year ago with the vision to be a one-stop platform for easily generating yield – not just on crypto assets, but via a multitude of financial services.

Cake aims to be the gateway for millions of users to easily and safely attain high yield on their assets. Such yields are usually only offered to institutional investors, or the technically savvy crypto trader. But Cake DeFi is here to break down these barriers.

At present, Cake DeFi offers lending and staking services. To overcome the fears of bad actors in the industry, the company prides itself on its highest level of transparency in all levels of its offerings. Its secondary distinguishing features are its thoughtful user interface and user experience, and quick and genuine customer service.

High Yield Lending – Guaranteed

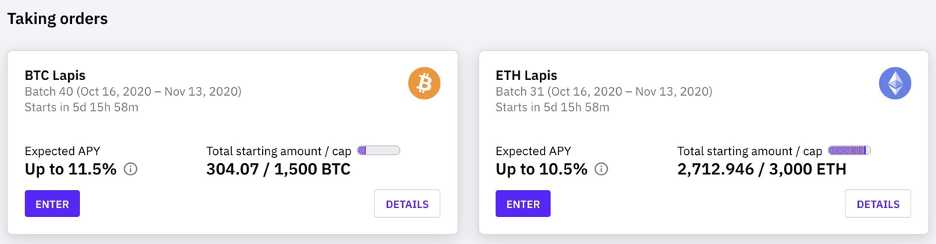

At the core of Cake’s services is its Lapis lending products. Cake offers 9% APY (annual percentage yield) on BTC and 8% APY on ETH holdings – for each batch lasting four weeks. On top of this already attractive yield, if the respective asset increases by about 15+% at the end of the batch, a bonus 2.5% is applied to the yield. This effectively bumps the maximum yield on BTC to 11.5% APY should the bitcoin pump during the batch period.

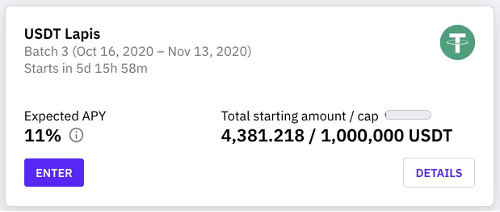

Cake also recently launched its USDT Lapis lending product, which offers a guaranteed 11% APY, making it one of the highest in the industry. While many users may be skeptical of how such yields can be achieved, Cake is fully transparent and discloses that it only works with the most trusted institutional partners like Genesis Capital and Signum Capital. With partnerships such as these, Cake is able to fully guarantee the yield and the capital, making the investment effectively risk free for the user.

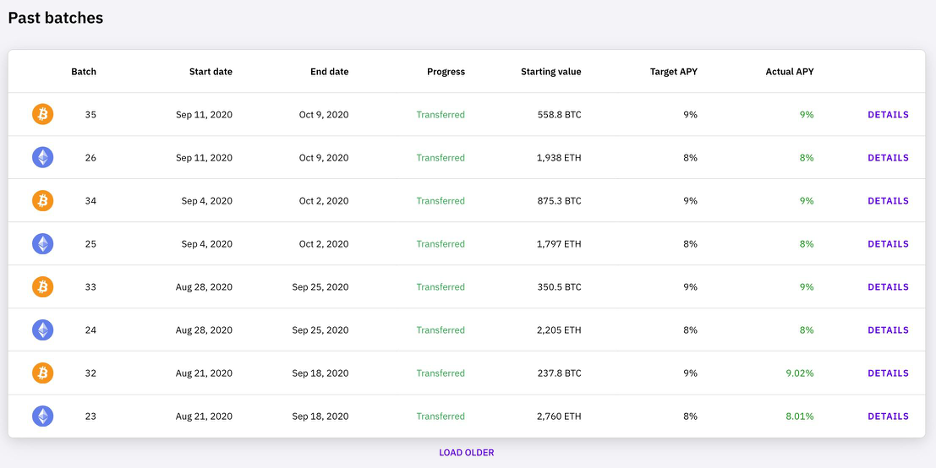

At the time of press, Cake is running its 39th batch for BTC Lapis lending, and 30th batch for ETH. What is interesting is that the platform publishes all information for each batch, including the amount that was invested in the batch, the expected yield, and the actual yield. This information is public for anyone, not just members, to review on its website.

Track Record and Growth

Reviewing the information all the way to the start, it can be seen that the first batch was started in Oct 2019. Since then, Cake DeFi has been delivering results consistently for each and every batch. From its early days with small investment amounts for each batch, it is clear that Cake’s assets under management are growing tremendously. Recent batches are now crossing 500 BTC, with the highest at 875 BTC so far. With such growth rates and also consistent results, it is clear that investors are increasingly trusting their assets with Cake DeFi’s Lapis lending products.

Staking Service

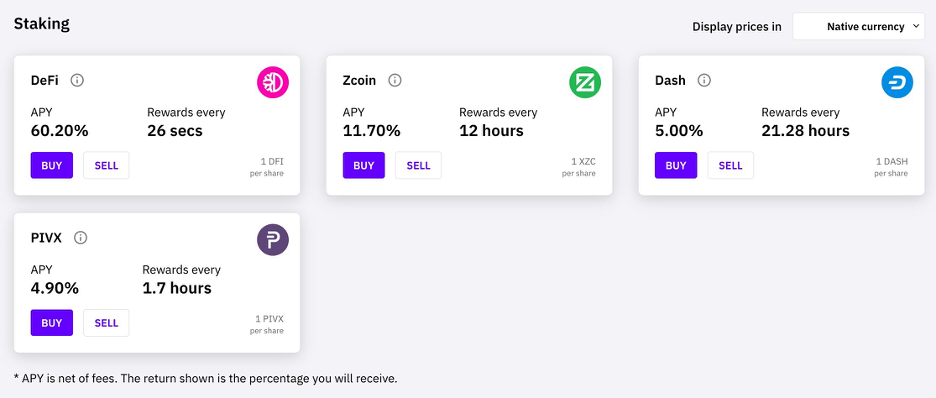

The second service Cake offers is a simple to use staking pool. This product once again has its core focused on transparency. Cake currently offers Zcoin, Dash, PIVX and also offers up to 60% APY on DFI (the native coin of the DeFi blockchain). Users can easily participate in the pools with as little as 1 DASH / XZC / PIVX / DFI.

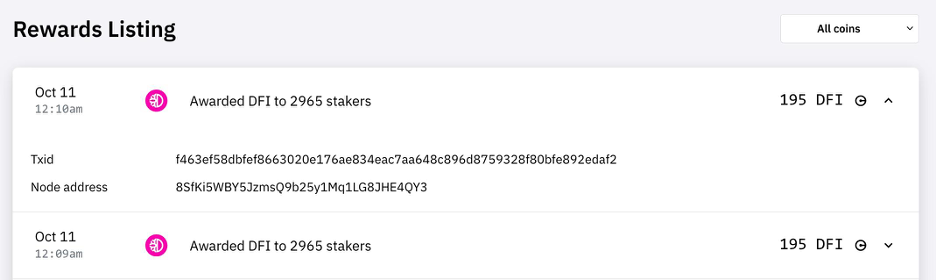

Cake publicly discloses all reward listings so anyone is able to identify and verify each and every masternode payout, all with the transaction ID and the node address.

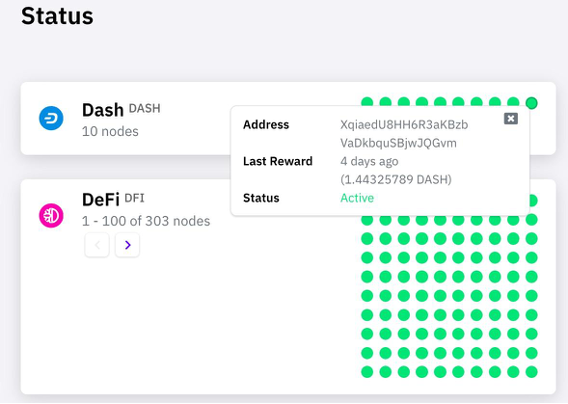

The status of all masternodes hosted on Cake are also verifiable. Further information regarding the address, time since last reward, and the amount are also publicly accessible.

Legal & Compliance

While many crypto companies are registered in offshore islands like Seychelles, and the Cayman Islands. Cake is registered and operating in Singapore, where the rule of law and regulatory enforcement is widely regarded as one of the top in the world. Cake is also fully compliant under the strict regulatory requirements of the Monetary Association of Singapore, and a member of the Association of Crypto Currency Enterprises and Start-ups Singapore (ACCESS), and the Singapore Fintech Association (SFA).

What Makes Cake DeFi Different

To grow the value of cryptocurrency assets like Ethereum and bitcoin, one needs to hodl in hopes that the value increases in time; or alternatively participate in cryptocurrency trading. However, with cryptocurrencies being highly volatile, it often requires constant checking on the price action of the asset, as well as technical analysis charting on multiple time frames – to give a prediction of where the market could be moving.

Many novice cryptocurrency traders are drawn to the volatility and quick pumps in prices, but they are usually not experienced enough to understand the price movements of bitcoin, nor the intricacies of how the momentum of altcoins differ in relation to bitcoin. Unfortunately, most novice trades will usually make many losing trades before ultimately giving up on trading.

Cake is meant for the user who prefers not to be involved with the hassle and risk of trading cryptocurrencies. Users who prefer to focus their attention and time on other activities would be glad to hear that Cake offers a painless solution to compounding one’s crypto assets.

Cake DeFi enables this by allowing users to seamlessly roll over their principal and interest from each batch, unto following batches at the flick of a switch. Thus allowing users to leverage the magic of compound interest in a hassle-free manner. To keep users informed of their earnings growth, Cake sends out weekly and monthly reward aggregation emails with full details about all staking proceeds and balances. For Lapis lending participants, an email is sent detailing an entry into, and also at the completion of each batch – detailing fully the amounts earned and the interests accrued.

CeDeFi

It is unfortunately too common in the cryptocurrency industry to see all sorts of shady and ‘illegal’ activities, that one could easily lose their funds on. These are not limited to just rug-pulls with new DeFi projects, fake token listings, and exit scams. But also pump and dumps in token prices, exchange hacks, and Ponzi schemes. Furthermore, there have been many incidences where errors in smart contracts of recent DeFi protocols have led to massive loss of user funds.

For this reason, Cake strives to push the boundaries of transparency in the industry. Even though the well known adage of ‘not your keys not your coins’ applies in this sense – Cake bridges the divide over CeFi vs DeFi, by offering the best of both worlds: a CeDeFi solution. One that users can feel completely assured that their holdings are in good hands, and without the need for deep technical knowledge required in many DeFi transactions of late.

The company also publishes quarterly transparency reports so that the public can have a deep understanding of how the company is performing, and also what each individual department of the company has been working on for the quarter. Analyzing these reports, it is clear that Cake has been achieving its targets and milestones constantly, and growing at a remarkable 10% WoW.

With its vision laid out clearly, and a solid team to back bring it to fruition – Cake DeFi will continue to be the innovative gateway bringing masses into the crypto space.

If you are looking to harvest the best yields in the industry, and make your crypto produce cashflow for you, sign up here!