The past week has seen a flurry of activity in the crypto markets. The price of Bitcoin has shot well past its previous all-time high (ATH), setting a new Bitcoin 2020 all-time high of $24,273. Additionally, Bitcoin’s previous all-time high record from 2017 has been shattered, with Bitcoin rallying past the psychologically important $20,000 barrier. This article breaks down the Bitcoin 2020 all-time high.

Anyone keeping an eye on the cryptocurrency markets will know that Bitcoin has been on a tear lately. What’s more, the price of Bitcoin is often seen as a bellwether of the wider cryptocurrency market. As such, Bitcoin’s recent bull run has not only proven that Bitcoin’s previous all-time high of $20,000 wasn’t a fluke, it is also an indicator of growing interest in the cryptocurrency market as a whole.

However, fully understanding the Bitcoin 2020 all-time high requires one to look at the history of Bitcoin, and previous all-time highs and bull runs. This article goes through the details of Bitcoin’s new 2020 all-time high, as well as how the crypto has gotten here. Additionally, we look at some of the differences between Bitcoin in 2017 vs 2020, when the previous Bitcoin all-time high was reached.

If you want to learn how to trade Bitcoin or cryptocurrency basics, be sure to check out Ivan on Tech Academy. Ivan on Tech Academy is one of the most popular online blockchain education platforms, and has over 30,000 already enrolled students. Join a vibrant cryptocurrency community, and enjoy dozens of blockchain courses.

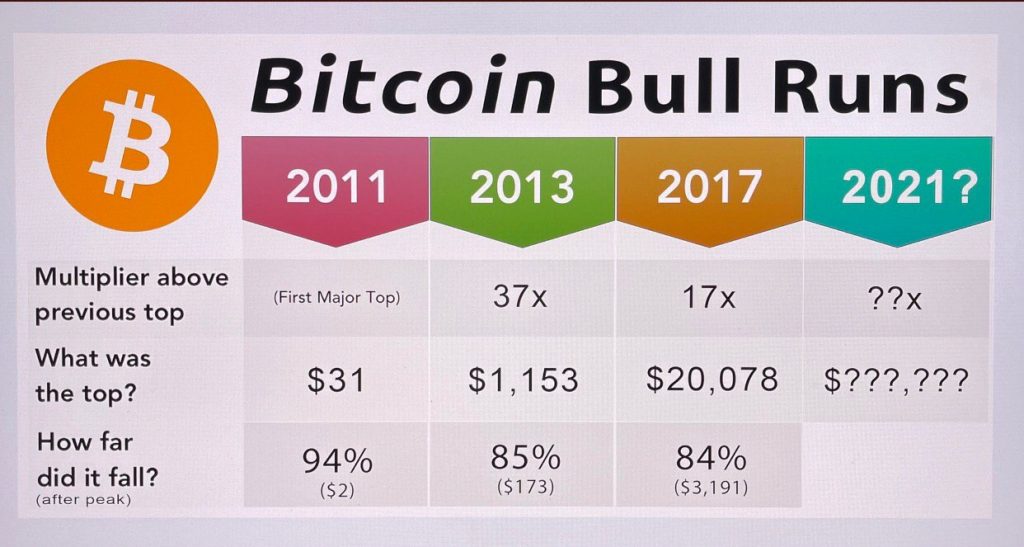

Previous Bitcoin Bull Runs and All-Time Highs

Ever since Bitcoin’s inception back in 2008, and subsequent launch in 2009, this premier cryptocurrency has been on a number of so-called ”bull runs”. For those of you unfamiliar with this concept, a market is a market which is ”on the rise”, and a bull run is a period characterized by surging optimism and increasing asset prices.

The average price of Bitcoin has increased by astronomic proportions ever since the cryptocurrency was first launched, and this is largely due to various bull runs. In order to give some context for the 2020 bull run and Bitcoin all-time high, let’s first look at some of the previous Bitcoin bull runs.

At the time of writing, Bitcoin is trading at roughly $23,571, according to COIN360. This is due to the past weeks’ bullish Bitcoin performance, but even if the price of Bitcoin continues to surge for months, this bull market cannot go on forever. It is also worth keeping in mind that bull markets are often followed by substantial corrections and bear market periods. Consequently, we will also touch on how much the price of Bitcoin has fallen after the cryptocurrency reached previous all-time highs.

- Bitcoin’s 2011 All-Time High

Back in 2011, Bitcoin saw one of its first major bull runs. At the end of this price surge, the price of Bitcoin had risen to $31. If you are just getting into the cryptocurrency industry, it can seem hard to imagine that a Bitcoin price point of $31 could be described as the peak of a bull run, but the cryptocurrency market was a very different industry nine years ago.

With that said, however, the price of Bitcoin then went on to ”crash” after peaking at $31. In fact, Bitcoin’s price fell roughly 94% after this 2011 all-time high, crashing to a price point of around $2. What’s more, the price of Bitcoin fell by 70% in just the four days between June 8th and June 12th of 2011. It would then take the price of Bitcoin roughly 1,5 years to surge past its previous ATH of $31.

- Bitcoin’s 2013 All-Time High

Nevertheless, in 2013, the price of Bitcoin began to skyrocket towards a new all-time high. Although the cryptocurrency industry was still in its infancy, the crypto market had begun to mature compared to the 2011 Bitcoin bull run.

In fact, 2013 actually saw two separate Bitcoin bull runs, and although the cryptocurrency reached new all-time highs, the major bull run took place during late 2013.

During this period, the price of Bitcoin would surge to a high of $1,153. Compared to Bitcoin’s 2011 all-time high, this represented a 37x increase of 2011’s high. Nevertheless, as you will learn is a common theme, the price of Bitcoin then went on to crash to $173, or by around 85%. This shows how new all-time highs are often followed by market consolidation and corrections, and times of bearish sentiment.

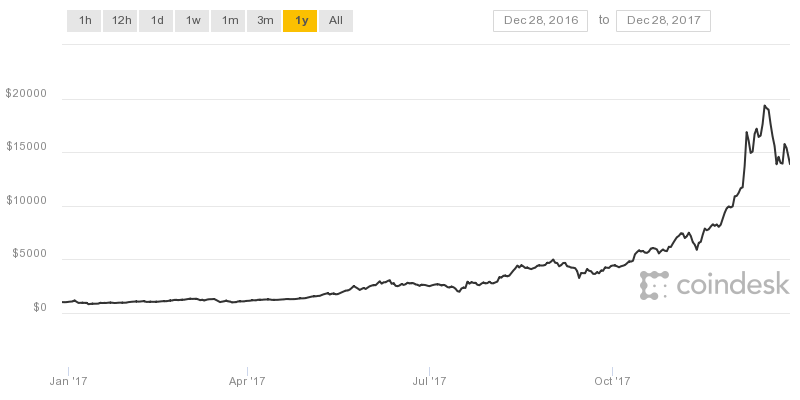

- Bitcoin’s 2017 All-Time High

The definitive Bitcoin bull run was that which took place during late 2017. This is when Bitcoin really began to make a name for itself in the mainstream media. Although the cryptocurrency industry of late 2017 can still seem young when viewed from a late 2020 context, it had matured massively compared to back in 2013. The cryptocurrency infrastructure in 2017 was far more robust and developed than it had been four years earlier.

If you are in need of a reminder, the 2017 Bitcoin boom saw the premier crypto’s price surge to a high of $20,078 – which would not be surpassed until late 2020. What’s more, this +$20,000 price tag represents a 17x increase over Bitcoin’s 2013 all-time high. This massive price surge was what really made the general public aware of Bitcoin’s existence.

With that said, however, the 2017 Bitcoin all-time high was not without issues of its own. Perhaps most notably, the crypto frenzy fueled an ICO boom and massive altcoin interest. While this is not anything negative, it is clear in retrospect that some got a bit carried away during the run-up to the 2017 Bitcoin all-time high. Following Bitcoin’s 2017 all-time high, the crypto would – as is often the case – go on to plummet by 84% to a price of $3,191. As you probably know, it would take until December of 2020 until Bitcoin’s 2017 all-time high was finally surpassed.

Bitcoin’s 2020 All-Time High

To preface, the cryptocurrency market of 2020 is very different to that of 2017. This is, in some ways, largely due to Bitcoin’s 2017 all-time high. When the price of Bitcoin surged to $20,000 in late 2017, this led to a greater amount of scrutiny in the crypto market as a whole. Bitcoin’s 2017 bull run was a real-life example of how cryptocurrency interest could grow massively, and a sign that it could – maybe – even be ready for general adoption.

Although Bitcoin’s 2017 all-time high and associated bull run eventually ended up being a ”false alarm”, in that Bitcoin didn’t reach general adoption following it, it still highlighted some of the fundamental issues in the crypto industry. For example, the relative lack of scalability was identified as being a major barrier to general adoption.

This has since been partly resolved, through initiatives such as Ethereum 2.0, Sharding, SegWit, Plasma, side chains and many other techniques. However, there is an argument to be made for that Bitcoin’s 2020 all-time high has been supported by 2017’s bull run, and the last few years’ development ultimately made this most recent bull run possible.

What’s more, even some of those who were previously skeptical of Bitcoin have now recognized the benefits, or at least validity, or the asset class. In addition to this, established companies like Fidelity and PayPal have announced that they are exploring cryptocurrencies. PayPal and Bitcoin is an interesting combination, and PayPal’s Bitcoin integration will likely make Bitcoin payments far more accessible to the wider public.

Earlier in 2020, Bitcoin underwent the 2020 Bitcoin Halving. This effectively cut the supply of Bitcoin in half, which improves Bitcoin’s underlying fundamentals. It’s impossible to say what drove Bitcoin’s 2020 all-time high, but there are certainly contending factors.

Bitcoin in 2017 vs 2020

We’ve previously noted some of the differences between Bitcoin and crypto in 2017 versus in 2020. It is clear that the crypto industry of 2020 is far more mature than that of 2017. Nonetheless, to show this in a clear way, let’s go through some of the major differences between Bitcoin in 2017 vs 2020.

First and foremost, the 2017 Bitcoin bull run was largely driven by private actors and traders. Although some crypto whales were certainly around, the majority of trading action back in 2017 came from speculators, cryptocurrency enthusiasts or other private traders. The situation in 2020, however, is very different.

In the years since 2017 – and especially in 2020 – institutional actors have been unable to ignore some of the advantages brought about by cryptocurrencies and blockchain technology. As such, institutional adoption of Bitcoin and crypto has risen massively. Various firms, banks, financial institutions and other companies are now actively investing in Bitcoin.

Additionally, the advent of the COVID-19 coronavirus pandemic has radically reshaped the map of how companies operate. As a result, some of legacy companies’ systemic issues have been laid bare, opening the door for new, more efficient technologies. Furthermore, excessive quantitative easing measures taken by central banks around the world are eroding trust in fiat currencies such as the US dollar.

What’s more, the various crypto derivatives options have grown explosively, and the field of decentralized finance (DeFi) was almost unheard of three years ago. The amount of crypto exchanges has risen substantially since 2017, and the general market infrastructure is much more diversified and reliable.

Will Bitcoin Reach a 2021 All-Time High?

A few weeks ago, the Ivan on Tech Academy blog published an article on the subject of ”is it too late to get into Bitcoin”, with the answer being a resounding no. Although no blog articles on this platform constitute investment or financial advice, it can be worth to note that at the time, the price of Bitcoin was less than $18,500. At the moment of writing, it is roughly $24,000. This seems to validate the previous suggestion that it is not too late to get into Bitcoin, as long as you yourself are satisfied with the price you’re paying.

As such, it seems clear that Bitcoin is continuing its cyclic pattern of booms and busts. If the price of Bitcoin keeps pumping as it has done these past few days, it seems likely that Bitcoin’s 2020 all-time high could soon be overshadowed by an even greater 2021 Bitcoin all-time high. Nonetheless, what goes up must come down, so do not be surprised if the price of Bitcoin goes on to fall sharply after it has reached a new all-time high. If history is any guide, the price of Bitcoin tends to drop sharply following new record highs.

There are many reasons to be bullish for Bitcoin setting a 2021 all-time high, if this bull run continues. As investors are increasingly viewing Bitcoin as a reliable hedge against inflation – particularly relevant in times of massive economic stimulus packages – it seems Bitcoin could earn its moniker of being ”digital gold”.

Bitcoin 2020 All-Time High Summary

It is an exciting time to be in the crypto market, as Bitcoin is mooning. Additionally, Bitcoin’s bull run could very well bring the wider altcoin industry with it, prompting a market-wide surge in prices. Nevertheless, Bitcoin’s 2020 all-time high is not a guarantee that the price of Bitcoin will never fall again.

Rather, it seems likely that a correction will take place at some point. However, it’s hard to say whether that correction will happen tomorrow, next week, next month or next year. On the other hand, it is clear to see that if Bitcoin’s 2020 or 2021 all-time high follows the same pattern as previous all-time highs, the price of Bitcoin could likely surge well past the current 2020 all-time high of $24,273.

The crypto market is infamously fast-paced and it can be challenging to keep up with all the latest developments. Nevertheless, Ivan on Tech Academy has got you covered. The Academy offers countless cryptocurrency courses, and even courses on algorithmic trading and technical analysis. Enroll today using the code BLOG20 and get 20% off!