As you may already know, Bitcoin has recently smashed all-time-highs and is making a name for itself in a big way yet again. With more interest than ever before, Bitcoin bull run 2021 hype is arguably bigger than ever. Already, a massive influx of funds has entered the crypto space from several large net-worth individuals and institutions investing in cryptocurrency. Considering recent events, it is more important now than ever to understand how to protect your wealth. The upcoming bull run could change people’s lives. Understanding how to navigate the market to maximize your profits is key to avoiding getting rekt.

In this article, we’ll recap Bitcoin history with bull runs and what it can tell us in anticipation of a potential 2021 Bitcoin bull run. Furthermore, we’ll explain some key differences between the previous Bitcoin bull runs and the most recent highs. Lastly, we’ll give you some advice on ways to protect your wealth when investing in cryptocurrency.

The cryptocurrency industry is growing rapidly, with new innovative projects emerging almost daily. There has never been a better time to learn a new skill, and blockchain is the most in-demand skill on LinkedIn right now. At Ivan on Tech Academy, we teach you everything you need to know to find your perfect job in crypto! Regardless of your previous experience, there are a variety of roles within the blockchain industry that need filling. Ivan on Tech Academy is the premier blockchain academy, with everything you could ever need in one place. From The Bitcoin Standard to Smart Contract Programming courses, Ivan on Tech Academy is the best place to kickstart your blockchain career!

What Is A Bitcoin Bull Run?

In finance and economics, you may have heard the terms ‘bull market’ and ‘bear market’ being used. These are references to the overall trend a chart is showing. If a chart is bearish, this means the trend looks like it’s going down. Conversely, if the chart is bullish the trend indicates the price will continue to rise.

Every three years or so, we approach a period known as the ‘Bitcoin Bull Run’. Nobody knows exactly when a Bitcoin bull run will begin or end. However, some key indicators can help traders predict when trends have reversed.

Bitcoin’s bull run history indicates that a bull run will occur shortly after the halving event. The halving event occurs every 3-4 years or so (or every 210,000 blocks mined). Miners are nodes (computers) that do all the computational processing to mathematically verify transactions and append blocks to the blockchain. For every block added, the miner receives a reward in Bitcoin. At each halving event, the reward for miners is cut in half.

Mining Bitcoin is an expensive business and when the halving event occurs, mining profits are reduced significantly. Quite often, it can result in miners making a loss for several months. The price of Bitcoin needs to increase up to a point where it is profitable for miners to create Bitcoin, else the system would collapse.

The amount of Bitcoin that can ever be mined is a hard cap of 21 million. The capped supply creates scarcity. The amount of Bitcoin put into circulation is reduced by 50% each halving, thus reducing inflation. Bitcoin is a deflationary asset, meaning that as the value of the dollar decreases, the value of Bitcoin increases.

Bitcoin Bull Run History

Mining Bitcoin once upon a time could be done through using an everyday home desktop computer. As per the Bitcoin whitepaper, the capacity to mine Bitcoin has become increasingly more difficult as the network of nodes widens and hash power grows. Thankfully, the facilities for storing Bitcoins have become increasingly easier! You can read about the full History of Bitcoin Wallets to discover the first-way people were able to hold Bitcoin. (Spoiler: it included downloading the entire blockchain!)

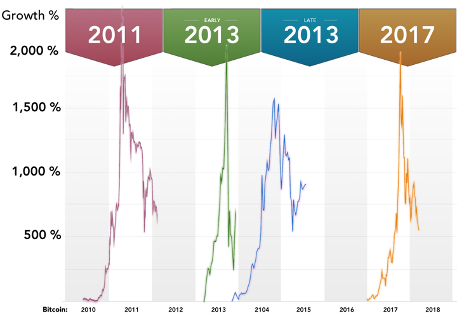

Below, we’ve shown a breakdown of the Bitcoin bull run history over time, and what it can potentially indicate to watch out for this time around. It is important to familiarize yourself with the Bitcoin bull run history when investing in cryptocurrency. This gives you a more well-rounded perspective of the volatility of price movements, and potentially some buying or selling indicators. It’s worth noting though that although history doesn’t repeat itself, it often rhymes.

2010 – 2011 Bull Run

The Bitcoin whitepaper was released on Halloween date 31st October 2008. On January 3rd, 2009 Satoshi Nakamoto (the anonymous developer behind Bitcoin) mined the genesis block of Bitcoin. In 2010, the price of Bitcoin soared from $0.0008 to $0.08 in July 2010.

In February 2011, history was made when the price of 1BTC was equivalent to $1. This made Bitcoin seem like a legitimate currency to speculators and more appealing to investors. So much so, during the middle of the year, Bitcoin reached its peak bull run price of $31 in June. Toward the end of the year in October, however, Bitcoin was worth just over $2. That was a 94% drop signifying the beginning of a bear market. The largest drop in a Bitcoin bull run history.

2013 Bull Run

2013 was a strong year for Bitcoin. The Bitcoin hype started strong with WordPress announcing they were beginning to accept Bitcoin as payment in December 2012. In February 2013, Bitcoin was sitting around the peak of the 2011 Bitcoin bull run price, at $31.

On April 1st, Bitcoin’s market cap had hit the $1 billion mark, with 1 BTC valued at $104. The price continued to rise to $262 over the following weeks before crashing down to $120 within 6 hours. In May, the networking of Bitcoin really began to take off with programmers and venture capitalists meeting at various Bitcoin conferences around the world. In October, the price was sitting at $158 before peaking at $1,153 in December.

The following year saw one of the largest Bitcoin exchanges close down after a hack, with over 650,000 BTC stolen. Mt Gox has since been able to recover 200,000 BTC, however, the value of the funds stolen totaled just over $450 million – pushing the exchange into insolvency. In 2014, the BTC price fell 85% bottoming out at $127.

2017 Bull Run

According to Bitcoin bull run charts, Bitcoin started 2017 at around $970. The price swiftly rose to just over $1100, before a steep decline to $730 all within the first 12 days of the year. However, 2017 was a busy year for crypto – with more interest and investors than ever before. The ICO (initial coin offering) model was becoming the go-to for investors hoping to make big gains on new projects launching within the space. Sadly though, a lot of these ICOs were scams, with individuals, teams, or developers shortly disappearing with funds once investors were sold on the project. This led to the ICO bubble bursting the following year, in early 2018.

However, in the meantime, Bitcoin was slowly and surely creeping up in price throughout 2017. It reached it’s previous all-time-high level in March, with mini Bitcoin bull runs occurring every couple of months or so, followed by a bearish few weeks throughout the year. On 1st December, 1BTC was equivalent to approximately $10,900. On December 17th, the price had nearly doubled reaching just over $20,000 on some exchanges. This was the top of the previous bull run, before bottoming out at it’s lowest price of $3,191 in March 2020. That’s an 84% drop from its all-time-high levels.

2020

This year, on December 17th, Bitcoin smashed through the previous $20,000 all-time-high price reaching $24,000, despite the price crash in March due to the pandemic. Bitcoin has bounced back faster and stronger than the traditional financial markets and looks bullish as ever as we enter the new year.

Whenever there is a significant move within Bitcoin, alongside the halving event, there is often another narrative coming into the scene. In 2012, the hype was Bitcoin itself, and reaching the $1 mark psychologically made people understand the concept of a digital currency a bit more. The 2015 main narrative which catalyzed the ICO boom, was ‘ETH but ‘X’’. This is referring to the number of projects created that set out to be ‘Ethereum but better’, ‘Ethereum but faster’, etc.

The year 2020 has brought about decentralized finance, or DeFi. Hundreds of DeFi applications have been built on the Ethereum network, with more corporate interest and involvement than ever before. This leads us nicely into what could be different about the Bitcoin bull run 2021.

What’s Different About The Bitcoin Bull Run 2021?

There is more excitement and investors in 2020 than in the entire previous Bitcoin bull run history. This is generating marketwide predictions of new all-time-highs in the Bitcoin bull run 2021, ranging from $50,000 to $400,000 per BTC!

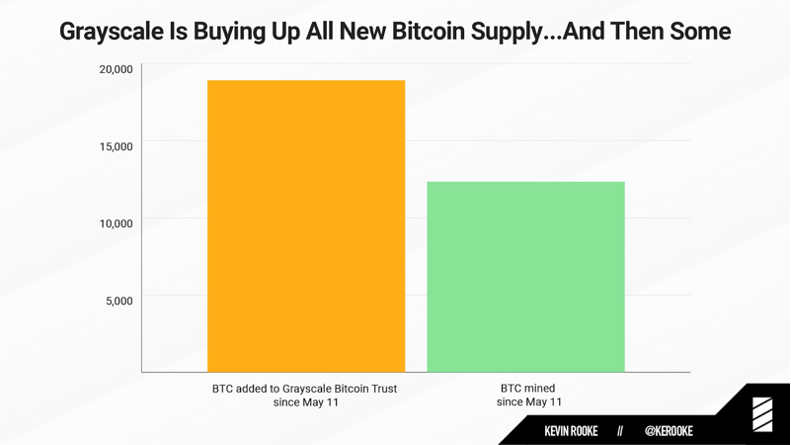

Over recent weeks, as Bitcoin smashed $20,000, there have been a few 10-15% price drops, which have been bought up within minutes. There is a lot of speculation with institutional investment, and large publicly-traded companies transferring their liquid assets into Bitcoin. MicroStrategy has now purchased over 70,000 BTC, with holdings worth just shy of $1.6 billion. As of November, Grayscale, one of the United States’ largest hedge funds, holds over 2.6% of the circulating supply of Bitcoin. In addition to this, Grayscale has also started investing in Ethereum, reportedly holding more than 2% of circulating supply also.

With such extreme buying pressure never seen before, dips are being bought up in a flash. Questions are being raised as to whether we will see such dramatic pull-backs and price corrections throughout the Bitcoin bull run 2021. Also, more people are searching to learn how to protect their wealth in times of economic crisis. The answer, of course, is Bitcoin.

For anyone new to cryptocurrency or unsure how to get involved, check out Ivan on Tech Academy’s Crypto Basics course! It covers everything you need to know to get started investing in Bitcoin and other cryptocurrencies! Or if you’d like to know more about how Bitcoin works on a fundamental level, have a look at our Blockchain & Bitcoin 101 course. 14-day money-back guarantee!

How To Protect Your Wealth When Investing In Cryptocurrency

It is crucial to have some knowledge about how to protect your wealth to be able to save and make a stable living. However, this is not something we are taught in schools. Ivan on Tech Academy is a great place to start learning how to protect your wealth. We offer valuable information, particularly when investing in cryptocurrency, as to how to avoid many beginner mistakes of trading or investing.

With the potential Bitcoin bull run 2021 set to likely see more interest and investment than ever before, we have listed a few key tips to avoid getting rekt in the bull market. Investing in cryptocurrency has the potential to drastically change one’s life for the better, or worse – if you don’t know what you’re doing.

DYOR (Do Your Own Research)

This is the top number one tip and can not be stressed enough. See our Essential Research Tools guide if you’re unsure of the best ways to carry this out. Be sure to check out the team behind a project, and see if it fits with the narratives around 2020/2021’s hottest projects: Baseline, Oracles, Lending, Derivatives (read more hottest trends here!).

Don’t Bet The Farm

Dollar-cost averaging (DCA) has statistically been the most cost-efficient way of investing. Investing a small amount on a frequent basis can reduce many of the risks associated with trading. By investing small amounts over a longer period during a bull market, investors often increase the probability of making a reliable profit. Nonetheless, only invest what you can afford to lose. If you want to speculate, make sure that you manage risk.

Don’t Be Greedy

Make sure to have a strategy in place for taking profits. Are you willing to hodl for a year? 10 years? Perhaps you want to allocate a small portion of your portfolio to more speculative assets. For instance, you may wish to dabble in some volatile new altcoins. When doing so, consider an exit strategy. How high a return do you want to get from this trade?

It’s important not to be greedy during the Bitcoin bull run 2021. Never take out a loan to buy crypto. Only ever invest what you can afford to lose, and finally, never bet the farm!

Avoid Getting Rekt By Tax

At the end of the financial year get an accountant to calculate your tax due and cash it out in fiat by the end of December. Any gains made between January and December within a year must be calculated. Many people did not consider this in previous bull runs. After making substantial gains, followed by a price crash without having taken profits, left a lot of people in debt to the taxman the following year. For the Bitcoin bull run 2021, this will be calculated from gains made between January 1st – December 31st, 2021.

BSI Indicator

The Ivan on Tech Academy BSI Indicator for TradingView is a next-generation tool that combines on-chain analysis with technical analysis. Using the BSI Indicator helps you time the market with way more success. Furthermore, the BSI indicator can help you find tops and bottoms with greater probabilities. Using this you can find the perfect time to enter and exit a trade!

Bitcoin Bull Run 2021 Summary

In summary, Bitcoin has shown some extremely volatile price action over the years. This is definitely something worth bearing in mind when investing in cryptocurrency. On the other hand, this time around, the Bitcoin bull run 2021 appears set to have institutional backing, waiting to buy up the dip if the price crashes!

Investing in cryptocurrency has never been easier. Thousands of Bitcoin ATMs have been installed around the globe. There are new exchanges and protocols to gain exposure to Bitcoin without the responsibility of holding private keys. For example, in October we saw the announcement of PayPal integrating cryptocurrencies for its 300+ million users. People can easily buy and trade Bitcoin and other cryptocurrencies with one of the world’s largest payment merchants.

Another global payment merchant giant, Visa, has announced several partnerships throughout 2020, introducing crypto debit cards. This is a perfect example of how using and spending cryptocurrency is set to become mainstream with this kind of adoption.

Be careful – doing your own research and taking full responsibility for your wealth management is key to learning how to protect your wealth. Hopefully, these tips will help you in making decisions when investing in cryptocurrency.

Are you new to investing and trading? Check out the Technical Analysis 101 course by Ivan on Tech Academy, to learn all you need to know to get started! Knowledge of technical analysis will provide you with an edge in the coming Bitcoin bull run 2021, understanding the emotions of the charts. Also, our FinTech 101 course is ideal for anyone wanting to learn more about the integration of crypto into the traditional financial system!