If you've ever wondered, "what is a staking pool?" and "how does it differ from staking alone?" we've got you covered. This article will explain the ins and outs of crypto staking pools. But before examining these options, we need to review the proof-of-stake (PoS) consensus mechanism.

Proof-of-work (PoW) blockchains such as Bitcoin require crypto mining to validate blocks of transactions. On the other hand, PoS blockchains use crypto staking, and no mining is required. Therefore, you can only stake on PoS blockchains. Let's explore this concept further. Since we mentioned Bitcoin above, are you ready to learn more about Bitcoin? Take the Blockchain & Bitcoin Fundamentals course at Moralis Academy!

PoS Blockchains

Some of the most prominent blockchains use PoS. That includes chains such as Cardano (ADA), Avalanche (AVAX), and Solana (SOL). Since many like to compare specific blockchains, read our "Polkadot vs Cardano" article! Moreover, some blockchains are transitioning from PoW to PoS. Ethereum, for example, is the second-largest blockchain after Bitcoin. It also began as PoW but will hopefully accomplish its move to PoS by this year.

PoS blockchains don't use miners. They use validators to verify blocks. Furthermore, to become a validator, one must stake tokens from the native blockchain and lock them up for various periods. This is where staking comes in.

One can stake tokens on a PoS blockchain to become a validator. However, the number required can add up to a hefty sum. For example, Ethereum will require a staked amount of 32 ETH. Even after the recent price crash, 32 ETH equals roughly $67,000. That kind of cost excludes most people from participating. Speaking of Ethereum, did you know you can learn how to build an ETH wallet? Visit our blog at Moralis to learn more.

Validator Nodes

A validator node is a full node with special privileges. It has the power to validate blocks of transactions and receive token rewards for doing so. However, as mentioned, one must stake tokens first.

First, the PoS algorithm selects a validator for each block from those with the minimum amount locked. The algorithm considers various factors when choosing the next validator in line. These factors include the validator's stake size and how long they've held it. There is also a randomization factor at play.

Next, this validator forges the block, and other validators join in to verify it. As a reward for their work, the validator receives native coins. However, if the block holds any fraudulent transactions, the validator who created the block gets their stake slashed. Getting slashed means losing some or all of their staked tokens. Any nodes that validated that particular block get penalized as well. This "carrots and sticks" incentive system helps keeps validators honest.

Have you heard about the Bored Ape Yacht Club NFT collection? Check out our recent article exploring ApeCoin (APE) to learn about its governance token.

What is a Staking Pool?

We've already learned that users who hold a particular stake in a blockchain's native currency can become validators. Also, as they lock up their tokens, they can receive rewards. So, what is a staking pool, and what does it have to do with the PoS algorithm?

A staking pool is just another way to lock up tokens on a particular blockchain. It's a way for an investor to combine their resources with others. By doing so, they split the costs and the rewards. It is similar to a mining pool on a PoW blockchain like Bitcoin.

This option works well for people who can only muster up a fraction of the cost to become validators. They can still earn passive income without locking up a sizable amount of tokens by joining a pool.

Staking Pool Advantages

So, what is a staking pool, and what are the advantages of investing solo? Besides splitting the costs, another advantage is that the investor doesn't have to learn how to operate their own pool. Nor do they have to set up and run a validating node. Instead, the designated staking pool operator handles these details.

Staking pools offer an investor a shot at earning passive income. Moreover, they get to hold their favorite token in hopes of long-term price appreciation. Like solo staking, rewards come via newly minted tokens that accrue each time a block of transactions gets validated. Further, stakeholders get their share based on the proportion to the number of tokens staked. Thus, investors can generate higher returns if the staked token's price rises over time.

Choosing a Staking Pool

Staking pools are a way to get involved with staking that is easier than going solo and setting up a full validator node. Moreover, pools can be private or on a crypto exchange. With multiple staking pools from which to choose, picking one also depends on various factors:

1. Fees and commissions

2. Lock up periods

3. Annual percentage rate (APR)

4. Exchanges or private pools

Membership Fees and Commissions

Currently, fees and commissions vary but typically hover around 5%. Investors should read the fine print to see how much the pool operator charges for maintaining it since these platform fees and commissions cut into profits.

Have you ever wondered how to get blockchain certified? Join Moralis Academy and start your journey now! If you're new, start with the Crypto for Beginners course.

Lock-Up Periods

Staking pools contain different lock-up periods, which means the user won't be able to access their crypto for a certain amount of time. This period won't matter for those who hold for the long-term anyway. However, locking periods need more consideration for those who might need access to their tokens at a moment's notice.

Annual Percentage Rate

APR can fluctuate wildly, ranging from 15% to 150%. Investors who stake individually will earn greater rewards than those in a staking pool because rewards get diluted between multiple investors. In addition, private pools may offer higher APR than crypto exchanges. Moreover, becoming a validator pays better than joining a staking pool. While investors want to make the best returns possible, they should also consider the staking pool's security.

When studying staking and cryptocurrencies, many people also ask, "why to learn Web3 development?". In our blog article, we go over some excellent reasons why you should learn Web3 development. Moreover, businesses need to get their teams up and running for the new economy. Check out our list of blockchain for business courses!

Exchange vs Private Pool

Staking pool operators offer different value propositions to appeal to potential stakeholders. Private pools might offer higher annual percentage yields. However, they can be riskier than staking on an exchange, particularly if the private pool is new and without a track record. Investors don't want to join a staking pool offering high returns only to find out that the operator is using the pool's funds to finance his malicious intent as a validator.

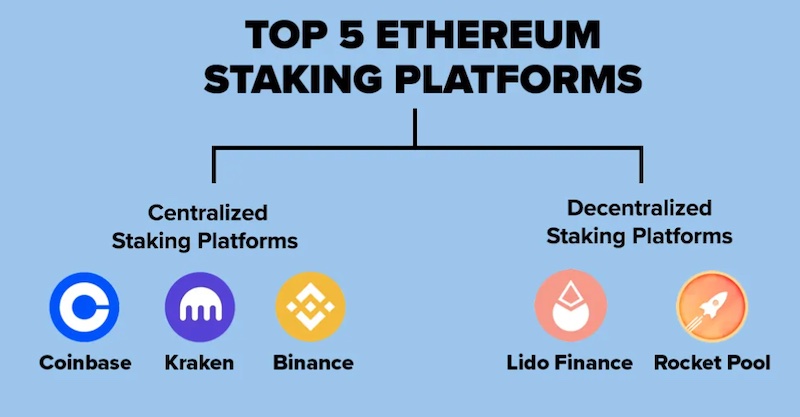

Better-known exchanges can offer more security and other advantages depending on their track record of performance. But, what is a staking pool, and what does it have to do with an exchange? Take Coinbase, for example. Users can stake ETH tokens in its exchange pool and get daily rewards. More importantly, there is no minimum balance requirement.

Cosmos is another popular blockchain for investors to stake tokens with other validator opportunities available throughout its ecosystem. Cosmos Antimatter is a new validator in the Cosmos ecosystem that distinguishes itself by pushing for decentralization within the network. The goal is to disperse 100% of the profits amongst stakeholders while simultaneously working to prevent validator cartels from forming.

In sum, staking through a crypto exchange is a good alternative for those who already have cryptocurrency idling there. In such cases, it handles most of the administrative work locating a node for the investor.

How a Staking Pool Operates

Whichever way an investor decides to go, staking pools typically operate in a two-tiered fashion. Generally, a pool operator manages the staking pool on a specific blockchain, and the stakeholders lock their coins on it. Further, an administrator oversees the validator's work to ensure accuracy. Lastly, earned rewards get split between the pool operator and stakeholders minus any membership, commission, or entry fees.

Therefore, staking pools offering high returns combined with the staked cryptocurrency's upside potential offer investors an excellent value proposition. They have the opportunity to earn yield and capital gains through token value appreciation. Furthermore, staking pools rewards users regularly (daily, weekly, or quarterly), depending on which one they choose. However, nothing in crypto is risk-free, and the same goes for staking pools.

What is a Staking Pool and Its Risks?

Now, let us address the question, "what is a staking pool and the risks?". Joining one comes with advantages and disadvantages. As such, before investing, there are caveats to consider. The hazards include price volatility, lock-up periods, custodial issues, and security breaches.

With the volatility of crypto, staked token prices will fluctuate. If you're in a pool that requires you to lock your tokens for an extended period, you won't be able to pull them out to sell. It will be painful to sit on your hands and watch as prices tank if you're used to quickly trading your way out of market whipsaws.

In addition, handing custody of your tokens over to a third party is another concern. Exchanges can get hacked, and private pool operators can run off with the funds. Besides these security issues, validator nodes can also go rogue.

Suppose a malicious validator forms a block filled with some fraudulent transactions. The network can slash a percentage of the staked tokens as punishment. If that validator is risking pool money, the stakeholders can lose some or all of their staked cryptocurrency due to the bad actor operating their pool.

Due Diligence

Because of the above risks, due diligence is necessary. Investors will want to choose crypto staking pools with a proven track record. Private staking pools may offer higher APY than some notable crypto exchanges, but they come with more risk. So there is always that trade-off to consider.

In addition, those who stake should look for pools whose operators regularly update the stakeholders regarding their performance. Look for one with transparent business operations, not one shrouded in mystery.

Stakeholders should also be "privy" to the pool's roadmap. They should understand the decision-making process and find out what role (if any) stakeholders get to play in that process. It's always preferable for future stakeholders to conduct performance reviews to help narrow down a list of pools before investing.

Lastly, some investors will prefer staking pools with fewer stakeholders or caps to prevent rewards from getting further diluted as time goes on. Now that we've answered the question "what is a staking pool?", you might want to expand your crypto knowledge further. As such, we recommend reading our "Crypto Backed by Gold" article for later reading!

What is a Staking Pool? Conclusion

So, if you've decided to stake your crypto, should you join a staking pool or fly solo and become a validator?

A staking pool will give smaller returns than solo staking because each block validation will divvy up the block rewards among the many stakeholders. In addition, staking pools charge fees, which will eat up some of the profits. However, stakeholders don't have to fuss with the technical implementation of setting up a validator node and the time and maintenance costs of running it.

So, there are advantages to each option, but it will boil down to how many tokens they can afford to stake for many people. Staking pools let investors in for only a fraction of the costs required to become validators.

Regardless of which option you choose, let's not forget the satisfaction of actively participating in your favorite crypto project. PoS blockchains can't function without stakeholders, and your investment goes a long way in helping project development. Furthermore, for "HODLers" who are in it for the long run, earning a passive income is better than watching your tokens idle in a wallet for years.

Ready to invest in your career for the long run? Enroll in Moralis Academy today and learn how to become a blockchain developer!