This article will explore the answers to these questions. But, before we specifically delve into the question of “what is crypto market cap?”. Let’s first look at how the market cap works in traditional markets. Then we’ll see how it applies to cryptocurrencies.

Market Cap in Traditional Investing

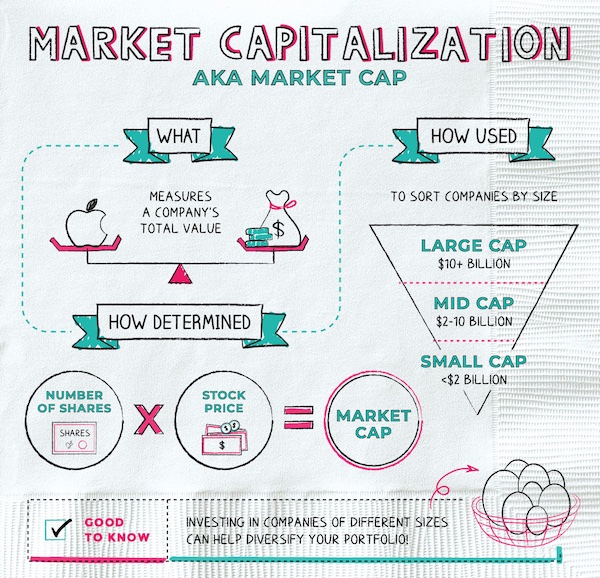

Determining a company’s worth is an essential part of the investment process. Even though an accurate valuation can be challenging to ascertain, using the market cap is relatively quick and easy. Further, investors use the market cap to determine a company’s size instead of only tallying sales or total assets.

So, market cap refers to the market value of a firm’s outstanding shares of stock. To calculate a company’s market cap, we multiply the number of its outstanding shares of stock by one share’s current market price. For example, if a company has one million shares selling for $100 each, it would have a market cap of $100 million.

Different types of traders require different kinds of metrics. For example, long-term investors gravitate to a company’s fundamentals. On the other hand, short-term traders who gravitate to swing or even day trading are more apt to study technical analysis. If you’re new to trading, make sure to check out the Master Technical Analysis course at Moralis Academy.

Market Cap and Risk Assessment

To assess risk, investors can look at the share price and the company’s size.

Share Price

After a company starts to publicly trade its shares on a stock exchange, supply and demand forces will kick in to determine its price. Basic economics dictates that high demand for a stock increases its share price. Likewise, too much selling pressure can drive the price down. This situation can occur when too many investors conclude that a company’s future for potential growth is not there.

So, by gauging a company’s market cap, investors can snap a real-time picture of its value whether a stock’s price is pumping or dumping.

Company Size

A company’s size is another characteristic that investors need to know. Size helps determine risk. More importantly, an investor can determine its size by analyzing a firm’s market cap.

Since the market cap is a valuable metric for assessing risk, it can be helpful for an investor in determining which stocks to pick. In this case, size matters. Below are the three market cap sizes.

Is a Higher Market Cap Better than a Lower One?

1. Large Cap – Over $10 Billion

These larger companies have typically been around for a while, and they tend to be significant players in well-established markets. However, large-cap investing doesn’t usually bring huge returns, particularly in the short term. But for the long term, large caps such as Apple and Amazon are more likely to reward investors with a consistent increase in stock price.

However, companies with large market caps come with their own sets of pros and cons. First, larger companies can typically secure better financing terms from banks. Also, their size can bring them other competitive advantages such as widespread brand recognition and economies of scale. On the negative side, they often have limited growth opportunities. Due to their already “behemoth proportions,” growth rates may slow or even decline over time.

2. Mid Cap – $2 to $10 Billion

Companies in the mid-cap range are in the process of expanding, or they operate in an industry expected to see rapid growth. On the negative side, though, they carry a higher risk than large caps. Albeit, they capture investor interest because of their powerful growth potential.

3. Small Cap – Less than $2 Billion

These small caps can be new or serve new industries and niche markets. Small caps are high-risk investments due to their smaller size, novelty, and the markets they serve. These smaller companies also have access to fewer resources. So, when faced with market shocks and economic slowdowns, they can take a harder hit than the larger caps. But, they offer an enormous opportunity for profits because of their massive upside potential.

Is a Higher Market Cap Better than a Lower One? M&A Limitations

Although market cap measures the cost of a company’s shares, it does not determine the cost to acquire a company. Therefore, a better method for calculating a business’ price for mergers and acquisitions (M&A) is necessary. One such method is “enterprise value.”

Remember, the market cap only reflects the value of a company’s equity. On the other hand, enterprise value reflects the total capital (including debt) invested in the business.

Even so, the market cap can help determine whether a company is a good takeover candidate or not. On the other hand, rumors of a merger or acquisition can dramatically affect a firm’s market cap. If enough well-heeled speculators believe that a merger will increase a company’s value, bullish sentiment can send the stock price much higher, which in turn increases its market cap.

One takes the market cap, adds debts, and subtracts its cash to calculate enterprise value. This method is how mergers and acquisition specialists estimate the cost to acquire a prospective company.

Is a Higher Market Cap Better than a Lower One? Equity Value

As mentioned, the market cap equation multiplies the number of outstanding shares of stock by a share’s market price. While this is extremely helpful, market cap standalone can be an inadequate indicator. That’s because the marketplace can overvalue or undervalue a share’s price. Therefore, investors need to perform a more thorough analysis of a company’s fundamentals. After all, a stock’s price can only tell us how much the market is willing to pay for the shares at that given moment.

You’re probably thinking, “okay, this is all great information, but what does it have to do with the question, ‘what is crypto market cap?'”

What is Crypto Market Cap?

The precursor was necessary to give you an idea of how the market cap metric works in traditional investing. Now, you can understand why it’s often quoted in the “cryptoverse.” Similar to conventional finance, it’s a popular way to gauge the value of a crypto asset.

What is Crypto Market Cap? Asset Valuation with Price

Price is only one metric that investors consider when valuing a cryptocurrency. They also need to research a project’s market cap. That’s because it uncovers a better picture of what’s going on.

So, investors use the market cap to compare cryptocurrency values. It is a crucial metric in crypto, just like in traditional investing, because it helps separate a protocol from the rest of the herd.

What is Crypto Market Cap? Calculating the Metric

The way to calculate the market cap for a cryptocurrency is also similar. We multiply the number of coins in circulation by a single coin’s market price. So, crypto market cap = price x circulating supply.

Let’s look at two different cryptos as an example:

1. Crypto #1

It has 500,000 tokens in circulation with a market cap of $500K.

2. Crypto #2

This protocol has 125,000 tokens in circulation with a market cap of $250K.

Doing the math, each token has the following price:

Crypto #1 = $1 per token.

Crypto #2 = $2 per token.

If one looks at the price only, crypto #2 appears to win. However, even though crypto #2’s token is twice the price of crypto #1, its value is only one-half the size based on market cap.

If you find good market caps for cryptocurrencies, you can invest in them via Web3 browsers. Moreover, even though crypto and blockchain may seem locked to the digital world of Web3, check out our “Blockchain in Supply Chain” article to discover real-world use cases.

What is Crypto Market Cap? Calculating Stability

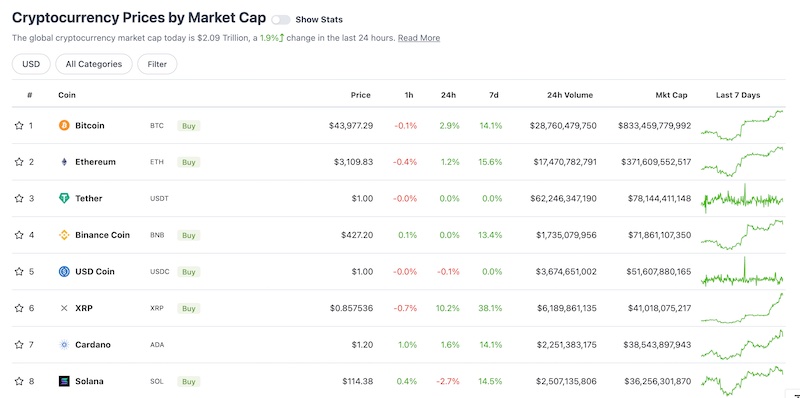

One can also think of the crypto market cap as a gauge for a coin’s stability. In crypto markets, however, “stability” is a relative term. Bitcoin, for example, has the largest market cap in the cryptocurrency markets ($851 billion at the time of writing). But traditional investors still consider it far more volatile than any stock.

Compared to cryptocurrencies with smaller market caps, though, Bitcoin is a stable investment. Crypto’s with smaller market caps are subject to sudden price shocks by whales and other whimsical segments of the marketplace, moving large sums in and out. Such whipsaws have hammered plenty of traders over the short history of crypto. So when asking, what is crypto market cap? You can think of it as a stability gauge.

Do you understand how cryptocurrency with the largest market cap works? Join Moralis Academy today to access a vast library of crypto classes. To learn about Bitcoin, take the Blockchain & Bitcoin Fundamentals course!

Is a Higher Market Cap Better than a Lower One? The Size Factor

Similar to traditional investments, we can break down cryptocurrency market cap sizes into three categories:

1. Large Cap – Over $10 Billion

This category includes top cryptocurrencies such as Bitcoin and Ethereum and most of the top 20 cryptocurrencies. These platforms and protocols have a longer track record with a brimming ecosystem of developers maintaining and building new projects. Ethereum, in particular, has a myriad of projects in its ecosystem, from DeFi to NFTs.

Furthermore, large caps have tokens available on more exchanges with higher liquidity and are less volatile than mid and small-cap cryptos.

2. Mid Cap – $1 to $10 Billion

These cryptos come with higher risk but also have more upside potential.

3. Small Cap – Less than $1 Billion

Small market caps have tremendous profit potential contrasted with the negative aspect of the most volatile price swings.

We’ve talked about Bitcoin, but what is Litecoin? Also, if you’ve ever wondered about the difference between Cardano vs Solana, follow the link.

Circulating Supply, Max Supply, and Total Supply

When asking, “what is crypto market cap?”. One must also consider the supply factor. Below are three different ways to calculate a token’s supply.

1. Circulating Supply

This amount approximates the number of tokens circulating in the market.

2. Total Supply

The total supply refers to the total amount of tokens presently in existence, subtracting the tokens burned.

3. Max Supply

This metric approximates the maximum amount of tokens that will ever exist during the cryptocurrency’s life cycle.

So by multiplying a token’s price by the differing supply amounts, one gets varying market caps.

Circulating Supply vs Fully Diluted Supply

Let’s use Bitcoin as an example to see how the market cap can change based on the chosen supply metric.

Close to 19 million BTC have already been mined. So, that number represents the “circulating supply.” The 21 million BTC that will be mined eventually is the “fully diluted supply.” Bitcoin’s price at the time of writing is roughly $44,000. So the circulating supply market cap is 19 million x $44K = $836 billion. The fully diluted supply market cap is 21 million x $44K = $924 billion.

Now it’s easy to see how market cap estimations can fluctuate depending on which methodology an investor chooses – circulating supply or the fully diluted supply.

Circulating supply will reflect a project’s market cap right now. Fully diluted market cap represents a projected number but has its uses. However, investors must be wary that a protocol can radically inflate its market cap if its future supply of coins is enormous. One should also consider the effect of locked tokens the protocol can never sell when performing calculations.

How to Research Crypto Market Caps

If you’re ready to start researching, there are two leading websites to check out:

1. CoinMarketCap.com

CoinMarketCap claims to be “the world’s most referenced price-tracking website for crypto assets.” Its mission is to make cryptocurrencies more discoverable worldwide by empowering its users with accurate, unbiased information to draw their own conclusions. The U.S. government and major news outlets use its data for reports.

2. CoinGecko.com

CoinGecko provides data on multiple crypto assets, including market cap. CoinGecko queries’ info comes from numerous sources and must pass through various algorithms to verify its integrity.

What is Crypto Market Cap – Conclusion

In sum, the crypto market cap is a financial metric that investors can use to compare the values of various cryptocurrencies. However, it is not standalone nor perfect. So it’s best to use the market cap as one point of reference along with other metrics and investing fundamentals.

Investing in higher or lower market caps is a matter of preference. Cryptos with higher market caps will appeal to those who want more stability and less volatility. But for those who are more risk-tolerant and want to hit that rocketship to the moon, lower caps will be the way to go. It all depends on the investor’s goals.

Would you like to become a blockchain developer? Whatever your goals are in crypto, you’ll find what you’re looking for at Moralis Academy. Start building your future on the blockchain today!