If you’ve ever come across Acala, you probably know it by the company’s tagline “The DeFi Hub of Polkadot”. Powered by the Acala token (ACA), the Acala network provides a range of cross-chain decentralized finance (DeFi) services through the Acala Mandala application. Also, Acala’s sister network ‘Karura’ and the native Karura token serves as an open-source and permissionless suite of decentralized finance applications (dApps) on the Kusama blockchain.

In this article, we’re going to dive deep into the Acala network and explore the various services the platform has to offer. We’ll also discuss the Acala token (ACA), and the role it plays within the Acala platform. Furthermore, we’ll explore the Acala Mandala platform, the Karura network, and much more!

If you’re unfamiliar with decentralized finance (DeFi), see our DeFi 101 course at Ivan on Tech Academy! Here, you’ll learn how the Digital Financial Stack operates, how to set up and interact with the number one Web3 wallet, MetaMask, plus much more! Once completed, our DeFi 201 course takes your DeFi experience to the next level! This includes learning how to take advantage of crypto arbitrage opportunities, execute flash loans, discover DeFi hedge funds, and many other exciting DeFi opportunities. See our video-guided, expert-led courses today, only at Ivan on Tech Academy.

What is Acala Network?

Acala aims to become the “all-in-one DeFi hub of Polkadot”. The platform is also Ethereum-compatible, meaning that it can harness the power of the number one smart contract-enabled blockchain and the many decentralized applications (dApps) that operate within the Ethereum Network.

Furthermore, Acala provides seamless interoperability between blockchains along with a host of financial applications. These include liquid DOT - a “trustless staking derivative” application, aUSD - a stablecoin that is multi-collateralized and backed by various cross-chain digital assets, an automated market maker (AMM), and decentralized exchange (DEX). Also, all of the aforementioned services come with minuscule transaction fees. Moreover, these transaction fees can be paid for using any type of token!

What is Polkadot?

Acala is a Polkadot parachain offering a layer 1 infrastructure for seamless interoperability with Ethereum and other blockchains. Ethereum is the second-largest cryptocurrency that brought about the facilities of smart contracts. Smart contracts were revolutionary as the first way of programming money. But, what is Polkadot?

Polkadot was built by Ethereum co-founder and Solidity programming language creator, Dr. Gavin Woods. Polkadot itself is a network of blockchains consisting of a relay chain, parachains, and parathreads using the innovative Substrate framework. To learn more about how Substrate operates, save our ‘Exploring Parity Technologies’ Substrate’ article for later.

The relay chain is the heart of Polkadot, connecting the sovereign parachain and parathread blockchains in the network. Additionally, the relay chain is responsible for interoperable data and transactional communication between these chains. Parachains are independent blockchains that are modular, customizable, and can have their own native tokenomic and governance structures. Parathreads are similar to parachains, however, these are often smaller chains that don’t require 24/7 connection to the relay chain. The utility and flexibility of Polkadot are key to the success of the Acala platform.

Exploring the Acala Platform - The “DeFi Hub of Polkadot”

Acala Network shares Polkadot's underlying security infrastructure. This ensures that the platform is resistant to attacks and can facilitate forkless upgradability. Also, the Acala platform is host to a range of decentralized applications (dApps) that harness the power of Polkadot for cross-chain decentralized finance (DeFi) accessibility. Below are some of the key features of the Acala ecosystem.

Acala EVM

Launched in February 2021, the custom-built Acala Ethereum Virtual Machine (EVM) is a Polkadot-native Ethereum-compatible virtual machine designed to optimize and maximize the full potential of Substrate (see our Ethereum Virtual Machine Deep Dive article if you’d like to learn more). The Acala EVM provides Substrate, Solidity, and Web3 developers with a full-stack experience (Acala+EVM+Substrate+WASM) using just a single wallet.

The Acala EVM offers a fully composable DeFi environment, meaning decentralized applications (dApps) deployed in the Acala EVM can interact seamlessly with cross-chain assets. Also, the Acala EVM allows developers to use an “on-chain automatic scheduler” for recurring payments such as subscriptions. Moreover, Acala EVM is created for developers to “Bring your own gas”. Both cross-chain and native tokens integrated through Acala can be listed on a decentralized exchange (DEX) hosted by Acala EVM (with governance approval), or be used for transaction fees on the Acala network. The Acala EVM coupled with no-fork upgrades means any new Substrate pallet can integrate with Acala with zero friction.

The Acala Token (ACA)

The native ACA token has two primary functions within the Acala network. Firstly, ACA serves as a utility token across the Acala platform. ACA is used for transaction fees and smart contract-based applications that operate across the Acala ecosystem. Furthermore, the ACA token is used in staking and other fundamental network activities.

Secondly, the Acala token (ACA) is used for the governance of the Acala network. Holders of the ACA token are granted voting rights. This allows token holders to vote on proposals regarding Acala Treasury governance, the election of council members, risk management, and upgrades to the network. Moreover, Acala token holders can vote on adjustments to key risk parameters of the Acala network and the decentralized applications (dApps) that make up the Acala ecosystem. These parameters include collateral type proposals, stability fees, and liquidation ratios.

Acala Dollar (aUSD)

The Acala Dollar (aUSD) is a multi-collateralized stablecoin that powers the native Acala decentralized applications (dApps) and decentralized finance (DeFi) experiences. These include lending, borrowing, interest-earning, and synthetic asset trading. The aUSD token is equal to one US dollar. This makes it a useful trading pair and a reliable store of value. Acala network offers multiple ways to leverage returns with aUSD using the Acala Mandala DeFi suite (mentioned further on).

To learn more about stablecoins and why they are so important, save our ‘Guide to Stablecoins’ article for later!

Also, if you want to discover how blockchain technology can be implemented into current business IT infrastructures, see our Blockchain Business Masterclass course at Ivan on Tech Academy! Here you’ll learn how and why companies are turning to blockchain, and how you can help other businesses do the same! Also, to discover more about the business integration of blockchain, see our Blockchain in Enterprise and OriginTrail 101 courses today!

Decentralized Sovereign Wealth Fund

Proposed by Dr. Antonia Chen, the Acala decentralized Sovereign Wealth Fund (dSWF) is a long-term economic funding model using multi-collateralized backing to ensure the future development of the Acala network. The aim of the dSWF is for Acala to become a self-sustainable network. This means that control of the network is in the hands of token holders, not venture capitalists (VCs). Using foreign cryptocurrency reserves, the Acala dSWF will help with community incentives, research and development, and securing a parachain slot for the Acala network.

Acala Mandala

Acala Mandala is the home to Acala’s decentralized finance (DeFi) suite of applications and protocols. Still in testnet, Acala Mandala is open-source and permissionless, meaning anyone can interact with the applications. However, it is worth noting, Polkadot.js must be installed to interact with Acala Mandala. Polkadot.js is free and can be downloaded as a browser extension and implemented within seconds.

Once you have connected with a Web3 wallet (such as MetaMask) the homepage will be unlocked to view all of the different protocols available. The graphical user interface (GUI) is intuitive, simple, and easy to navigate. The menu column on the left describes the list of different ways to interact with Acala Mandala. These include:

- Borrow aUSD (Offering over-collateralized loans)

- Swap (Decentralized exchange)

- Earn (Earn LP tokens from providing liquidity with multiple tokens)

- LDOT Liquid Staking (Stake DOT to mint LDOT)

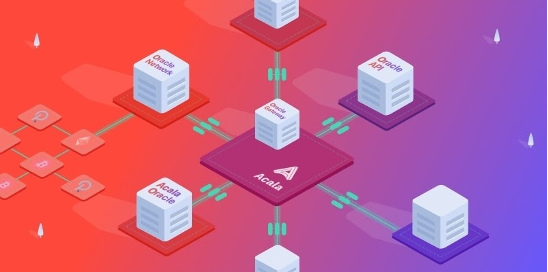

- Oracle Price (Token price display from multiple oracle price feeds)

- Governance (View proposals and schedules for different councils, including the General Council, Honzon Council, Homa Council, and Technical Committee.

Acala Foundation

The Acala Foundation was created to support up-and-coming projects that are integrated with Acala applications such as aUSD, staking liquidity, and the Acala decentralized exchange (DEX). Also, all projects working in conjunction with the Acala foundation can take advantage of marketing collaborations, sharing of technological innovations, and much more!

The Acala Foundation engages with projects under the Acala umbrella and identifies potential candidates for collaborations and integrations. With a team of esteemed backers and industry-leading professionals, the Acala foundation is dedicated to the long-term sustainable growth of the Acala network.

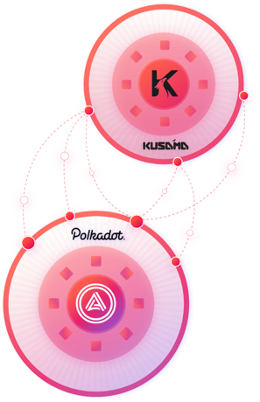

Karura

Karura was founded by the Acala Foundation to create the ultimate all-in-one DeFi suite for Kusama. Referred to as Acala’s sister network, Karura offers much of the same seamless user experience as Acala.

Kusama is an independent network often referred to as Polkadot’s testnet or ‘canary network’. The two networks are created by Parity Technologies and are very similar. However, Kusama offers faster deployment of new applications with quicker governance parameters than Polkadot. Once the bridge between Kusama and Polkadot is launched, Acala and Karura will be fully interoperable. Karura aims to offer decentralized finance (DeFi) applications throughout the entirety of the Kusama network ecosystem.

The Karura application offers staking, borrowing, and lending, plus a native decentralized exchange (DEX) and stablecoin, kUSD. Similar to aUSD, kUSD is also multi-collateralized. Furthermore, Karura offers similar micro gas transaction fees for trades. Plus users can pay the micro gas fee in just about any token!

Karura’s native utility token KAR powers the ecosystem, offering staking rewards for multiple assets including the KAR token and Kusama’s KSM token. Karura offers liquid KSM staking, offering users the chance to stake their KSM tokens to receive LKSM tokens in return. Users are then free to trade these tokens, use them to take out a collateralized loan, or provide liquidity for further rewards. Users of Karura can also provide kUSD liquidity to the Karura cross-chain automated market maker (AMM) decentralized exchange (DEX) to receive exchange fees and stability fee profits from the kUSD stablecoin protocol.

Karura also offers users the opportunity to stake KSM tokens without time-locks or restricted release schedules. Users can stake any amount of KSM tokens they’d like then unstake whenever they want!

Acala & Karura Roadmap

The Acala and Karura roadmap is packed with developments planned throughout Q1 and Q2 2021. During Q1 we saw the implementation of the Acala EVM testnet, multiple audits, and development on the Polkadot Testnet Rococo.

In Q2 2021, we can expect to see developments of the Karura platform with the Karura parachain auction and the mainnet genesis. Furthermore, the team is expected to enable the Karura governance council, staking derivatives, and liquidity mining protocols. Also in the pipelines is the deployment of full Ethereum Virtual Machine (EVM) and smart contract support. The Acala and Karura roadmap is full of many exciting activities and updates for the future!

Acala Network & Acala Token Summary

Acala has seen a lot of media attention, and with good reason too. The all-in-one decentralized finance (DeFi) platform Acala Mandala is set to be the go-to DeFi hub on Polkadot. Moreover, the Acala Foundation has recreated a similar experience with Karura as the heart of DeFi on the Kusama network. Both platforms have seen great success and support, even before the mainnet launch. Also, Coinbase Ventures announced its backing of Acala and Karura in March 2021, which is a mark of confidence for many investors.

Moreover, Acala has recently received a grant from the Compound community, to build a ‘Starport’. A Starport will be a cross-chain gateway for decentralized finance applications for the Compound Chain and the Polkadot ecosystem. Acala looks to have a bright and active future and is certainly a project to keep an eye on during the 2021 Bitcoin bull run!

If you’re interested in learning how to gain knowledge in the number one in-demand skill according to LinkedIn, Ivan on Tech Academy is the perfect place to begin. Even if you have zero programming experience or knowledge, Ivan on Tech Academy can provide all the educational material needed to get a job as a blockchain developer, in just a few courses. Our Javascript Programming for Blockchain Developers course is for those who are new to programming.

This will provide you with enough programming knowledge to move on to our Ethereum Smart Contract Programming 101 course, to learn the foundations of the Ethereum programming language, Solidity. From here, our Ethereum Smart Contract Programming 201 course provides students with the opportunity to deploy decentralized applications. Plus, our Ethereum Game Programming teaches students how to create non-fungible tokens and a decentralized marketplace! Join Ivan on Tech Academy today to see the wide range of life-changing courses on offer!