Late last year, after much ado, the United States’ presidential election process was finally formalized, and Joe Biden was declared the victor. On January 20th of 2021, Joe Biden was formally sworn in as the 46th President of the United States. As expected of any new president, several changes are to be made where the commander-in-chief appoints new cabinet members. Some of the most vital positions Biden will need to fill are those of Secretary of State, Secretary of Defense, and – most importantly when it comes to the future of Bitcoin and crypto in the US – Secretary of the Treasury. What’s more, Biden has nominated Janet Yellen to become the next US Secretary of the Treasury. Nevertheless, according to Janet Yellen Bitcoin and cryptocurrencies are far from the future of the financial system. So, what consequences might this have on the wider cryptocurrency market, and how is she likely to treat crypto and Bitcoin under Biden?

Although Yellen is only nominated at this point and will have to be formally confirmed by the US Senate before taking office, odds are she will become the next Treasury Secretary. Moreover, the US Secretary of the Treasury holds significant influence, not only domestically, but also on a global scale. The influence of this position means that Yellen’s opinion and views on crypto will be of importance to the industry. Additionally, Janet Yellen has been vocal about her rather conservative views on cryptocurrencies and Bitcoin.

Naturally, no one knows for sure exactly what crypto policies Yellen will champion as the US Secretary of the Treasury in the coming years. Nevertheless, it is worth taking a look at her previous statements on crypto to gauge her general sentiment regarding the cryptocurrency sector. Many traditional economists, such as Yellen, have traditionally struggled to understand crypto and blockchain just due to the fact that they lack a proper understanding of the technology and industry. If you want to supercharge your cryptocurrency and blockchain education, be sure to join the over 30,000 students that have already enrolled in Ivan on Tech Academy, one of the world’s premier blockchain academies.

Who is Janet Yellen?

Janet Yellen is a relatively esteemed traditional economist, with a vast amount of experience in finance. Her career is long and meritorious – she started as an assistant professor of Economics at Harvard University. After her time at Harvard, Yellen became an economist with the Federal Reserve Board of Governors. Three years later, she returned to the world of academia and became a faculty member at the University of California.

Janet Yellen

Almost 14 years later, Yellen was appointed as a member of the Federal Reserve Board of Governors once again by President Bill Clinton. After three years serving on the board, Yellen left the position to continue her career elsewhere. In 2010, Yellen was nominated to become the US Federal Reserve Vice Chair by President Barack Obama. Six months later, Yellen was appointed to the position. She started her four-year term as the second woman in history to hold this position.

After her four-year term, Yellen was appointed the US Federal Reserve Chair, which was confirmed on January 6, 2014. Yellen was the first woman in history to become the Federal Reserve Chair, a role that she held between 2014 and 2018. During her time as both Vice-Chair and Chair of the Federal Reserve, Yellen navigated the US recovery from the financial crisis in 2008. During her tenure, she managed to hold inflation below 2% and reduce unemployment from 6.2% to 4.1%.

As such, Yellen is far from a controversial pick to head the Treasury Department. Instead, a relatively recent poll by Politico and Morning Consult highlights Yellen’s high domestic approval ratings. A long career, an impressive track record within the traditional financial sector, and high approval rates are probably three of several reasons why President Biden has decided to appoint Janet Yellen as the next Secretary of the Treasury. Nevertheless, cryptocurrency fans may worry about what Janet Yellen’s Bitcoin and crypto stance will be once she takes office.

Janet Yellen and Bitcoin

When it comes to traditional finance and the history of money, Janet Yellen’s experience is unquestionable. However, many cryptocurrency fans will argue that Yellen’s qualifications may have been stellar in the 20th century, but they fall somewhat short in the 21st century. The advent of cryptocurrencies, Bitcoin, DeFi, and blockchain-driven financial solutions is reshaping the financial playing field. Additionally, Yellen’s Bitcoin views have been skeptical for many years. However, Yellen certainly isn’t unaware of Bitcoin. When she testified to Congress in 2017, an anonymous man behind her held up a sign saying “Buy Bitcoin”, an image of which quickly went viral.

With a long track record working with traditional finance, it might not be surprising to learn that in the mind of Janet Yellen Bitcoin and crypto are viewed with skepticism. This is nonetheless unfortunate and ultimately disappointing since this indicates she either isn’t understanding or paying attention to what is going on in the crypto industry. Taking a deep dive into the crypto world’s ins and outs show most people the potential that these currencies have and how they can revolutionize the financial market. This is especially important now that various countries are gearing up to release Central Bank Digital Currencies (CBDCs).

In contrast to her comments regarding crypto and Bitcoin, Yellen spoke fondly of blockchain technology in 2016 and 2017. She said that blockchain is an important technology that can influence how we conduct transactions in the future. This shows us that she is not entirely out of the loop. Furthermore, blockchain is already revolutionizing the financial sector through decentralized finance (DeFi), which has grown at a frantic pace. Nevertheless, it would seem that to Yellen Bitcoin and crypto isn’t worth getting excited over.

Janet Yellen Bitcoin Claims

As previously mentioned, Yellen has expressed her concerns regarding cryptocurrencies throughout the years. She mentions – among other things – that digital currencies are not legal tender. She also brands cryptocurrencies as “highly speculative assets”, owing to their relatively volatile and unregulated nature.

According to Janet Yellen Bitcoin is a means of payment that is mostly used for illicit financing. Furthermore, suggested by Janet Yellen Bitcoin is a means for terrorists to finance their activities, which she argues is a wider concern with cryptocurrencies in general. Janet Yellen also suggests that cryptocurrencies need to be curtailed to ensure that money laundering does not occur through crypto channels.

However, terms like “illegal” and “terrorism” are powerful words that have a significant impact on people. Yellen’s use of these terms are arguably somewhat misleading, as they blow the problem out of proportion. The claim that cryptocurrencies’ main use is for illegal transactions is just completely wrong. A fresh report from Chainanalysis shows that only 0.34% of crypto transactions were of a criminal nature. This is less than one percent and far less than “most transactions,” indicating that Yellen’s Bitcoin statement is simply wrong.

Furthermore, the illegal transactions that do occur using cryptocurrencies are declining fast. In 2019, the report showed that 2.1% of the transactions were illicit, which – in just one year – fell by almost 1.8 percentage points. As more and more people adopt cryptocurrencies, these few illegal transactions fade into obscurity. This further proves that the problem is far less serious than what Yellen claims.

How Will Janet Yellen Affect Crypto?

Even though Janet Yellen’s personal views on cryptocurrencies seem to be rather lackluster, her appointment isn’t all bad for the crypto industry. In a recent testimony to the Senate Finance Committee, Janet Yellen urged America to “act big” to revitalize its flailing economy. To avoid long-term economic problems and help rebuild the US economy in the wake of the pandemic, she supports the significant stimulus plan presented by President Joe Biden. The plan involves several different aspects, one of which is stimulus checks.

Yellen urges the US to act big now to save the economy

Although this is not financial advice, various observers view these stimulus checks are being favorable for the crypto market, since they will provide more liquidity to US citizens. As such, some analysts believe that these stimulus checks could help drive the crypto markets even higher, as both young and old investors increasingly look to invest in Bitcoin.

The financial stimulus plan is vast, and to ensure that all the citizens eligible for the checks receive their money, the US needs to administer an additional $1.9 trillion (for the complete stimulus plan). Each of the checks would be for $1,400, which – in combination with previous stimulus checks of $600 – would amount to $2,000. Since the interest rates are at an all-time low, it makes some Keynesian sense to borrow to stimulate the market.

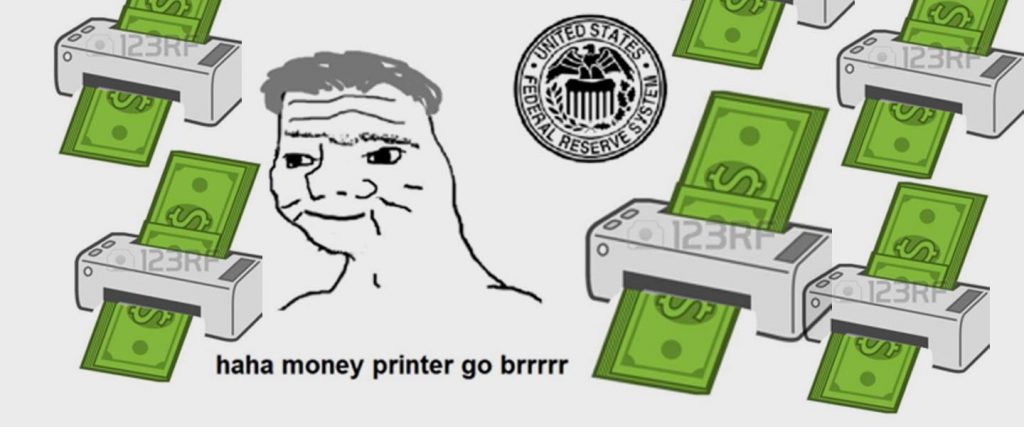

However, the money needs to come from somewhere, and this takes us back to the well-known “Money Printer Go Brrr” meme, which further demonstrates one of the benefits of cryptocurrency – Satoshi Nakamoto cannot simply “print more” Bitcoin and effectively devalue the existing supply. As such, these latest stimulus checks can be thought to illustrate the growing disillusion with the US dollar, as it clearly highlights the Federal Reserves’ ability to essentially print more fiat currency out of thin air.

Can Someone Ban Bitcoin?

So, what’s the worst-case scenario of a new Janet Yellen Bitcoin policy? Well, that would be a blanket ban on Bitcoin or cryptocurrencies. Some countries like Algeria, Ecuador, and Egypt have previously banned Bitcoin. However, a ban in the US is highly unlikely, since Bitcoin and crypto have already become “too big” to effectively shut down. We are seeing substantial lobbying groups and a positive sentiment among policymakers towards crypto. These are two major factors making it hard to ban cryptocurrencies in the US.

Along with lobbyists and policymakers, Bitcoin is already a growing part of the financial system in the US. A crypto ban would mean that billions of dollars would be lost, as institutions overseeing vast amounts of crypto would need to close down. Along with this, thousands and thousands of jobs would disappear, creating even worse problems throughout the whole market.

Furthermore, even if a ban would somehow happen, it would be next to impossible to enforce due to cryptocurrencies’ decentralized nature. The only solution to this would be for the government to be in complete control over the internet.

However, enforcing a ban on cryptocurrencies has proven to be quite difficult for countries with an existing ban. Countries such as Egypt and Pakistan, even with a ban, have inhabitants invested and using cryptocurrencies.

Will Janet Yellen Ban Bitcoin?

Janet Yellen does not have the most liberal attitude towards cryptocurrencies, and she will hold significant influence over the next four years. This poses a question of whether she has the power to ban Bitcoin, and if so, will it happen?

One thing that seems likely is that according to Janet Yellen Bitcoin is a concern. It does not matter if you agree or not; she has this view and wields significant influence in the financial world. However, outright banning Bitcoin would prove challenging even for the US Secretary of the Treasury.

Why is this? Well, according to Yellen Bitcoin is used to enable illicit transactions and partially fund terrorism, and it thus seems clear she is not a crypto supporter. Consequently, it is improbable that she will suddenly embrace crypto, and will likely be cautious to drive through liberal reforms when it comes to this asset class. Even though outright banning crypto would prove to be a hard task, if not impossible, she might still be open to imposing new crypto and Bitcoin regulation.

However, restricting and regulating crypto might prove to be a difficult task that could backfire. Imagine that your bank restricts the possibility of buying crypto; that just creates more of an incentive to buy cryptocurrencies, because in doing so, you gain more control over your own money.

It will be interesting to see what will happen in the near future and the coming years. For all we know, Yellen might not even raise any larger remarks regarding cryptocurrencies. However, her concerns and public belief that cryptocurrencies play a part in “funding terrorists” could be an incentive for her to look closer at the industry. Yellen also recently mentioned that she will investigate the possibility to curtail the use of cryptocurrencies, which is something that might spark uncertainty for the industry. Nevertheless, Yellen’s eventual approach to the crypto sector is still up in the air, and we do not know for sure how she will act.

Janet Yellen and Bitcoin – Summary

When confirmed, Janet Yellen will be the first woman to take on the role of US Secretary of the Treasury. This is not the first time she breaks a glass ceiling, as she did it once before when she was appointed the first woman to become the Federal Reserve Chair. She has a long resume when it comes to traditional finance and is a competent candidate. However, Yellen has been a vocal opponent to cryptocurrency, and her appointment could prove ultimately difficult for the crypto industry. Understanding Janet Yellen’s relationship to Bitcoin is key to understanding how the US will deal with crypto in general and Bitcoin in particular during the new Biden presidency.

The 46th US President – Joseph R. Biden Jr.

Yellen does not speak very fondly of cryptocurrencies, where according to Janet Yellen Bitcoin is mostly a means for facilitating illicit transactions – a statement that is patently false. However, the Secretary of the Treasury wields a lot of power in the financial world, and could even affect global regulations. This means that her conservative view on cryptocurrencies can become a problem for the industry. However, several factors indicate that the worst-case scenario, a US ban on crypto, for example, would be difficult – if not impossible – to implement. On the other hand, Yellen has seemed to welcome blockchain technology.

It is an interesting development and only time will tell us what will happen. Some of President Biden’s other nominees, such as his pick for SEC Chairman – Gary Gensler – are decidedly more positive towards crypto and Bitcoin. In the end, it remains to be seen exactly how the government will treat crypto and Bitcoin under Biden. However, if you would like to learn more about cryptocurrencies, Bitcoin and blockchain, feel free to tune in to the number one blockchain education platform Ivan on Tech Academy for a vast selection of blockchain courses.